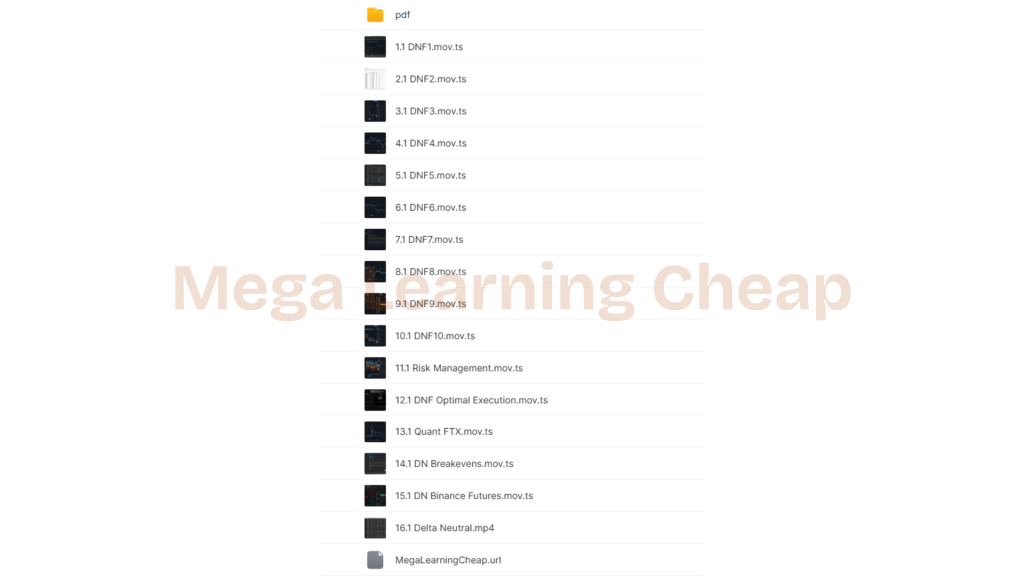

Delta Neutral Trading by Bitcoin Trading Practice

Access The Delta Neutral Trading Course For $500 $10

The Size is 0.80 GB and was Released in 2020

Key Takeaways

- For example, delta neutral trading, which seeks to reduce directional risk, can be particularly effective in the Bitcoin market.

- To become, and remain, delta neutral requires frequent rebalancing with spot, options and futures instruments.

- Knowing about market structures such as contango and backwardation allows traders to adjust their strategies to shifting conditions and identify potential opportunities for profit.

- Risk management is important, as liquidation risk, impermanent loss, and execution slippage can all affect delta neutral positions.

- Selecting good exchanges and utilizing solid rebalancing utilities help sustain delta neutral plays.

- Delta neutral trading is the next step up from basic arbitrage. It enables traders to hedge away risk and possibly increase returns over the long run in crypto markets.

Delta neutral trading by bitcoin trading practice was a means traders attempted to reduce risk by offsetting purchases and sales so price movements impact less. For bitcoin trading, it means employing options, futures, or spot trades to maintain a position’s value if bitcoin shifts price. A lot of traders opt for delta neutral setups when they want consistent gain, not huge wins or losses from crazy price action. Others utilize it to shelter their holdings in steep sell-offs. Delta neutral concepts function with both short and long trades, and suit many trading styles. The following sections explain what delta neutral is, what tools traders use, and strategies for bitcoin markets.

Understanding Delta Neutral Trading

Delta neutral trading is a strategy to mitigate market volatility risks in the cryptocurrency market. This is achieved by employing financial instruments, such as options and futures contracts, to maintain a portfolio’s net delta near zero. In the volatile Bitcoin market, where prices leapfrog each other frequently, delta neutral trading strategies allow seasoned traders to immunize themselves against abrupt risks. By going long and short, traders seek to neutralize their exposure to Bitcoin’s price action and enhance their trading strategy.

1. The Core Idea

Delta neutral trading is essentially about designing trades so that profits in one position offset losses in another, aiming for a net delta of 0. This approach means you’re not speculating on Bitcoin’s price moving up or down, but rather focusing on a balanced delta exposure to maintain a low total risk exposure. As a result, if Bitcoin’s price increases, profits from one side can offset losses from the other. This strategy can make trading less stressful during market volatility and can be effective in both calm and stormy cryptocurrency markets.

2. The ‘Delta’ Metric

Delta represents the amount an option price will change if Bitcoin changes by one unit, scaling from -1 to 1. Understanding delta is crucial for a trading strategy as a +0.5 delta indicates the option should increase by $0.50 if Bitcoin increases by $1, while a delta of -0.5 means the opposite. This knowledge allows traders to establish effective hedging strategies. In cryptocurrency markets, where market volatility can spike quickly, this understanding is critical. Delta is commonly calculated by the Black-Scholes model.

3. The ‘Neutral’ State

Neutral in this context means you’re not taking sides on price moves within the cryptocurrency market. You’re positioned such that your portfolio value remains stable despite fluctuations in market volatility, whether Bitcoin rises or falls. This requires careful monitoring of your positions, as price changes can shift your net delta away from zero, helping to implement a robust risk management strategy.

4. The Bitcoin Context

Bitcoin’s extreme market volatility makes delta neutral trading shine, especially in the crypto derivatives markets. As more individuals and institutional traders enter the cryptocurrency market, employing a robust trading strategy that utilizes delta neutral strategies becomes essential. These strategies enable traders to engage in cryptocurrency trading without exposing themselves to excessive risk from immediate price changes.

Executing the Strategy

Delta neutral trading aims for a net delta of zero, allowing seasoned traders to balance their exposure and ensure profits and losses from market volatility offset each other. This trading strategy helps monetize funding rates or futures premiums instead of speculating on price changes, particularly in the cryptocurrency market.

- Pick a trading venue that has reliable order execution, low fees, supports spot and derivatives trading. This is important for handling trades immediately because gaps in prices and inefficiencies can close quickly.

- Construct a delta-neutral position by holding spot Bitcoin and opening an equal but opposite position in bitcoin futures. For instance, purchasing 1 BTC on the spot market and shorting 1 BTC in a quarterly futures contract equals positive and negative deltas, respectively.

- Track your portfolio’s delta regularly. Market moves and funding rates as well as time decay can push delta away from zero. Adjust with small spot or futures trades to nudge the portfolio back to neutral if it drifts — e.g., short 0.2 BTC if delta creeps up to +0.2.

- Arbitrage opportunities, e.g. Price or funding rate differences between spot and futures. These holes can plug up fast so the pirates have got to be fast.

- Just keep adjusting positions and rebalancing as necessary to achieve delta neutrality, particularly when dealing with options, whose delta changes as prices swing and time passes.

Spot Position

Spot holdings provide the foundation for risk management strategies with derivatives. With spot Bitcoin on hand, you can hedge risk from futures or options positions, especially in the volatile crypto market. In choppy markets, spot holdings buffer swings from leveraged positions, which keeps the portfolio stable. A lot of traders peg spot BTC holdings to soften the volatility spike and facilitate position adjustments — particularly when they have to re-calibrate their market delta on short notice.

Futures Hedge

| Market Condition | Spot Position | Futures Position | Outcome | Profit Driver |

|---|---|---|---|---|

| Rising BTC price | Long 1 BTC | Short 1 BTC | Delta neutral | Funding rate |

| Falling BTC price | Long 1 BTC | Short 1 BTC | Delta neutral | Futures premium |

| Volatile, sideways | Long 1 BTC | Short 1 BTC | Delta neutral | Arbitrage |

Traders offset spot exposure with opposing futures positions, making the selection of the appropriate futures contract crucial due to factors like expiry dates and liquidity that can affect the effectiveness of the hedge. Profits often arise from market volatility or dislocations in funding rates, rather than direct BTC price moves. For example, if quarterly futures trade at a premium, shorting them while holding spot can yield profits as prices converge.

Rebalancing Acts

- Use portfolio trackers to track the delta exposure in real time.

- Set stop orders to auto-adjust positions if delta moves too far.

- Run regular checks, especially during high volatility.

- Use simple spreadsheets or trading bots for faster calculations.

Timely rebalancing is the key to keeping risk in check in the cryptocurrency market. It allows traders to secure profits from arbitrage or funding rates while avoiding losses from drifting delta. This approach is beneficial for portfolios of all sizes, ensuring balanced delta exposure and sustaining profitability over time.

Navigating Market Structures

Market Structures is a must-read for all delta neutral traders in bitcoin, especially those focusing on cryptocurrency trading. Market structure defines risk and opportunity, allowing traders to identify profitable setups and respond to sudden changes. By understanding market volatility, you can avoid converting a delta neutral strategy into one exposed to massive price moves. Market structures such as contango or backwardation change quickly, so you need to adjust your trading strategy accordingly. Delta neutral trading requires ongoing effort; without keeping your net delta at zero, you’ll face unwanted exposure to price changes.

Contango Profits

| Market Type | Spot Price | Futures Price (3-month) | Difference |

|---|---|---|---|

| Contango | $60,000 | $62,000 | +$2,000 |

For contango, futures prices lie above spot prices, which often reflects market volatility. This occurs when traders anticipate that bitcoin’s price will increase or when carrying futures incurs costs – for instance, funding fees. When you identify contango, you construct a delta neutral trade – long spot, short futures. The difference between the two prices, referred to as the ‘basis,’ is where the profit is.

Making money in contango isn’t about predicting where the market is going; it’s about locking in the spread. When you purchase physical bitcoin and sell an equivalent amount in a futures contract, you collect the spread as long as your position remains delta neutral. The trick is to maintain balanced delta exposure, which at times implies rebalancing to price changes or funding rate fluctuations. In fast markets, these gaps can close rapidly. Traders monitoring contango in real time can trade before the spread vanishes.

Insight into contango points you in the right direction and keeps you away from otherwise attractive looking trades with latent danger. By monitoring the spot-futures relationship, you can determine when to enter or exit, thus making your decisions less emotional and more aligned with a quantitative strategy.

Backwardation Risks

Backwardation occurs when futures trade at a discount to spot. This reverses the typical spread and can surprise traders. If you’re delta neutral and the market goes into backwardation, the spread is against you. Profits from funding rates or premiums can evaporate, or even become losses if you don’t adapt.

The danger increases in volatile markets, with gaps that can fill in minutes. You’ve got to detect backwardation in time or you’re going to end up stuck. One way to reduce this risk is by utilizing stop-loss orders or establishing concrete criteria for when you should exit your position. Monitoring funding rates assists as well, since these can swing from positive to negative and eat up profits.

Mitigating backwardation risk involves staying vigilant, rebalancing frequently, and occasionally moving to different markets or options-based systems. Options provide greater flexibility, allowing you to benefit from volatility rather than just price movements. In any case, the objective is to maintain your net delta near zero. That takes effort, but it’s worth it for anyone who wants to steer clear of huge, sudden losses.

Identifying Inherent Risks

Delta neutral trading in bitcoin markets is not without risk even when the portfolio delta is close to zero. Such inherent risks arise from rapid price moves, liquidity gaps, and volatility shifts. These risks can tip the scales of positive/negative delta, turning once-stable setups into unstable ones. Traders have to keep an eye on the markets and tune their positions frequently. Position-level caps allow the markets to move, but allow you to lose more if trends endure. Navigating these risks involves striking a balance between the desire to remain neutral and the fact that market dynamics move fast.

Examples of how inherent risks can impact delta neutral positions:

- Fast price jumps making a neutral position vulnerable.

- Huge bitcoin price swings causing liquidations with delta near zero.

- High volatility leading to increased slippage and unexpected losses.

- IL diminishes returns when prices shift beyond anticipated intervals.

- Not adjusting delta in time causing drift and unplanned risk exposure.

Risk management tools — such as stop-loss orders and margin controls — are crucial. Traders have to watch for liquidity and platform reliability. By understanding market dynamics such as volatility spikes and liquidity shifts, traders are better able to identify and respond to risks in their early stages. A delta-neutral strategy, when managed well, can enhance portfolio stability and minimize risk, but only if traders stay vigilant and recalibrate as required.

Liquidation Risk

Liquidation risk is particularly notable in delta neutral trading strategies, as even a portfolio with perfectly balanced longs and shorts can be forced to close if prices move too far. In the cryptocurrency market, high market volatility means positions can get liquidated quickly, erasing capital. Leaving enough margin is critical; if margin dips below required levels, exchanges will liquidate positions to cover losses, even if the portfolio’s overall delta is stable. Implementing stop-losses, maintaining margin buffers, and monitoring funding rates can assist in mitigating this risk. A good habit is to check your margin requirements frequently, especially when market conditions are shifting rapidly.

Impermanent Loss

Impermanent loss occurs when the price of bitcoin or its pair shifts from the baseline, eroding gains even as market delta appears neutral. It’s ubiquitous in cryptocurrency trading and hedging. To mitigate this loss, traders can reduce exposure to wild price gyrations, rebalance more frequently, or deploy snappier hedges. Understanding impermanent loss helps you to strategize and implement an effective risk management strategy, particularly when market conditions move outside anticipated ranges.

Execution Slippage

Execution slippage is a common issue, particularly in periods of high market volatility. This spread between anticipated and realized fill prices can damage margins, converting a breakeven trade into a losing one. Rapidly moving cryptocurrency markets amplify slippage. Utilizing trusted trading venues with strong order-matching, limit orders, and trading during periods of greater liquidity can mitigate this issue. In large market moves, breaking up an order into smaller trades can decrease slippage.

The Strategic Advantages

Delta neutral trading is one of the best-kept secrets of bitcoin because it allows traders to reduce exposure without sacrificing potential profits. The fundamental concept is to construct a portfolio in which profits and losses from price changes offset each other. This is accomplished by compounding assets with positive and negative delta until the resulting net delta is near zero. With bitcoin’s price frequently swinging up and down, this strategy can maintain profits while navigating the crypto market’s volatility.

The obvious benefit is the opportunity for consistent yield regardless of bitcoin’s price direction. Delta neutral traders don’t attempt to predict the market’s next move. Instead, they arrange trades that profit off of volatility itself or funding rates. For instance, in robust trending markets, perpetual swap funding rates can remain one-sided for extended intervals. By simultaneously holding long and short positions, traders can collect these funding payments and accrue small but consistent profits. Even a minuscule advantage—a mere 0.01% per trade—can accumulate quickly, especially for seasoned traders in the crypto derivatives markets.

Risk control is another big advantage. For one thing, by maintaining a net zero delta, traders skirt big hits from sharp price moves. Hedging strategies like this equate to less stress over bitcoin’s next big plunge or surge. The stance will require regular adjustments, however, because delta changes as the market moves. Without these tweaks, the hedge can slide and leave the trader exposed to unwanted risk. With diligence and frequent inspections, portfolio risk remains under control and doesn’t depend on market conditions or guessing.

Long-term performance also receives a push. Delta neutral trading is not about fast profits but rather compounding small profits. In jump-and-plunge markets, this can bring some steadiness. It allows traders to make money off of volatility itself–meaning that crazy price swings become an income opportunity, not a burden. This is advantageous for investors looking to construct consistent returns while minimizing the anxiety of large market swings.

Beyond Simple Arbitrage

Delta neutral trading elevates simple arbitrage to the next level by providing more leverage and control within volatile markets such as Bitcoin and the broader cryptocurrency market. Simple arbitrage looks for tiny price gaps across markets or exchanges. Delta neutral trading tries to keep a position’s net exposure to market swings near zero, which means the trader is less susceptible to abrupt price shifts and can seek returns from different avenues, like volatility or funding rates in the crypto derivatives markets.

This trading strategy frequently employs both spot and derivatives products, such as purchasing Bitcoin on the spot market and concurrently selling an equivalent amount of Bitcoin futures. Constructing a delta neutral position is not set-and-forget; it requires routine monitoring and adjustment to maintain a robust risk management strategy. As price fluctuations or funding variations can move the net delta from zero, careful oversight is essential. If not monitored diligently, these initially direction-neutral arrangements can drift into directional risk territory, behaving more like a wager on the market than a hedge against it.

Delta neutral doesn’t mean just Bitcoin. By pairing assets such as Bitcoin & Ethereum, traders can exploit opportunities to arbitrage price correlations. For instance, when the spread between Bitcoin and Ether expands beyond its typical range, a trader can place offsetting long and short bets to catch the expected mean-reversion. This demands a robust understanding of asset co-movements and how events or market conditions alter them.

Options add an additional dimension to this strategy. With options, traders can construct delta neutral trades that profit when volatility changes—not just from price movements. For instance, a trader might deploy a straddle or strangle, where profits are earned if the market becomes more volatile, allowing for a shift from speculation about Bitcoin’s direction to reliable returns from mechanisms such as futures premiums or funding rates.

Several seasoned traders employ algorithms to detect undervalued or overvalued assets and establish delta neutral trades that capture these pricing discrepancies. This approach can reduce emotional trading and simplify identifying and exploiting transient market gaps, enhancing their overall trading performance in the cryptocurrency markets.

Conclusion

Delta neutral trading allows traders to engage with bitcoin price action while managing risk. It provides a legitimate application for people seeking stable returns, not extreme fluctuations. They employ these configurations to secure profits, limit loss, or simply remain in the game as prices move rapidly. Actual trades scream of holding spot bitcoin and shorting futures, or even playing with options to delta neutralize the risk. Each route has some quirks, so a keen eye on fees, liquidity, and timing really rewards. It takes time to learn to identify these setups, but it develops skill and confidence in your own strategy. For those interested in expanding as a trader, experiment with delta neutral steps and see what aligns with your personal style.