Darren Jenkins – Defi Income Optimizer

Get The Defi Income Optimizer Course for $499 $10

The Size is 17.67 GB and is Released in 2025

Darren Jenkins’ DeFi Income Optimizer gives you a 12‑month, step‑by‑step path to turn crypto into passive income. You’ll learn staking, lending, liquidity strategies, and portfolio management across eight modules, with weekly coaching, a private community, and unlimited email support. The DeFi Portfolio Planner, templates, and risk frameworks help you track yields, fees, and exposure while targeting 10%–100%+ APY. It’s $20 for immediate access and built for beginners and investors seeking steady returns. Keep going to see exactly how it works.

Program Overview and Objectives

Although markets change fast, Defi Income Optimizer gives you a structured, 12‑month path to turn crypto holdings into passive income. You’ll follow a Complete DeFi Training Course with eight clear modules: blockchain basics, secure wallet setup, buying crypto, staking, lending, portfolio management, and liquidity mining for recurring rewards. Each step builds skills so you can aim for consistent passive income without guesswork.

You get weekly group coaching, an exclusive community, and unlimited email assistance to keep you moving. The program’s objective is simple: help you apply practical, risk‑aware strategies so your capital works harder while you stay in control. Market updates, a DeFi Portfolio Planner, and early access to top DeFi coin picks support your execution.

While it doesn’t promise passive income immediately, it equips you to implement proven tactics at the right pace for your risk tolerance. By the end, you’ll manage positions confidently and compound returns using repeatable, diversified DeFi methods.

Key Benefits and Expected Outcomes

Because you want clear results fast, Defi Income Optimizer equips you with step‑by‑step DeFi strategies to turn idle crypto into working capital, targeting 10% to 100%+ APY while managing risk. You’ll implement vetted DeFi protocols to generate passive income within days of setup, using clear checklists and a DeFi Portfolio Planner to align yields with your risk profile.

You’ll gain confidence through weekly live coaching and ongoing support, so you can troubleshoot, refine positions, and act on timely market updates. You’ll practice disciplined portfolio management—position sizing, rebalancing, and exit rules—to protect capital and compound gains.

Expected outcomes include a diversified, automated income stream, faster decision‑making, and fewer costly mistakes. You’ll understand how to evaluate protocols for security, fees, and liquidity, and how to adapt when market conditions shift. All content serves educational purposes, empowering you to make informed choices and execute repeatable processes that scale sustainably as your experience and capital grow.

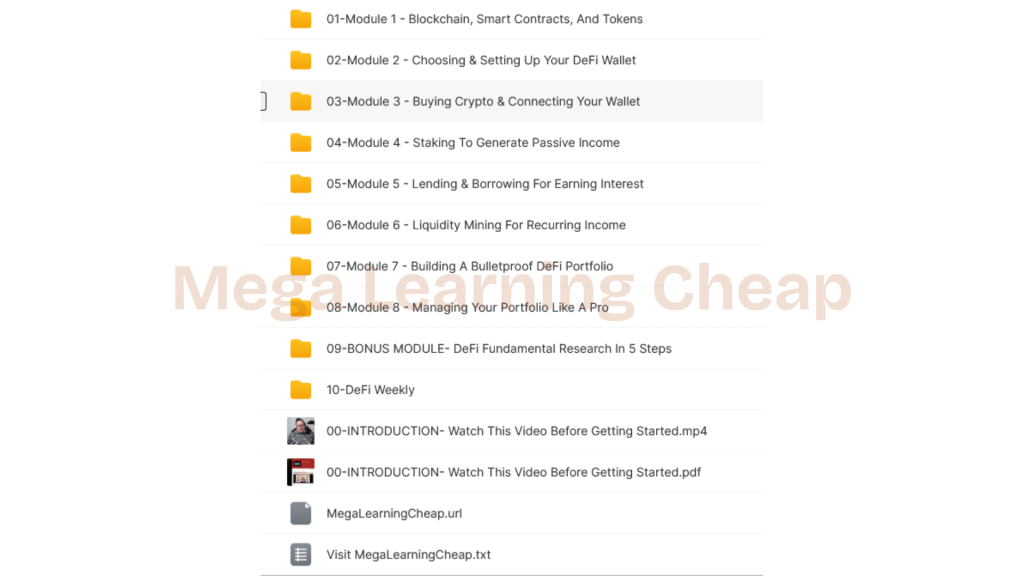

Curriculum Breakdown: 8 Core Modules

You’ll start with Foundations and Setup to grasp blockchain basics and configure a secure DeFi wallet. Next, you’ll apply Staking and Lending strategies to generate steady yield. Finally, you’ll master Liquidity and Portfolio Management to optimize returns and manage risk across market cycles.

Foundations and Setup

Blueprint in hand, you’ll move through eight focused modules that turn DeFi from buzzwords into skills. You’ll start with foundational knowledge—how blockchains record value, how smart contracts automate agreements, and how tokens move through decentralized rails. With that base, you’ll set up a secure DeFi wallet, verify seed phrase practices, and enable network settings so you can interact with protocols confidently.

Next, you’ll learn how to purchase crypto and connect your wallet to trusted apps, bridging from theory to action. You’ll practice small, safe transactions and confirm approvals, fees, and permissions. As the course progresses, you’ll preview how staking, liquidity programs, and portfolio management strategies align to generate passive income. By the end of setup, you’ll be prepared to execute, measure, and iterate with discipline.

Staking and Lending

While the setup gave you tools, staking and lending turn them into income. In this module, you’ll lock tokens for staking to earn rewards that can range from 10% to over 100% APY, depending on the DeFi protocol. You’ll also use lending platforms to supply assets and collect interest, often beating traditional banks, all while tracking balances and yields from your connected wallet.

You’ll practice selecting protocols, approving contracts, and monitoring returns without guesswork. We’ll emphasize risks: price volatility can erode gains, smart contract bugs can drain funds, and reward tokens can depreciate. You’ll learn risk checks, from auditing contracts and caps to spreading allocations. Master these workflows to generate sustainable passive income through staking and lending, using disciplined safeguards and clear performance metrics.

Liquidity and Portfolio Management

Even as markets shift, liquidity and portfolio management turn your setup into steady, risk-adjusted income. In Module 6, you’ll master liquidity mining—how to deploy capital into pools, capture fees and incentives, and structure positions for recurring income while controlling exposure. You’ll analyze pool mechanics, impermanent loss, and execution costs so rewards outweigh risks.

Module 7 moves to building a resilient DeFi portfolio. You’ll diversify across protocols, chains, and yield types, apply disciplined asset selection, and size positions to balance drawdowns and upside. You’ll stress-test allocations and align them with clear objectives.

Module 8 equips you with advanced risk management and monitoring. You’ll track performance, rebalance based on data, and respond to market shifts using real cases and current toolsets to optimize results.

Bonus Module: DeFi Research in 5 Steps

Although the DeFi space moves fast, this Bonus Module: DeFi Research in 5 Steps gives you a clear, repeatable framework to evaluate projects with confidence. You’ll approach DeFi with disciplined research, focusing on smart contracts, on-chain data, and team credibility so your investment decisions reflect quantified risks, not hype.

First, scope the problem a protocol claims to solve and map competitors. Second, inspect smart contracts: audits, open-source repos, upgradeability, admin keys, and bug bounty depth. Third, analyze core metrics—TVL quality, liquidity concentration, token emissions, fee revenue, user retention, and treasury runway—to separate durable traction from mercenary capital. Fourth, vet the team: experience, prior shipping history, governance transparency, and authentic community engagement. Fifth, stress test incentives and edge cases: oracle exposure, bridge dependencies, liquidation dynamics, and regulatory touchpoints.

Coaching, Community, and Ongoing Support

You’ve got a rigorous research framework—now you’ll put it to work with coaching, community, and ongoing support that keeps you moving. Each week, you’ll join live Zoom group coaching to implement strategies, ask targeted questions, and learn from peers’ wins and missteps. You’re not alone; you’re plugged into a focused community where passive income builders compare notes, share due diligence, and collaborate on opportunities. When issues pop up between sessions, you’ll lean on unlimited email support for clear, timely guidance. You’ll also get ongoing market updates—new startups, breaking news, and best-performing coins—so you can adapt fast and stay aligned with risk management.

- Weekly group coaching calls to refine strategies in real time

- A private community for collaboration, momentum, and accountability

- Unlimited email support for rapid problem-solving and decision-making

- Market updates that spotlight actionable trends and credible signals

- Curated resources that reinforce discipline and accelerate execution

Tools, Templates, and Portfolio Planner

In this section, you’ll put our ready-to-use templates to work, so you can track positions, yields, and fees with precision. You’ll organize your holdings in the DeFi Portfolio Planner to target passive income while managing risk across protocols. With ongoing updates, you’ll keep your plan current and make faster, data-backed decisions.

Ready-to-Use Templates

Because momentum matters when you’re building passive income, the DeFi Income Optimizer hands you ready-to-use tools, templates, and a Portfolio Planner you can deploy on day one. With these ready-to-use templates, you move from theory to execution fast—staking, lending, and liquidity mining are mapped out so you can generate passive income within days. Each template aligns with the DeFi Portfolio Planner, helping you track investment performance while optimizing returns and minimizing risks.

- Prebuilt staking schedules with APY targets and risk flags

- Lending ladder templates that auto-balance utilization and collateral

- Liquidity mining checklists that calibrate fees versus impermanent loss

- Performance trackers that surface ROI, volatility, and drawdowns

- Decision rules for rebalancing and yield rotation

You’ll act decisively, monitor outcomes, and refine positions using clear metrics and proven playbooks.

DeFi Portfolio Planner

While markets move fast, the DeFi Portfolio Planner gives you structure: clear tools, ready-to-use templates, and a cohesive planner to allocate, track, and optimize your crypto income strategies. You’ll organize digital assets, map allocations, and align them with passive income goals without losing sight of risk.

Use the templates to log positions across protocols, capture yields, and monitor fees and impermanent loss. The dashboard aggregates performance so you can spot winners, prune laggards, and rebalance with intent. Built-in risk assessment frameworks quantify exposure by protocol, asset, and strategy.

Set milestones, define rebalancing rules, and test investment strategies against market shifts. Whether you’re new or seasoned, the DeFi Portfolio Planner helps you diversify, iterate, and compound—turning scattered bets into a disciplined, goal-driven portfolio.

Risk Management and Safety Practices

Though DeFi can boost yields, you’ll only thrive by managing risk with discipline. Prioritize risk management and safety practices before chasing APRs. Diversification across vetted DeFi protocols limits single-point failures and cushions volatility. Track market trends and rebalance when thesis or performance changes. Secure accounts with strong authentication and cold storage to reduce attack surfaces. Study protocol mechanics—impermanent loss, liquidation thresholds, oracle risks—so you size positions intelligently and avoid avoidable drawdowns.

- Diversification: spread capital across multiple DeFi protocols, assets, and chains to reduce correlated losses.

- Security hygiene: use 2FA, hardware wallets, allowlisting, and minimal hot-wallet balances.

- Continuous review: monitor market trends, adjust allocations, and harvest or compound based on updated risk-reward.

- Protocol due diligence: audit history, TVL stability, team transparency, and risk disclosures on impermanent loss and leverage.

- Ongoing education: follow credible research, forums, and alerts to catch emerging threats early.

Set rules. Document allocations, stop-loss triggers, and max exposure per strategy—then stick to them.

Pricing, Access, and Delivery Details

Get in now for $20—down from $2,490—and secure access to Darren Jenkins’ Defi Income Optimizer via an exclusive group buy. This limited pricing reflects a steep reduction from the original cost while keeping the course exclusive and not free.

You’ll receive immediate access upon confirmation. Delivery is handled through a secure mega download link, so you can start right away without waiting for shipments. The course includes 8 extensive online training modules, totaling 17.5 GB, giving you a complete, structured path through the material.

To begin, request the course via the provided email contacts. You’ll get payment options and instructions, and you’re expected to complete payment within 24 hours to confirm enrollment. Once processed, we’ll send your private link for instant download and access. Everything is digital, clearly organized, and ready to go, ensuring a smooth delivery experience. This approach balances affordability with exclusivity, letting you lock in premium content at a fraction of the original price.

Who Should Enroll and Enrollment Steps

Curious if this is for you? If you’re new to crypto and DeFi or you’re an investor seeking safer, steadier returns, you’ll fit right in. You’ll learn practical systems for earning passive income while building toward financial freedom. With Darren Jenkins guiding you, you’ll design a sustainable portfolio and apply strategies with confidence, supported by live weekly coaching and a motivated community.

Here are the enrollment steps and who benefits most:

- Beginners who want clear, step-by-step DeFi foundations.

- Investors prioritizing consistent returns over speculation.

- Professionals aiming for financial freedom via decentralized systems.

- Action-takers who value expert mentorship from Darren Jenkins.

- Learners who thrive with live weekly coaching and community support.

To enroll, email to request access. Choose your payment option: $2,997 in full or three monthly payments of $1,197. After confirmation, you’ll receive course access, the community invite, and your coaching schedule—so you can start implementing immediately.

Frequently Asked Questions

Is Prior Tax Planning Guidance Included for Defi Income Reporting?

Yes, prior tax planning guidance is included for DeFi income reporting. You’ll get frameworks to categorize yields, staking, liquidity incentives, airdrops, and token rewards, plus timing rules, cost-basis methods, and record-keeping tips. You’ll learn how to handle gas fees, impermanent loss, wrapped assets, and chain-to-chain moves. You’ll also see guidance on tax-loss harvesting, character (income vs. capital) treatment, and year-end strategies so you can optimize filings and reduce surprises.

How Are Program Updates Handled During Major Protocol Changes?

Program updates roll out rapidly during major protocol changes. You receive scheduled snapshots, seamless syncs, and swift hotfixes to sustain stability. You’ll get auto-updates by default, with manual opt-in channels for cautious changes. We stage revisions in a sandbox, run regression tests, and push phased deployments to prevent downtime. You can check changelogs, subscribe to alerts, and toggle compatibility modes. If something breaks, you’ll see rollback options and prioritized support escalation.

Do You Provide Region-Specific Compliance or KYC Considerations?

Yes, you get region-specific compliance and KYC considerations. You’ll see configurable KYC tiers, residency checks, and sanction-screening aligned with your jurisdiction. You can enable geo-fencing, block restricted countries, and map local AML thresholds to on-chain limits. We integrate with leading KYC/AML providers, support KYB for entities, and log auditable trails. You’ll receive policy templates, risk scoring, and update alerts so you can adapt quickly to regulatory changes without disrupting user onboarding.

What Hardware Wallets Are Recommended for Multi-Chain Strategies?

You’ll want Ledger Nano X, Trezor Model T, Keystone Pro, and GridPlus Lattice1 for multi-chain strategies. They support major EVM chains, Bitcoin, Solana (Ledger/Trezor via integrations), and custom derivation paths. Use Ledger Live, Rabby, or Keystone’s QR workflows for safer DeFi. Enable passphrases, segregate accounts by chain, and store seed backups on steel. For power users, pair a hardware wallet with a dedicated signing device and a separate hot wallet for approvals.

Can I Audit Past Alumni Results or Case Studies Independently?

Yes—you can, but there’s a catch. You start with promises of glowing testimonials, then dig deeper. You verify identities on LinkedIn, cross-check dates, and look for on-chain wallet histories that match claimed results. You request unedited dashboards, third-party analytics, and timestamps. You compare cohort outcomes, not cherry-picked wins. You ask for methodology, risk metrics, and drawdowns. If they hesitate, you’ve learned enough. If they cooperate, you’ve got credible case studies.

Conclusion

You’re standing at a crossroads: keep piecing together scattered DeFi tips, or follow a proven path. This program pairs bold yields with strict safety, fast wins with steady habits, and curiosity with discipline. You’ll master eight core modules, add a simple research framework, and lean on coaching, tools, and a planner that turn noise into a portfolio. Risk meets rigor. Access meets action. If you want confidence, not chaos, enroll now—then execute with clarity.