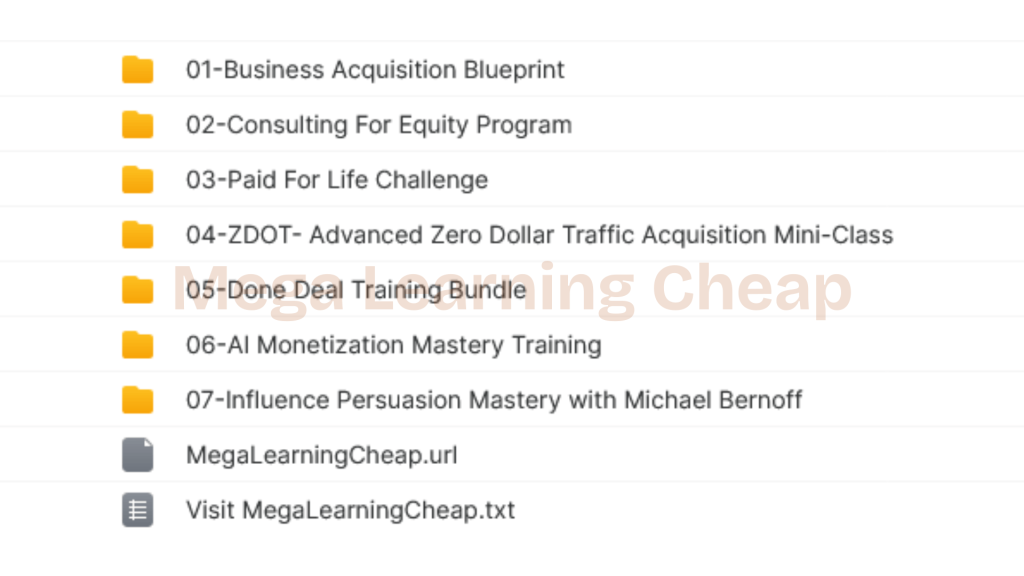

Epic Network – Epic First Deal Blueprint

Get The Epic First Deal Blueprint for $997 $15

The Size is 75 GB and is Released in 2025

Epic first deal blueprint is a step-by-step program that shows new investors how to source, analyze and close their first real estate deal with actionable tasks and easy-to-use tools. Designed for new investors, it includes lead sourcing, deal screening with simple math, negotiation scripts, and outreach methods that work for most US markets. Lessons target inexpensive lead sources, straightforward KPIs such as CPL and response rates, and actionable schedules, typically 30–60 days. It demonstrates how to construct a mini pipeline, deploy a lightweight CRM, and monitor offers and follow-ups. To assist in due diligence, it provides checklists, sample contracts, and risk flags. Next, the guide dissects each phase with actual examples and templates.

Understanding The Epic Network

The organized network connects founders, investors, and advisors to take actual deals from concept to close. It’s focused on lucrative acquisitions and equity deals, not theory, and provides members with tools, training, and partners to move quickly while minimizing risk. This platform serves as a comprehensive roadmap for successful entrepreneurs looking to make their first business acquisition.

The epic network acts as a deal engine, linking buyers to sell-side brokers, founders, and off-market leads. It also provides access to a database of investor contacts—from family offices and PE funds to angel groups. Members receive curated deal sources and automation strategies, including business buying checklists that guide each stage from outreach to diligence to close. A notable user case involved a service business sourced through the network’s pipeline review, filtered with automated cash-flow screens, and routed to three aligned investors from the database within two weeks.

Training within the network is action-oriented, emphasizing advanced acquisition strategies. The core offer is a business buying blueprint course that breaks down efficient acquisition strategies, including target selection, signal-based sourcing, and funding strategies. Members celebrate victories such as top-line fees for guidance work and revenue shares on growth transactions. One recorded transaction generated $2 million in sales at a 25% income share, showcasing the profit potential of utilizing these strategies.

Ways to finance are realistic and diverse, incorporating creative financing methods like asset-based loans, seller financing, and revenue-based financing. Sample decks include plain term sheets and draft clauses. AI-driven workflows enhance sourcing and analysis, clustering lookalike targets and flagging risks in P&Ls. Members report that they automate initial deal analysis, allowing them to save time and swiftly identify potential acquisitions.

Content is deal flow. The network shows you how to construct quizzes that slice your leads by budget and timing, and how to leverage short social video that funnels investors and operators into a common pipeline. It amplifies reach and credibility across markets, which is important for international readers who operate in various regions and time zones.

For both new and experienced buyers, the network’s worth lies in scale, speed, and shared knowledge that compounds into generational wealth through effective deal-making and profitable opportunities in the marketplace.

The Epic First Deal Blueprint

This step-by-step system is designed to help aspiring entrepreneurs close their first profitable deal with little or no money down. It combines our three marquee programs — the epic first deal blueprint, consulting for equity blueprint, and AI monetization mastery — into a single track. With 40+ hours of video, group mentorship calls, and DealDone.io for automated deal analysis, it provides valuable insights into effective risk management and profitable acquisitions. Additionally, 21 case studies on risk-free acquisitions are included to guide you through the acquisition process and maximize profit potential.

1. Identify Your Niche

Start with statistics. Skim market reports, search trends, and industry benchmarks and try to identify niches where demand is relatively stable, margins are high and revenue repeats. Subscription services, B2B SaaS and compliance-heavy areas all tend to perform nicely.

Fit the niche to your abilities or passions. If you’ve got sales chops, local lead-gen agencies come. If you know healthcare, medical billing or compliance tools may be less risky. Personal fit reduces ramp time and increases seller confidence.

Rank targets by profit, growth, and risk. Use a simple grid: revenue over 500,000 EUR, margins above 20%, churn under 10%, and clear customer concentration caps. Note owners near retirement, they’re the best in seller financing.

Exploit Epic Network gaps The course’s research templates and AI agents identify underflown models—such as niche e-learning with robust SEO moats or boutique logistics providers with recurring contracts.

2. Map Key Players

Develop a database of owners, investors, consultants, and partners connected to your niche. Plus suppliers, key customers and referral nodes. Think Linked-in, trade groups, public registries.

Link up with legitimate dealmakers and sellers who want you to win. Participate in group mentorship calls to source intros and polish your asks. Warm trails win over cold trails.

Map competitors, suppliers, and customer clusters to reveal vulnerabilities. Example: agencies relying on one ad platform often seek equity partners to diversify channels.

Locate decision makers and influencers. Monitor who signs, who blocks, who opens for JV’s.

3. Craft Your Value

Create a clear value promise: fix leaks, grow sales, or reduce cost in 90 days. Provide instant equity or a growth consult that connects your upside to outcomes.

Bring evidence. Use the toolkit: case studies, quick-win SOPs, and the 5-80-5 multiplier principle to show how small changes drive outsized gains. Enhance AI workflows for rapid content—blog posts, training clips, product videos—that extend reach with no large budgets.

Structure creative offers: consulting-for-equity, seller carry, or “pocket” investment with staged milestones. Customize every pitch based on industry benchmarks and DealDone.io results.

4. Initiate Contact

Reach out with laser targeted scripts for email, LinkedIn and calls found in the blueprint. Keep the opener tight: problem, proof, next step.

Blend channels to increase response rates. 2 emails, 1 LinkedIn note, 1 call. Space each 48 hours.

Spell out in simple language the value consult/neart term income options/equity paths. Share one-page plans and 15-minute audit.

Track outreach in a simple table: contact, date, channel, reply, next step. Check weekly–tweak copy by response data.

5. Structure The Deal

Let $0 deals and seller financing and revenue shares and JVs align incentives. Limit personal risk, link equity to results.

Establish benchmarks, conditions and exits early on. Specify handover, earn-outs and KPI triggers

Crunch numbers using DealDone.io and the deal templates. Nix deals that fall short of margin, cash flow or customer concentration thresholds.

Bargain for smart investment, percent of revenue, and a scalable plan. With the program’s 21 case studies and customer acquisition playbooks, plus the guarantee-backed support, sail from LOI to close with confidence.

Why Traditional Models Fail

Conventional acquisition playbooks often drive buyers to make big cash offers, rely on inflexible financing, and endure protracted diligence cycles. This approach presumes deep pockets, a proven track record, and ample time, which many aspiring entrepreneurs or time-poor operators cannot satisfy. Consequently, quality opportunities can fall off the table prematurely. Hiring expensive consultants and pursuing bank debt raises the bar even higher, causing deals to stall when sellers seek speed while buyers are left waiting on lenders and time-consuming audits that can last for months.

Basic buyer programs frequently overlook clever financing and new income levers. They tend to bypass essential strategies like seller financing, earn-outs, holdbacks, and performance-based tranches that can mitigate risk for both parties involved. Additionally, they miss out on AI monetization paths—such as automating lead generation, upsell scoring, support triage, or content pipelines—that can significantly lift cash flow quickly with minimal pilots. Without these advanced strategies, business models often rely on blunt cost cuts and general assumptions that rarely hold up after closing.

They fall apart on the build side. Testing tools and sandboxes are scarce, so teams can’t de-risk integrations prior to go-live. APIs are difficult to discover, poorly documented or slow to assist, so schedules slip. Old, rigid integration patterns can’t keep up with new data sources or changing rules. Limited access to core data—be it meds, allergies or lab results in health contexts—mortally wounds product fit and stymies growth. When developer docs, guidance and community support are weak, learning grinds to a halt. Ex-failed attempts create cognitive and emotional friction, and teams shy away from audacious but rational decisions. In many legacy deals, they even lock in revenue-based billing that swings month to month, which strains cash and erodes trust.

| Pitfall | Impact |

|---|---|

| High upfront capital | Excludes new buyers; concentrates risk early |

| Slow lender processes | Misses windows; seller fatigue |

| No creative deal terms | Higher default risk; poor alignment |

| Weak sandboxes | Bugs and delays post-close |

| Opaque APIs, poor docs | Slower builds; brittle systems |

| Inflexible integrations | Hard to adapt; costly rewrites |

| Revenue-based billing | Unstable cash; planning chaos |

| No support community | Rework; repeated mistakes |

| Limited data access | Weak product value; churn |

| Cognitive baggage | Hesitation; narrow solutions |

The Epic First Deal Blueprint addresses these gaps with a comprehensive roadmap that includes repeatable, low-risk steps: structuring seller-friendly financing, piloting AI revenue lifts before closing, requiring sandboxes during diligence, standardizing integration patterns, establishing stable billing plans, and building a peer support loop that accelerates learning and reduces errors. This approach can empower successful entrepreneurs to navigate the acquisition process more effectively and tap into profitable opportunities.

Navigating Common Hurdles

First deals stall for a few predictable reasons: thin funding, weak deal flow, and fear of making a bad call. Each manifests itself in a different manner—cash shortfalls at closing, erratic pipeline, or endless dithering. The Epic First Deal Blueprint aims to slice through the clutter with actionable steps, but actual momentum requires groundwork, flexibility, and grit. Successful entrepreneurs chunk large moves into bite-sized tasks, validate their assumptions, and employ mentors to stress-test decisions. Maintain a loose schedule, communicate frequently with collaborators, and monitor your stress levels so you don’t burn out before you wrap.

Lack of funding often hides in the details: earnest money, diligence costs, and working capital needs. To address these issues, map out sources early – seller finance, rev-based pay-outs, holdbacks, and creative financing methods from aligned advisors. Use clean models with 3–5 drivers, not 30. Receive pre-vetted debt options in a shortlist with terms, covenants & collateral, so you can move quickly when a deal passes diligence. For limited deal sourcing, build a simple weekly input system: 20 direct owner outreaches, 5 broker checks, 5 peer referrals. Grade every lead on size, margin, churn, owner role, customer mix. Keep it scalable. For fear of failure, quantify the risk in experiments. Use small proof points: customer calls, a two-week data pull, or a pilot service add-on. Growth mindset helps here: treat each “no” as data, not a verdict.

To avoid analysis paralysis, follow the complete business buying blueprint today in steps: define a tight thesis (sector, size, margin), set a 90‑day pipeline target, standardize diligence checklists, close fast on green flags, and kill deals quickly on red flags. Keep assumptions exposed in your model, and revise them only when new facts emerge. Keep loops short—one-week sprints, weekly mentor reviews, and a monthly pipeline post-mortem.

- Map funding holes, stack seller finance, SBA/term debt, earn-outs.

- Build a 3-source deal flow: owners, brokers, and peer intros.

- Screen leads with a 5-factor triage within 24 hours.

- Run diligence in short sprints with kill criteria upfront.

- Seek mentor feedback; role-play lender and seller calls.

- Follow your distress; establish defined shut-off times to prevent burnout.

- Name biases (optimism, sunk cost) and counter with data.

- Iterate offers; present options that ease seller concerns.

Perseverance, mindset shift and insider training transform setbacks into workable steps and land healthy, lucrative purchases.

Measuring Blueprint Success

This blueprint rewards when advancement is apparent and replicable and connected to results of significance. Success = closed deals and cash in hand and steady growth across a portfolio that can scale without chaos.

Define clear metrics that set the bar and keep it fair:

- Closed deals per 30 days

- Immediate earn per transaction (upfront, premium, or rev-share)

- Portfolio value growth month over month

- Deal closure rate (win rate by stage)

- Time to first acquisition

- Customer acquisition cost and lead-to-close speed

- Recurring revenue stability and churn

Trace success via organized deal dissections. Log source, timeline, stakeholders, terms of offer, and obstacles. Note why a deal won or why it lost. Projected return versus realized return. The objective is to reduce cycle time and increase average deal size. Use a clean dashboard: total deals sourced, qualified, proposed, closed, and the drop-off at each step. A 5-80-5 multiplier mindset helps here: tighten the first 5% (lead quality and first call), improve the middle 80% (offer clarity and follow-ups), and polish the last 5% (terms and close). Small lifts at each step accumulate into large gains.

Conduct profitability analysis on every deal and across the pipeline. Monitor immediate revenue, installation expenses, service hours, affiliate commissions and projected lifetime value. Set guardrails: minimum margin per deal, maximum days to payback, and a green zone for revenue share that hits break-even within 60–90 days. Check cash flow health weekly. If upfront fees slip, compensate with stronger revenue share or shorter pilot terms.

Connect outcomes to sales objectives and growth mechanisms. KPIs that matter: revenue growth rate, customer acquisition volume, and deal closure rates. For most, a compelling proof point is closing your first deal within 30 days and snagging a premium upfront fee or a clean revenue share. A customized Next 30-Day Success Roadmap keeps activities focused and quantifiable. Measure time-to-result, not just totals.

Measure asset acquisition strategies, not just quantities. Which channels bring high-fit leads? What messaging increased reply rate by 2-3%? Apply both numeric and human checks—client fit, ease of delivery and your own stress load. Confidence shows up in policy: a short 3-day grace period with no refunds after can signal belief in the system.

Celebrate milestones to keep pace: first acquisition closed, first month of consistent revenue, the third scalable asset added to the portfolio, and a quarter with zero delivery overruns. These are the markers that demonstrate the blueprint functions under genuine stress.

The Mindset for Mastery

Mastery in the Epic First Deal Blueprint begins with your mindset prior to action. Skill sprouts from mindset. Systems and tactics function merely when your convictions and routines support them.

A growth mindset is the foundation. It means you think you can construct skill through persistent effort, not fortune or gift. Studies demonstrate that a fixed mindset limits advancement, yet a growth mindset fuels motivation and persistence. In practice, that looks like tracking your learning curve on each step of a deal: sourcing, outreach, due diligence, and close. When an owner says no, or not what did not land, adjust the script, and send ten more. Consider every miss as information, not a judgment. Eventually your hit rate increases.

Risk-taking is in the nature of the work. You step outside comfort when you send the initial 50 cold emails, call a dealer in a new niche, or crack open a 60-page financial statement. Mitigate risk by setting guardrails: define your buy box, set a maximum offer, require third-party checks, and use a 24–48 hour “cool off” before you sign. Adjust quickly as facts evolve. If a vendor costs 15%, try out a price increase on a subset of customers, or change the vendor once you’ve modeled the unit economics in a simple spreadsheet.

Mentorship accelerates the curve. Targeted coaching within Epic Network provides you with pattern recognition which you cannot obtain by studying alone. A mentor can check your LOI, flag missing reps and warranties and identify cash flow red flags. Peer groups provide real-time validation and reinforcement. Share your outreach/week, pipeline, 1 key block. Borrow a proven email template, and give yours back when it trumps the baseline. Live deal rooms, resource libraries, and checklists become a force multiplier.

Establish stretch, not break, goals. Set a 90-day goal, say ‘reach out to 300 owners, have 30 calls, place 5 offers,’ and then block time each day for the inputs that shift the needle. Desperately want candid feedback on your pitch, and shift money talk from scarcity to sustainability. Think like the top 1%: plan for years, not weeks, take smart bets, compound skills and cash.

Conclusion

To close the loop, Epic Network provides well-defined actions and tangible guardrails. The First Deal Blueprint sets one goal: close a clean, fair first deal. No fluff. No fuzzy hacks. You noticed the holes in outdated systems. You spotted the traps lurking in day one outreach, weak fit scores, and bad follow-up. You witnessed how to measure victories with easy measures such as reply rate, time to initial call and deal velocity.

To get real, conduct a small test. 1 niche, 1 offer, 1 week of outreach. Log every touch Score every lead Repair single per loop A founder in fintech did this in 10 days, and booked three solid calls.

Give it a shot! Begin with a slim list, a concise script and a clear scorecard. Then deliver.

![[ONLY $10] Lori Ballen – The 2 Hour Writing Course 4 Lori Ballen – The 2 Hour Writing Course](https://megalearningcheap.com/wp-content/uploads/2024/02/Lori-Ballen-–-The-2-Hour-Writing-Course.webp)