Troy Harris – Fast Launch Trading

Get The Fast Launch Trading for $250 $15

The Size is 25.33 GB and is Released in 2025

Fast Launch Trading is a trading style and education brand centered on quick, highly-digestible market moves, rapid implementation, and transparent trade guidelines. The approach emphasizes clear entries/exits strategies, risk limits per trade, and scalable setups over stocks, futures and forex. Lessons often span pre-market prep, price action signals and straightforward checklists to reduce noise. Tools tend to be basic: clean charts, volume, and time-of-day filters. Risk control remains paramount with mini position sizes, tight stops and fixed daily loss limits. Results depend on discipline and market context and liquidity at the open. To assist readers in evaluating fit, the bulk of the article covers foundational principles, daily workflow, pitfalls, performance tracking, and critical resources associated with Fast Launch Trading.

Why Trading Feels Impossible

Trading in the volatile crypto markets may appear easy at first glance, but obstacles quickly pile up for both newbie and experienced traders. It’s rarely just one issue; rather, it’s a combination of knowledge gaps, tool sprawl, and inconsistent risk rules that clash with fast market conditions. This is where a solid understanding of the crypto landscape becomes essential for success.

| Overwhelming factor | What it does | Source in day-to-day |

|---|---|---|

| Information overload | Slows action, causes second-guessing | Too many signals, news feeds, chat rooms |

| Lack of knowledge | Leads to poor entries and exits | Weak grasp of order flow, macro drivers, fees |

| Emotional decision-making | Chases wins, avoids planned stops | Fear after a loss, greed after a win |

| Insufficient risk management | One bad day wipes a month | Oversized position, loose stops, high leverage |

| Unrealistic expectations | Pushes overtrading and revenge trades | “Daily income” goals, social media PnL posts |

| Market volatility | Turns good setups into whipsaws | Data releases, earnings, surprise policy shifts |

| No clear trading plan | Random results and no feedback loop | Switching styles each week, no journal |

| Psychological biases | Locks in errors and blind spots | Confirmation, anchoring, loss aversion |

Charting contributes more noise. Hard patterns—head-and-shoulders, harmonic shapes, Elliott counts—appear obvious in retroactive mode but elusive in live markets. On tradingview novices fire up 5 indicators and stack time frames and can’t read the base trend. A simple, consistent view helps: one higher time frame for bias (4-hour or daily), one execution time frame (15-minute), and two core tools, such as a 20- and 50-period moving average for trend and an RSI for momentum. If price is below both moving averages daily and RSI < 50, fade rallies. One example: EUR/USD below the daily 50-MA with lower highs; a 15-minute pullback to the 20-MA with RSI under 50 is a short with a stop 0.2% above the swing.

Risk of loss increases when traders plagiarize antiquated advice, confuse random strategies, or violate rules. A workable base: risk 0.5–1.0% per trade, cap daily drawdown at 2%, set stop first, then size. For a 10,000 EUR account, 1% risk = 100 EUR, if stop is 0.25% away, size = 100 / 0.0025 = 40,000 EUR notional.

Tool selection must be light and tried. Choose a charting platform, choose a data source, choose a routine. For example, pre-market: mark levels, note events, define bias; live: wait for price to touch a level with confluence; post-trade: log entry, stop, size, reason, outcome. Stick with 2-3 indicators max and test for 50–100 trades before scaling size.

Meet Your Mentor, Troy Harris

Troy first made his name in live markets, not theory. He brings years of boots-on-the-ground trading experience across stocks, options, and crypto — with thousands of trades executed through bull runs and bear markets alike. This extensive experience includes navigating the volatile crypto markets, where he engages in high-volume days during steep drawdowns, mid-cap token swing trades, and options spreads to hedge crypto exposure. Troy meticulously monitors every setup, assessing the danger per trade and the reasoning behind each decision, ensuring that students not only witness wins but also understand the thought processes that lead to them. You’ll see strategies like laddered entries on volatile coins during news spikes or cutting size near key levels at 5% to 8% away to minimize slippage.

Troy’s history is public within his circle. Members witness live calls, post-trade breakdowns and authenticated case studies from previous cohorts. Outcomes span from incremental, consistent profits to bigger victories on trend moves — for example, students who implemented his risk guidelines (max 1% per trade, stop ahead of significant support breaking) frequently experience less account draw downs and more stable equity curves. The following built around him: passive income accelerator members, private group traders, and readers who first met him after he shared stages with Robert Kiyosaki, Deepak Chopra, Harry Dent, and David Goggins. Their testimonials reference clearer decision steps, less guess-work, and a focus on process, not hype.

His backstory resonates with many of our readers. A few years ago, Troy hustled in a 9-to-5 job, raised a family of four, and lived paycheck to paycheck. Exhausted and time-starved, he dedicated nights to learning about blockchain technology, wallets, on-chain data, and order flow. He made early investments when few recognized the value of Ethereum, with some selections generating returns in excess of 10,000%. This success didn’t come from luck; he logged notes, tracked catalysts, and sized small until the thesis proved out. His primary occupation now is teaching, and he designed the Fast Launch Trading Course, a comprehensive program that spans crypto fundamentals, market structure, entries and exits, risk, position sizing, and trade journaling. The aim is to create a plan that fits real life: simple rules, clear checklists, and tight risk.

He will host a live session on September 3, 2025, from 20:00 to 22:30 SGT, focused on how to target USD 5,000 weekly in crypto with a rules-first approach. You’ll find his author photo, credentials, and member praise inside the course hub and private group, where he provides direct feedback on trade plans and helps set risk caps and weekly targets, ensuring that every participant can navigate their own crypto journey with confidence.

The Fast Launch Trading System

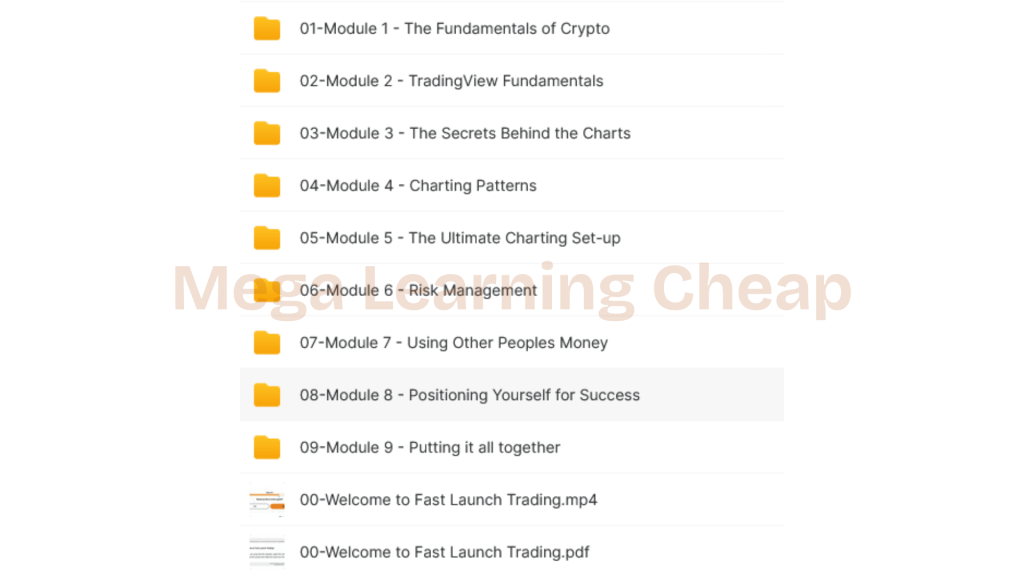

A full-fledged crypto trading system — designed to be fast and clear. Employing 9 organized modules, instant-access lessons, and continuous updates, the platform assists emerging traders in mastering the basics of cryptocurrency trading, taking advantage of opportunities, and handling risk from day one. The goal, in other words, is a rock-bottom foundation, pragmatic gut-feel, and a cautious, risk-friendly approach to sustained income.

| Feature | What it is | Why it matters | Unique angle |

|---|---|---|---|

| 9 modules | Basics to advanced analysis | Step-by-step learning | No-jargon, action-first flow |

| Risk focus | Rules, checklists, sizing | Cuts large drawdowns | Emphasis on real use |

| Technical depth | Patterns, indicators, TradingView | Clear entries/exits | Personalized chart setup |

| Live support | 3 months email coaching | Timely feedback | Coach review of plans |

| Real-time updates | Alerts, chat, sessions | Faster decisions | “Fast launch” tools |

1. The Foundation

Start your crypto journey with the platform and tools that make analysis straightforward. You gain access to TradingView configuration support, including templates, watchlists, alerts, and a layout you can replicate on any device. Understanding chart dynamics involves analyzing timeframes, volume, and price reaction at critical zones in the volatile crypto markets.

The core concepts ground the early modules, focusing on candlestick psychology, trend channels, and support/resistance. You will learn to utilize three key indicators with intent: moving averages for trend bias, RSI for momentum shifts, and volume to confirm breaks, all essential for successful trading in cryptocurrencies.

A concise blueprint ensures a fast launch trading special. Open a TradingView account, add the base template, map market structure, and define risk per trade. You will discover how price moves in waves, giving you the insight needed to navigate the crypto landscape effectively.

2. The Strategy

Troy’s plug-and-play playbook spanning breakouts, wedges and head-and-shoulders. Criteria are tight: clear levels, rising volume, and invalidation lines marked in advance.

You get step-by-step checklists for finding A-grade breakouts and sizing for a 2:1 or 3:1 reward. Stops sit beyond structure, not round numbers.

Position sizing is governed by rules. Risk 1% fixed, volatility adjusted and scale out at targets. The plan integrates trend analysis, patterns, and habits into one page you can follow as price moves quickly.

3. The Execution

Live group sessions and a chat room keep you on track. Real-time alerts flag levels, you decide with your rules.

TradingView tools manage entries, alerts and notes. Fast Launch add-ons, such as risk and target placement presets.

Instructions cover live and paper trades: where to click, how to move stops, when to cut losers. A log tracks entries, exits and reasons, so you can refine edge over weeks, not days.

4. The Mindset

Discipline and patience occupy the middle of your trading journey in the volatile crypto markets. You receive routines for pre-market checks, post-trade reviews, and techniques to mend FOMO, all aimed at improving your trading routine. Troy shares a mindset map and confidence drills to help traders navigate drawdowns effectively.

Targets process first, with earnings second, as incremental victories establish sustainable routines and open up time for further investments. Members get to practice tilt-preventing reframes and stress breaks, ensuring they stay focused on their goals. This approach is crucial for anyone looking to achieve world trading success in the crypto landscape.

The fast launch trading special module offers members instant access to valuable information and secrets that enhance their understanding of price movement. By applying these techniques, traders can develop a robust strategy that aligns with their financial objectives and maximizes gains in the cryptocurrency market.

5. The Growth

Sustained by 3 months of 1-on-1 email coaching, a private community, and frequent market notes. Advanced modules dig deeper on pattern nuance, order flow and risk tweaks.

Your progress is monitored with milestones, reviews, and coach feedback. Compare notes with peers, study shared playbooks, and tap member-only perks.

Beyond The Charts

Fast Launch Trading goes beyond chart setups to capture the forces that drive price movement, define risk, and direct generational wealth in the volatile crypto markets. Technical analysis matters, yet price action sits inside a wider frame: macro trends, policy cycles, market mood, and real business value.

Expand learning to include passive income strategies, smart investing, and leveraging blockchain technology for future investments.

Create a foundation that accumulates as you swap in the volatile crypto markets. Set guidelines to direct profits into low-cost index funds, short-term government bonds, and cash-yield accounts. Stake and real-yield protocols in vetted chains for passive income opportunities, but limit smart-contract exposure with hard caps and cold storage. Instead, track macro drivers like interest rates, inflation, and growth to time risk-on/risk-off shifts. Mix technical reads with basic data—earnings, token emissions, treasury runway—so the portfolio doesn’t rely on a single tactic. Automate rebalancing each month, max drawdown & position caps, and tag each position with a goal and exit plan to reduce emotion.

Teach how to identify new cryptos, coins, and tokens with high potential in the evolving cryptocurrency landscape.

Screen for actual demand in the crypto markets, not just buzz. Scan whitepapers for obvious use cases, code repos for consistent commits, and verify audits by reputable firms. Map tokenomics, including supply schedule and utility, while contrasting on-chain metrics—like active addresses and fee growth—against competitors. Go beyond just The Charts; track liquidity depth and exchange quality, not merely price. Watch sentiment and psychology: funding rates and social volume can flag extremes that fade, helping traders navigate the challenges of the volatile crypto markets.

Discuss the importance of financial system awareness, investor quadrant principles, and strategic business opportunities.

Understand how policy and banks direct flows in the volatile crypto markets. Rate hikes can press risk assets, while fiscal support can buoy cyclicals. Employ an investor quadrant mindset: wages, small business, passive assets, and equity ownership each play a role in your investment strategy. Look for edges where you possess domain expertise—data tools, niche content, or B2B services for traders—and treat them as cash-flow motors that can finance long-term bets in the crypto landscape. Maintain risk budgets by strategy, incorporating stop rules and scenario testing to navigate the crypto journey.

Highlight additional resources such as workshops, online communities, and exclusive insights for holistic growth.

Join workshops for live risk, entries, and macro context drills focused on crypto markets. Take advantage of online communities that have a proven track record, common watchlists, and post-trade analyses to enhance your trading routine. Subscribe to macro calendars, on-chain dashboards, and quant screens to keep in the know about cryptocurrency market developments. Keep a journal: thesis, data, size, result, and lesson, while continuing to study and optimize strategies as the volatile crypto markets evolve.

Your Course Inclusions

Designed for concentration and efficiency. The course progresses from foundational skills to scalable action, then grows with you. Content is divided into 9 hard modules, but grouped here into six themes for clarity. Each module employs simple language, brief videos, and action-oriented tasks. Templates, setups, and plug‑and‑play systems get you into action immediately, with charting homework grounded in TradingView.

- Foundation: Covers market mechanics, order types, fees, liquidity, and how to read a price chart from scratch. You learn TradingView fundamentals — from layouts and watchlists to alerts and script basics. Includes a full module on risk management, using fixed‑fraction rules, stop placement, and risk vs. Reward math with 1:2 and 1:3 examples. You get position size worksheets that convert a 2% risk limit into a lot size in seconds.

- Strategy: Teaches clear entry and exit rules, plus confirmation steps. You learn flag, wedge, double top and break–and–retest chart plays to measure direction and momentum. Systems such as trend‑follow, range‑bound, and breakout setups with if‑this‑then‑that rules. All include screenshots, checklists, and scenario notes for high‑volatility days.

- Execution: Shows how to map a trade, place orders, and log results. You time with ATR‑based stops, bracket orders, and alert‑to‑entry flows in TradingView. Pre‑trade plans, risk caps per day, and a post‑trade repository template. You receive win rate, average R, and drawdown journaling templates, so you visualize the edge in actual numbers.

- Mindset: Builds habits that keep risk sane and errors low. Concentrate on bias checks, rule recall under pressure and how to halt after a loss. Short drills train patience, plan adherence, and trade selection when the feed is noisy.

- Growth: Explains scaling rules, risk step‑ups, and using other people’s money. You discover funded account routes, evaluation hacks, and how to limit risk as you grow size. Contains a strategy to scale up only if your magazine demonstrates steady pageviews.

- Bonus Fast Launch Trading: Fast‑start templates, opening range plays, and launch checklists. Access to exclusive tools — like pre‑configured TradingView layouts, risk calculators, and system presets.

Added value: lifetime access, updates, private group membership, and 3 months of direct email coaching from the cryptocurrency email support team. There’s a risk‑free refund policy.

Is This Course For You?

Fast Launch Trading prioritizes clarity, tools, and consistent habits, ensuring you gain instant access to a straightforward strategy for navigating the volatile crypto markets.

Clarify that Fast Launch Trading is ideal for beginners seeking a structured, step-by-step crypto trading course.

If you’re new to crypto trading, we start with the basics and layer in technical analysis in layman’s speak. This complete crypto trading program guides you through TradingView configuration, essential chart patterns, and straightforward exercises you can try. The 9 modules maintain a steady pace, ensuring you don’t leapfrog or overlook important steps. Examples illustrate how to interpret trends, identify support and resistance, and design entries and exits. We’ll send you video lessons and templates for setting alerts, writing a checklist, and tracking trades, fitting students who seek a structured path to develop expertise in a reproducible fashion.

Assert suitability for individuals wanting to launch their trading journey, build passive income, and avoid common pitfalls.

This program provides a step-by-step blueprint for short-term and swing trades, emphasizing risk per trade, stop-loss placement, and position size in the volatile crypto markets. It’s not about getting rich quick; instead, it aims to establish principles that reduce errors and keep you moving forward. If you want to cultivate passive income opportunities over time and can follow a plan, this works. You learn how to sidestep overtrading, revenge trades, and bad risk-to-reward ratios, while case-style walk-throughs illustrate how a trade is planned, placed, managed, and logged.

Confirm the program’s fit for those needing clear guidance, proven strategies, and support from an experienced trader.

You get lifetime access to our fast launch trading special module, allowing you to refresh your modules as the crypto markets shift. For the first 90 days, you receive personalized feedback and support, which helps you course-correct early in your trading journey. This is handy if you want someone to check out your charts or your plan and identify holes. The strategies leverage universal tools and patterns nearly every platform supports, so you can use them anywhere, enhancing your success in navigating the volatile crypto markets.

Advise who should not enroll: anyone expecting guaranteed profits, unwilling to learn, or looking for investment advice instead of education.

Pass on this if you’re after surefire profits, copyable signals, or tips! This is a school, not investment guidance. If you’re not going to journal, try out ideas, or learn from loss, it ain’t gonna help. Your trading routine also depends on your goals and your learning style, especially in the volatile crypto markets, so consider that.

Conclusion

To recap, the line appears open. Troy presents a direct strategy. Troy harris – fast launch trading system fast launch trading each step. You receive live calls, tools, and actual trade notes. You learn risk first, profit next. No hype. Just work that matches real life.

Consider, just for a moment, a single small victory. One neat station. One rule that saves money. Traders who adhere to that tend to survive. That’s what the course is looking for. Brief sessions. Clear words. Defined rules. Real road testing on live charts.

Need evidence for your argument? Begin with a test week. Just paper trade 3 trades. Notice the set up, the risk and the exit. Test the rules. If so, hop in the following cohort and secure your spot.