Backtest Wizard – Flagship Trading Course

Get the Flagship Trading Course For ONLY $198 $10

The Size is 4.48 GB and Released in 2025

Key Takeaways

- The Backtest Wizard course delivers key backtesting and risk management techniques, empowering traders of any level to enhance strategy generation and implementation.

- They learn to graduate from cruddy spreadsheets to state-of-the-art tools and python programming to rigorously and realistically test strategies and automate.

- The course spans the gap between theory and practice, providing both structured lessons and practical projects to get traders applying the systematic techniques in live markets.

- Students turn intuitive trading concepts into measurable algorithms, leveraging statistics and simulations to evaluate risk and return in different market environments.

- The course breaks down advanced Python concepts into digestible pieces, providing newbies and veteran traders with detailed instructions and hands-on projects.

- Future students should weigh their own objectives and experience — the course is structured to provide a lot of value for individuals seeking an edge in the world’s toughest trading arenas.

Backtest Wizard is a trader software designed to backtest trading strategies on historical market data. Traders use it to verify that their rules perform prior to trading with real funds. The tool allows users to analyze historical trades, configure entry and exit points, and visualizes the performance of various strategies through the years. Reports typically display returns, drawdowns, and risk metrics for every strategy. Backtest Wizard currently supports many stocks, currencies, and other markets. Being able to iterate quickly and switch settings allows traders to save time and identify errors early. For those who want to know whether a plan is robust or frail, backtesting tools like Backtest Wizard provide unequivocal evidence. The following sections describe how it works and highlight key features.

Why The Backtest Wizard Course Matters

In short, the backtest wizard course is an excellent flagship trading course for traders seeking to develop powerful, data-driven trading systems. It’s designed for both new and veteran traders who want to graduate from guesswork. You learn crucial skills in algorithmic trading, risk management, and Python for backtesting and automation. With an emphasis on rule-based trading, it assists in eliminating sentiment from the process and encourages the construction of strategies based on actual statistics, enhancing your backtesting skills.

1. Beyond Spreadsheets

Most traders begin with spreadsheets, but these tools have their limits. The backtest wizard course provides access to professional-grade software and sophisticated backtesting tools unavailable in simple spreadsheet applications.

Armed with these tools, traders can put their strategies to the test against tremendous amounts of market data. That is, more accurate backtesting of a strategy’s past performance and risk. Tools in the course assist users in identifying vulnerabilities and optimizing their strategies to be better equipped to withstand market fluctuations. Hands-on examples demonstrate how to configure, backtest and optimize strategies in a fashion its far more potent than manual spreadsheet work.

2. Demystifying Code

Coding may appear difficult to most traders, particularly non-technical types.

The course employs a progressive instruction style to decompose Python fundamentals. This method assists students of all skill levels develop proficiency in authoring and evaluating basic scripts. As trades track along, they discover how to automate tasks and create rule-based systems that work across markets. By the end, they’ll be able to write, test, and modify their own code for backtesting, providing them greater control and agility in their trading.

Python isn’t just a nice-to-have—it’s at the heart of contemporary trading, enabling users to customize and backtest their own models.

3. Bridging Theory

The course closes the gap between trading theory and practice.

Real-world examples and case studies demonstrate the process of starting with an idea and transforming it into a proven, functioning system. Each module leads traders through creating, backtesting, and optimizing their own strategies. This practical effort assists traders figure out what concepts perform, and why, utilizing tools such as walk-forward optimization and out-of-sample testing.

4. Quantifying Intuition

The key is converting intuition into hard numbers. It’s about taking a hunch and backtesting if the data supports it.

Monte Carlo simulations measure risk and reward. Systematic tests help make strategy comparisons fair and transparent. Constructing a portfolio of backtested strategies allows traders to better control risk.

Short tests show which ideas work.

5. Managing Risk

Risk is at the core of trading.

The course includes targeted lessons on tools and charts for risk management. Traders learn to identify safe risk levels for various securities. Charts and metrics monitor risk and reward.

Learning this keeps losses small.

| Feature | Benefit |

|---|---|

| Python training | Build, test, and automate trading strategies |

| Advanced backtesting tools | Improve accuracy and risk control |

| Systematic trading methods | Remove emotion, make data-driven decisions |

| Case studies and practical tasks | Real-world skills and better trading performance |

| Risk management modules | Minimize losses, maximize gains |

Making Python Accessible

Because of its clean syntax and simple vocabulary, Python appeals equally to beginners and experts alike. This gets folks concentrating on how stuff works, not weird rules or tough terminology. When learning to trade code, these characteristics count, especially for those interested in systematic trading. Python’s code in plain style lets most folks read and write it with less strain, regardless of their background. The broad distribution of Python’s tutorials and tips contributes to its popularity. Nearly all guides are step-based, and powerful annotations facilitate learning from what others post. This means that even if you don’t have a tech job, you can start and learn on your own schedule.

A key aspect of this flagship trading course is to simplify the steps for beginners. The course begins with the foundation, then provides practical exercises that correspond to trading demands. For instance, students can code a backtest to see how a trading strategy would have performed historically, leveraging advanced backtesting techniques. These practical drills get readers experiencing tangible results, not just reading about them. The concept is to apply actual work, not just concepts, so that students acquire practical skills. Even first-timers can observe how their efforts connect to the real world, which motivates them toward trading success.

It works for the know-more crowd, including intermediate traders. It includes hard concepts, such as how to establish self-running trades. That means how to leverage Python’s big tool kits, like pandas or NumPy. At first, all these tools may seem overwhelming, but every lesson provides guided walkthroughs. Through practical, real-world assignments, the course assists users in figuring out how to select and apply the appropriate tools to get the job done. Along with course notes when things can get tricky, such as when Python’s loose rules might conceal tiny bugs, it demonstrates how to employ utilities such as IDEs or web notebooks that assist in displaying code and outcomes in parallel. These tools help you debug and learn through practice.

The Power of Practical Application

Practical application is at the heart of mastering backtesting and trading strategies. When users engage with real data, they cease to speculate and begin to decide on information. This habit allows them to detect trends and patterns, rather than responding to market static or instinct. With the flagship trading course, users run hands-on projects that make the theory practical. For instance, after reading about a moving average crossover, they can immediately test this notion with years of price data and find out how it stands. It creates a powerful connection between what they studied and how it functions in practice.

There is more reason to work on live projects than just building skill; it molds discipline. When you stick to a time-tested plan, you won’t make panic trades out of fear or greed. Take, for instance, when a backtest reveals a strategy’s vulnerabilities, such as overfitting — users are able to address these holes before risking actual capital. This trial-and-error feedback loop fortifies their plan and helps them stay calm and collected in real-market action, enhancing their backtesting skills.

The importance of practical application is evident in the way it assists users in evaluating a strategy’s prospective robustness. Backtesting allows them to determine whether a technique is effective in various markets, over stocks, bonds, or currencies. This way, they can discover whether their design is too narrow or if it can pivot to new fads. Metrics such as annualized return, Sharpe ratio, and maximum drawdown tell you whether or not a strategy is actually worth deploying, providing a comprehensive view of risk and reward in their trading approach.

Case studies support this method, particularly in the practical case studies module. Consider, for instance, the experience of many traders who constructed and tested a basic momentum system — it worked during some years, but then failed when markets shifted. By noticing this in advance, they could adjust their rules or introduce additional filters, resulting in improved outcomes over time.

Practical application requires both programming and a solid understanding of trading fundamentals. When users combine these skills, they can identify mistakes, optimize algorithms, and analyze messy data. Over time, this way of working results in smarter, more systematic trades and a greater likelihood of long-term success, reinforcing the value of a comprehensive curriculum in trading education.

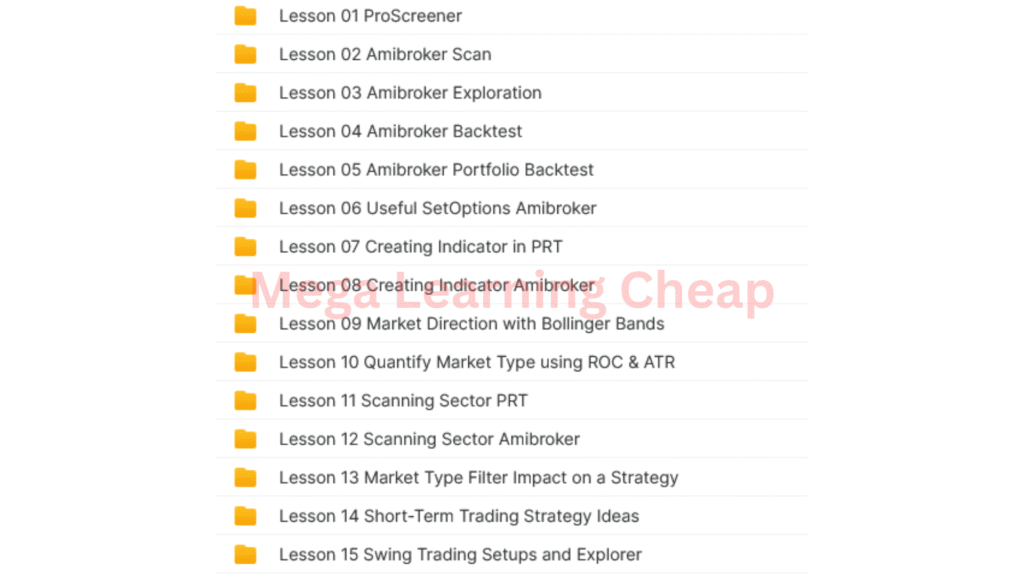

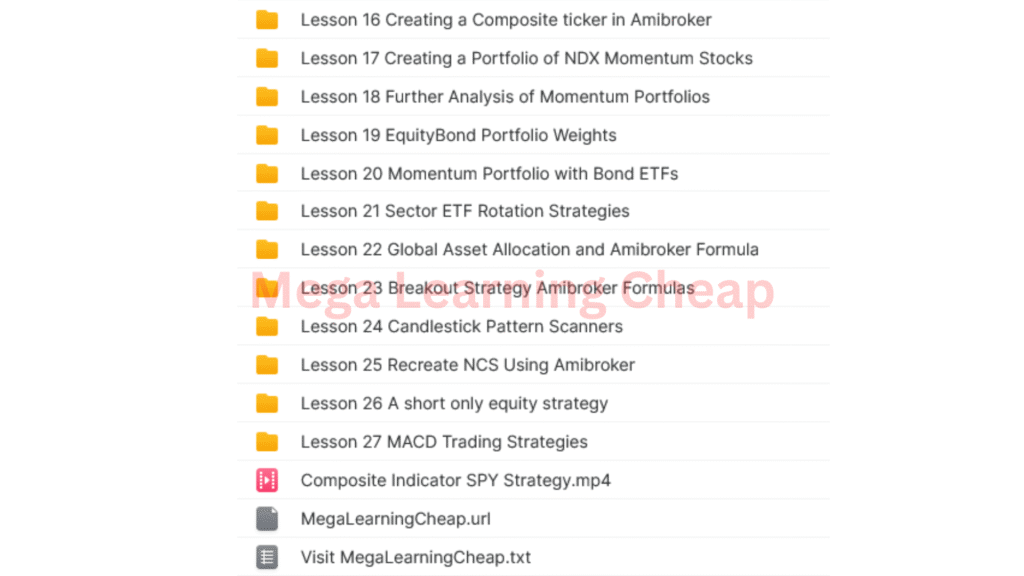

A Look Inside The Curriculum

Backtest wizard’s curriculum is expansive yet focused, designed for traders looking to develop or evaluate trading strategies. With each subject building upon the last, students can progress from complete beginners to advanced material. It opens with a foundation on how to apply pro-level indicator formulas and custom backtest templates, providing a solid launch pad for both rookie and seasoned traders eager to construct their own robust trading strategies.

The second portion of the curriculum transitions to practical tools and analysis, covering essential skills for effective trading. Tutorials encompass applying ProScreener, identifying swing setups, and researching short-term trade ideas, which are crucial for systematic trading. Students learn how market type filters can alter the functioning of a strategy and discover how to scan sectors in Amibroker and PRT, ultimately building a momentum stocks portfolio similar to the NDX.

Advanced modules delve into more sophisticated strategies, including the advanced backtesting techniques module. Walk-forward optimization, Monte Carlo simulations, and out-of-sample testing are broken down in plain English, with explicit instructions so users can test their strategies’ robustness before trading. The course covers how to use rate of change (ROC) and average true range (ATR) to measure market types and how to build custom indicators in both Amibroker and PRT.

There’s a hands-on case study component, demonstrating how to construct real strategies from the ground up. This mapping out helps students view the process from beginning to end, making the theory far less abstract and easier to apply. The course includes documentation templates, performance tuning guides, and implementation tutorials, ensuring that the course materials are accessible and practical.

Key skills taught in the course focus on enhancing trading skills and backtesting skills, which are essential for achieving sustainable trading success. With actual trading illustrations, each lesson becomes memorable, equipping learners with the knowledge needed to excel in financial markets.

- Building and testing trading strategies

- Using and writing indicator formulas

- Scanning and filtering market sectors

- Creating custom backtest templates

- Measuring and filtering by market type

- Walk-forward and Monte Carlo testing

- Portfolio construction and rotation strategies

- Writing clear strategy documentation

My Unfiltered Perspective

The Backtest Wizard is one of the few organized and systematic backtest courses, emphasizing the importance of maintaining disciplined logs of every observation. This approach aids traders in identifying trends and optimizing their systematic trading strategies as time progresses. The course guides you through changing one variable at a time and then re-running the backtest, allowing you to see the effect of each adjustment. This incremental style prevents you from getting bogged down in too many changes at once, a frequent pitfall for many traders. Another key takeaway is the heavy emphasis on performing numerous backtests. One test is not enough because market conditions change, and randomness can cause bias. The course forces you to test across various scenarios—bull runs, shakeouts, and even black swans—highlighting the danger of market evolution bias, which is the fallacy that a strategy that succeeded five years ago will continue to succeed today.

The Backtest Wizard course doesn’t sugarcoat difficulty. Data reliability is a significant topic, as feeding it unreliable data or failing to verify its origin will yield poor output. It encourages you to question whether the results are true and cautions against taking results at face value. This training promotes testing across a large data set—at least 10 years of data for long-term traders—to span multiple market cycles. This is crucial because a mechanism that performed well in one generation might stumble in a subsequent one. The course emphasizes that backtesting isn’t “one and done.” You must continue testing as markets evolve and fresh information arrives.

| Strengths | Weaknesses |

|---|---|

| Step-by-step, structured process | Requires discipline to keep detailed records |

| Focus on data reliability | Can be time-consuming |

| Covers many market conditions | May be overwhelming for new traders |

| Encourages long-term perspective | Some content is not beginner-friendly |

To extract maximum value from this flagship trading course, maintain a trading journal where you record every backtest and adjustment. Concentrate on one minor adjustment at a time, using advanced backtesting techniques to test for years across multiple market cycles. Before you register, consider your objectives. This course may not be the right fit if you want instant answers. However, if you’re looking to construct a rock-solid tested trading system, this method offers exceptional value.

Is This Course For You?

This course is designed for individuals who want to transition from gut-based to data-driven trading. If you’re an intermediate trader ready to make the leap from guessing to rules and numbers, you’ll benefit here. The course assists individuals eager to acquire data science abilities for the markets, particularly through its flagship trading course curriculum. If you want to create and experiment with your own trading concepts, not just copy others, this works well.

Before you begin, it’s essential to understand the basics. The course is NOT for those brand new to trading or coding. You should understand how markets function and have some trading experience. The lessons are python-based, so you should be able to code up simple snippets. If you’re a python newb but eager to learn, this course can still work for you — it instructs real code for real trading problems, particularly focusing on advanced backtesting techniques.

For technical analysts, this course bridges the divide between sketching charts and seeing if your theories play out in the market. It covers backtesting, walk-forward optimization, and Monte Carlo simulations, which assist you in determining whether your plan might survive real market gyrations. For instance, if you trade with moving averages or other signals, the course will walk you through how to test these concepts step by step and identify vulnerabilities, enhancing your backtesting skills.

If you want to get into systematic, rules-based trading, the course guides you in constructing complete trading systems. It teaches you to apply portfolio management skills to diversify risk and optimize your probabilities. You’ll do more than just hear theory– the case study portion allows you to construct and validate an entire strategy from scratch. By the end, you’ll know how to use data, code and logic to trade smarter.

Anyone fretting about the expense needs to consider what is won. The worth is in picking up some skills that can really help you trade with more craft and less flailing. You receive takeaways from experts who employ these strategies themselves. For traders prepared to grind, this flagship trading program can assist in enhancing your trading to a new stratum.

Conclusion

Backtest Wizard provides a genuine opportunity for experiential education. The course cuts the crap. Each section demonstrates Python with explicit instructions. The lessons decompose every assignment, so nobody gets overwhelmed. They work on real trades, not just look at boring code. The course suits various skill levels. It assists both newcomers and the seasoned hacker alike. Python can be gnarly, but the course breaks it down in simple terms with practical examples. Whoever wants to apply data to test trading concepts can apply these lessons. To begin, look at the course page and determine if the style fits your learning habits. Try it out and see how it aligns with your objectives.