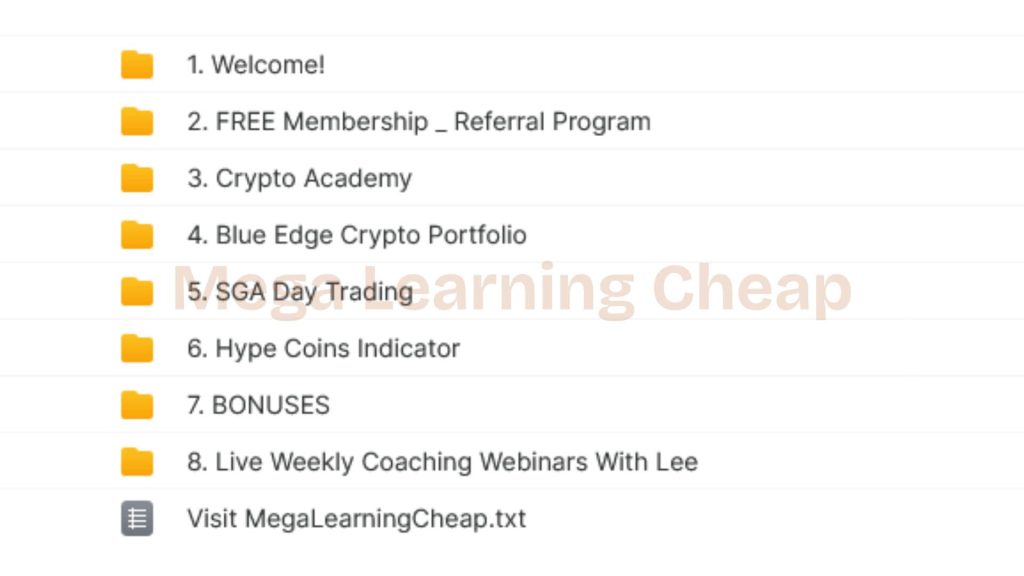

Blue Edge Financial – Crypto Academy

Access The Crypto Academy For ONLY $497 $13

The Size is 10.11 GB and was released in 2021

Key Takeaways

- The Crypto Academy takes you from Forex, Crypto, and prop farming ZERO to hero with well organized courses. Follow onboarding steps to onboard accounts, risk management, and prop challenge for payouts.

- Students receive proprietary algorithms, expert advisors and hedge bots to assist with strategy creation. Take advantage of our dashboards, trading platforms, and VPS access to experiment and refine your trading systems.

- Real-time market data, analytics, and leaderboard challenges fuel the development of practical skills. Begin with simulated markets, then bring strategies into live markets once you satisfy risk thresholds.

- Members get access to a global community with mentors, coaches and active discussion channels. Jump into group challenges, live sessions, and feedback sharing to fast track your learning.

- Authenticated client testimonials and Trustpilot scores provide an objective perspective on performance and results. Check out applause & apprehensions to establish realistic expectations and select the correct educational direction.

- It’s based on independent skill building, data-driven decisions, and continuous improvement. Track your performance metrics, hone your strategies with input from mentors, and iterate based on market conditions. ===

Blue Edge Financial – Crypto Academy is an online education program that teaches the basics and advanced topics of cryptocurrency and blockchain. It touches on fundamental concepts such as how Bitcoin and Ethereum function, wallet configuration, on-chain security, and risk management. Among courses you’ll find market structure, spot and futures trading, and step-by-step lessons on exchanges and chart tools. Students receive worksheets, live sessions and recorded modules, emphasizing crystal-clear rules, plain language and duplicatable processes. Support through community forums and Q&A will help learners sanity check ideas and avoid common pitfalls. To assist with side-by-side comparisons, the following sections deconstruct pricing, course scope, instructor background, and user feedback, and provide notes on who benefits most from each track.

What Does The Crypto Academy Offer?

A time-in-practice path to trade forex and crypto, focusing on prop firms and their funded accounts, along with real-world execution. Many trading organizations offer courses, tools, and expert coaching to guide users from setup to payouts while addressing risks and market conditions.

1. Course Structure

The course is modular, catering to both beginner and advanced levels, and covers essential market basics, order types, and entries and exits. Advanced courses delve into market profile, liquidity zones, and algo-based setups, particularly for forex and cryptocurrencies. Specialized modules focus on prop firm rules and scaling plans, which are crucial for successful traders to maintain daily drawdown limits in their trading strategies.

You will benefit from an easy onboarding process that includes platform/account setup, broker and VPS setup, and EA installation. The course also guides you through challenge selection and rule mapping, ensuring that you are well-prepared for test trades and the full challenge attempt. Videos and tutorials illustrate the journey, showcasing case demos where students have achieved significant profits, such as $7,000 or $2,500 payouts.

With expert coaching and a proven prop farming strategy, the course equips you to navigate the forex market effectively. By learning the intricacies of prop firm accounts, you can enhance your trading experience and ultimately achieve trading success. This comprehensive approach ensures that you are prepared for the challenges of the trading world while focusing on stability and customer support.

- Forex Foundations: 6–8 hours;days, risk, entries) goal: safe execution

- Crypto Trading: 6 hours; volatility tactics; goal: manage swings

- Prop Farming Mastery: 10 hours, challenge guidelines, scaling, goal: funded pass

- Market Profile: 5 hours; organization, quantity; goal: higher R trades

- Algo & EAs: 8 hours;setup, test, deploy; goal: rules-based system

2. Learning Tools

Users receive EAs, hedge bots, and platform templates, along with analytics dashboards and optional VPS to maintain systems live 24/7. Proprietary algorithms and expert advisors support rule-based execution in forex trading and crypto, while systems are optimized for trending, ranging, and high-volatility sessions. Access is via the dashboard: download, license key, VPS link, install, and run a small-size forward test before scaling for trading success.

3. Community Access

The Discord and BEF groups offer round-the-clock live chat assistance, office hours, and peer feedback, ensuring customer support is always available. Group challenges keep you consistent, while the Prop Farming Leaderboard tracks over 500k strategies fine-tuned by our community. Members gain access to live trading rooms, receive update feeds, and can engage in events and competitions to enhance their trading experience.

4. Expert Mentorship

Mentors, including veteran traders and success coaches, offer personal coaching and one-on-one assistance to enhance your trading experience. The system employs intake goals and weekly check-ins, ensuring users can consult analytics teams for trend context while reviewing their trading strategies. To connect with a trusted company, simply fill out the mentor form, provide account metrics, and select time points for your journey.

5. Practical Application

Hands-on work comprises sim trades, funded-style drills, and real market challenges. You can enter online prop farmer leagues and take on numerous prop challenges, with gameplay reflected in the simulator. Our focus on drawdown, scaling, and payout cadence enhances the trading experience for many trading organizations. Outcomes differ; some wins occur, while others may lose funds, but we offer a 150% refund if you don’t get funded, terms apply.

Real User Experiences

This part highlights what users discuss regarding Blue Edge Financial’s crypto academy, focusing on trading strategies, customer loyalty, and the importance of market conditions. Sources from public forums, social platforms, and review sites reveal a mix of triumphs and lessons learned.

Online Feedback

Throughout Reddit threads, Discord snippets, X posts and specialized trading forums, users mention a vibrant community and prompt moderators. Office hours and “success coach” feedback get mentioned a lot, lauded for helping individuals polish entries, risk limits, and sparring tempo.

Negative notes swarm the trading bot. Multiple posts report that it fails over 50% of prop-firm challenges, particularly with strict drawdown guidelines. A handful label the program slow to prove gains, with a few taking months to even break even and noting significant losses en route.

Two themes repeat: it is not a quick win, and expectations matter. For some they say getting funded within a month and even a first payout, for others long testing and learning manual filters. A couple posts interrogate credibility, one calling the CEO a con artist, however, comment streams fight back and call for evidence.

| Source type | Sentiment | Key points |

|---|---|---|

| Forums | Mixed | Helpful community; bot inconsistency; slow ROI for some |

| Social media | Mixed-positive | Fast funding stories; praise for coaches; skepticism present |

| Private groups | Positive | Strategy variety; clear rules; peer accountability |

Why Customers Stay Loyal

Clients stay when the trading experience is consistent, valuable, and honest. Blue Edge Financial’s Crypto Academy deserves that reputation by coupling clear value with proven outcomes, while maintaining customer support close and actionable for long-term trading success.

High value, consistent results, and coach support

Members cite the combination of lessons, live market walk-throughs, and trade plan templates as a solid foundation for their trading success. It’s not the hype; they want tools they can use today—risk rules in % terms, easy entry/exit checklists, and weekly recaps of what worked and what didn’t. A high algorithm success rate, combined with expert coaching, cuts noise. When a bot or rules-based setup acts as disclosed in backtests and forward tests, trust builds among clients. Coaches keep members in the loop post sign-up, peruse trade journals, and provide candid feedback within 24–48 hours, fostering customer loyalty and a reputable trading experience.

Community and group challenges

A thriving community fosters daily practice, making it a habit. Group challenges—like 30-day risk-discipline sprints or ‘two trades a day’ drills—encourage traders to share their trading strategies. Participants exchange charts, trade post-trade notes, and track stats in spreadsheets together. When peers celebrate small victories—such as a complete month at 1% risk per trade or five clean exits in succession—customer loyalty and drive remain elevated. Those who stay more than three years often develop very close connections.

Transparency, trust, and proactive care

Trust accumulates as the team demonstrates where a strategy succeeds and where it fails, providing insights into various market conditions. Routine performance disclosures, tool caps, and clear-language risk warnings establish reasonable expectations for customer loyalty. Proactive support includes check-ins during drawdowns, quick fixes when tools break, and early notice on updates, ensuring a smooth journey for clients. Guarantees matter — a refund policy, including those touted as a 150% return of investment, indicates confidence and de-risks the prospect for new members.

Payouts, funding, and growth paths

Consistent returns from funded accounts remind many trading organizations that this work pays. Concrete milestones to get a funded account, pass a prop firm challenge, or scale to larger capital keep members hooked. These milestones — first payout, first €1,000 month, regular 2% weeks — ground long-term plans, while distinctive financing paths and stepped capital vehicles provide space for trading success without additional pressure.

The Educational Philosophy

Blue Edge Financial’s Crypto Academy develops competencies for actual markets, not speculation. The program is well organized to provide value, facilitating an easy onboarding process with clear transitions from novice modules toward live practice. The goal is to foster customer loyalty and long-term growth, equipping participants with the tools and network for trading success.

Articulate the commitment to empowering traders through practical education and real market experience.

The academy focuses on experiential learning, allowing participants to engage with real-time market data and develop effective trading strategies. Through daily trade planning and post-trade reviews, they can implement tactics in demo accounts before transitioning to mini live accounts. Workshops break down entries, exits, and risk caps using simple rules, such as fixed position sizes and stop-loss targets. Accountability through trade journals and weekly feedback rounds enhances their journey. Although a few participants have felt daunted by the program, they found it exhilarating to observe their trading success when meeting fundraising targets.

Emphasize the focus on developing independent trading skills and critical thinking.

The objective is autonomy in trading strategies. They instill lessons on how to read market structure, identify liquidity pools, and estimate trend strength with simple statistics. As case studies demonstrate winning and losing setups to train your judgment, not blind copying, the academy emphasizes integrity and transparency: results are shared with context, and risk warnings are plain. Among other things, traders are encouraged to question signals, experiment with concepts, and draft short pre-trade checklists. Other attendees noted that the method can seem intimidating initially, particularly when you’re unseasoned, but the tempo relaxes via scaffolded assignments and peer assistance, fostering a supportive environment for trading success.

Highlight the use of data-driven strategies and proprietary algorithms to adapt to market changes.

Tactics rely on information, especially in the ever-evolving world of cryptocurrencies. Our proprietary algorithms flag momentum shifts, volatility bands, and correlation breaks across coins, allowing students to observe how trading strategies translate into rule-driven behaviors. The academy explores live market data and promotes small, contained experiments that adjust when liquidity or spreads shift, ensuring a robust trading experience.

Assert the importance of continuous improvement, feedback, and adapting to new trading trends.

Feedback loops propel expansion in many trading organizations. They discuss questions and gain senior member feedback in community forums and live rooms, fostering customer loyalty. The academy’s transparent policies include a 150% refund promise if you don’t get funded, ensuring accountability. This method focuses on craft, assurance, and consistent behaviors that accumulate, ultimately enhancing the trading experience for clients.

Global Service Popularity

Blue Edge Financial’s Crypto Academy can be seen in top trading hot spots and booming areas. With over 5 years of experience, it has established trust in track record-driven markets. Its community spans users in North America, Europe, Southeast Asia, the Middle East, and parts of Africa. The activity is concentrated in cities with high internet usage, where users have access to crypto exchanges. Public posts and forums display users in the US, UK, Philippines, UAE, and South Africa exchanging case studies, charts, and funding milestones. This indicates a strong appetite from both retail traders and side-income aspirants who desire transparent avenues for skill development and capital availability, particularly in cryptocurrencies.

Attention has increased thanks to its prop farming and trading workflows. The pitch is simple: train with structured content, pass set rules, and gain access to larger trading accounts. Other users describe large financing in tight windows. One individual reports being funded with USD 1 million in trading capital in just 2.5 months. Others share how they broke through income plateaus, with one mentioning the program allowed them to earn more than their day job salary, and another having his wife retire early. These stories aren’t promises, but they demonstrate why the model travels beyond home, reaching places where capital access is constrained and trading success is a goal.

Site stats and user composition indicate worldwide popularity. Third-party trackers show consistent traffic from various geographies and referrers, such as finance blogs, education sites, and trading tools, indicating solid backlinks and brand mentions. Reviews back that up: one platform lists 577 reviews about the company, showing an active and vocal base. Many of the reviews laud the coaching, step-by-step rules, and community calls. However, a few users flag hype and request more explicit risk wording. This combination of acclaim and resistance is common among exchange services with broad appeal, reflecting the diverse experiences of clients.

Compared to other trading educator and funder brands, Blue Edge is positioned in the mid-to-upper tier by awareness and community size. It competes with global prop firms that emphasize challenge accounts and with education-first outfits that eschew capital programs. Blue Edge’s unique advantage lies in the curriculum and prop path mergers, which compress both learning and funding stages. Its risk rules, fees, and scaling pace differ by program, so due diligence still counts. Powerful backlinks, multi-market traffic, and a durable lifespan assist its rank, while ongoing marketing examination keeps expectations manageable for its users.

Company and Contact Information

Blue Edge Financial operates the Crypto Academy through its official website at https://blueedgefinancial.com/. The site contains course pages, video thumbnails, photos, and a private client area where students enter to view lessons, follow updates, and monitor their trading experience. Key offerings include the Virtual Prop Farmer and a Prop Farming Leaderboard that shares insights on more than 500,000 trading strategies. This trusted company utilizes technology like Google Maps, DNSSEC, and CloudFront. For support, clients should use the website, client portal, and community channels available.

Our Mission

Blue Edge Financial intends to unlock access to elite trading education and tools so individuals across the globe can discover, experiment and implement strategies without expensive hurdles. The Virtual Prop Farmer and the comprehensive strategy leaderboard demonstrate this focus in action, providing students with organized tracks and information at scale.

The company empowers traders pursuing financial freedom with defined curricula, real-time case studies and tracking of achievements. It craves a trusted, groundbreaking community where members assist one another via forums and communal trade reviews. The team dedicates consistent investment to content excellence, master coaches, platform velocity and a more seamless experience, from initial login to the master strategy labs.

Get In Touch

For any account problems, billing inquiries, or download requests, visit the website contact form within the member area. If you are not yet a client, start your journey at https://blueedgefinancial.com/ and use the on-site forms that appear on product or support pages. Many trading organizations find this easy onboarding process beneficial for new clients.

For quick updates and announcements, the Telegram channel is available at https://t.me/thecoursepedia blue edge financial. Joining our Discord community (linked from the website or client portal) can enhance your trading experience by providing quicker crowdsourced assistance, peer reviews of trading strategies, and group study sessions.

If you wish to request an individual coach, open a ticket in the client area and select Coaching as your topic. Typical responses include sales and billing inquiries addressed within 24–48 hours, while technical support is available within 24 hours on business days. Community replies are often received within minutes, making it a supportive environment for experienced traders.

Privacy and terms are detailed in the website footer. Users can configure email preferences in the client area, request data exports, and understand how their personal funds are managed. Notably, they offer a refund policy of 150% of program fees if you don’t get funded, subject to eligibility and proof of completion.

Conclusion

Blue Edge Financial’s crypto academy demonstrates value. Lessons remain brief. Tools hit the ground day one. Users trade consistent skill advancements, not buzz. The staff provides actual assistance, immediate responses, and concrete actions. The emphasis remains on risk, strategies, and consistent development. New traders start with easy assignments. Experts discover clean edges, such as rule sets and backtests. One student in Berlin applied the weekly plan to reduce drawdown by 12%. A nurse in Manila rocketed to her maiden 5% month just three weeks later. We serve many areas with reasonable rates and straight talk.

To get a feel, begin with 1 class, 1 set-up and log every trade for 30 days. For information or assistance, contact the team today.