Josh Aharonoff – Financial Modeling Fundamentals

Get the Financial Modeling Fundamentals for $2500 $17

The Size is 2.37 GB and is Released in 2025

Josh Aharonoff’s Financial Modeling Fundamentals teaches you a no-fluff, practical system to build three-statement models that stakeholders trust. You’ll import clean historicals, set key drivers, and forecast revenue using the EPN framework while blending top-down and bottom-up approaches for defensible scenarios. You’ll connect income statement, balance sheet, and cash flow, then surface KPIs with dynamic dashboards for instant variance analysis. The beginner-friendly, 4–6 week course includes templates, videos, support, and a 30-day guarantee—there’s more that can sharpen your edge.

Why Financial Modeling Accelerates Your Finance Career

Although credentials matter, financial modeling is what propels your finance career. When you can turn raw numbers into clear, decision-ready insights, you stand out from basic number-crunchers. Employers reward that skill with promotions, better roles, and higher pay across industries because you’re not just reporting results—you’re shaping decisions.

You’ll translate data into compelling business stories stakeholders actually understand. That clarity builds trust, aligns teams, and helps you influence strategy. If you’re targeting FP&A, modeling gives you the hands-on toolkit to forecast, budget, and evaluate scenarios with confidence, making the change smoother and your impact immediate.

Without practical modeling, you’ll miss opportunities and feel overwhelmed when faced with complex Excel builds. Traditional courses often stay theoretical, leaving you unsure how to apply concepts on the job. Effective training bridges that gap, turning concepts into repeatable practice. Master the craft, and you’ll elevate your judgment, speed, and credibility—exactly what accelerates your finance career.

The 7-Step System to Build a Three-Statement Model

You’ve seen how modeling shapes decisions—now put that skill to work with a clear, 7-step system that builds a fully integrated three-statement model. Start by importing clean historicals to anchor assumptions and verify relationships across the income statement, balance sheet, and cash flow. Build drivers next: set timing, currencies, and key operating assumptions that cascade consistently through the file.

Forecast revenue with the EPN framework—segment existing, pipeline, and new customers—so volume, pricing, and conversion translate into tractable, model-specific growth. Project cost of goods sold and gross margin from operational drivers. Forecast operating expenses by splitting variable and fixed costs; tie each to sensible drivers so margins and efficiency metrics react realistically.

Integrate the three statements so net income flows to equity, working capital rolls forward, depreciation links to PP&E, and the cash flow reconciles beginning and ending cash. Layer checks. Add scenarios and sensitivities. Close with dynamic dashboards that surface KPIs in real time for rapid, confident decisions.

Top-Down vs. Bottom-Up: Choosing the Right Forecasting Approach

While every forecast aims to be defensible and actionable, your path to it hinges on choosing between top-down and bottom-up methods. In a top-down approach, you start with macro data—industry size, growth rates, and competitive dynamics—then allocate a realistic share. If the global coffee market is $70 billion, capturing 1% implies $700 million in potential revenue. This frames ambition, pressure-tests strategy, and sets guardrails for scale.

A bottom-up approach flips the lens. You begin with internal data—sales by channel, conversion, pricing, and unit economics—then roll up. For a retail concept, you might analyze foot traffic, apply conversion and average ticket, and layer in historical seasonality to forecast sales at the location and portfolio levels. This grounds targets in operational reality.

Choose based on your context and data. Use top-down when market sizing and investor narratives matter; use bottom-up when you have reliable inputs. Blend both to triangulate a forecast you can defend.

From Historical Data to Dynamic Dashboards: Turning Numbers Into Insights

Because credible forecasts start with what actually happened, you’ll anchor your model in clean historicals, then connect the dots across a three-statement build so every assumption updates earnings, cash, and balance sheet in sync. Line up actuals beside projections to spot trends, seasonality, and outliers. That clarity lets you set defensible drivers and stress-test sensitivities without breaking the flow between statements.

For revenue, apply the EPN framework: model Existing customers with retention and expansion rates, track Pipeline with stage-weighted probabilities, and size New with acquisition assumptions. You’ll see where growth truly originates and which levers move it. On expenses, separate variable from fixed. Tie variable costs to operational drivers; phase fixed costs with hiring and contracts. You’ll improve margin visibility and cash planning.

Finally, surface insights with dynamic dashboards. Wire KPIs and budget-versus-actuals to your model so updates refresh instantly, enabling rapid variance analysis, scenario toggles, and decisive course corrections.

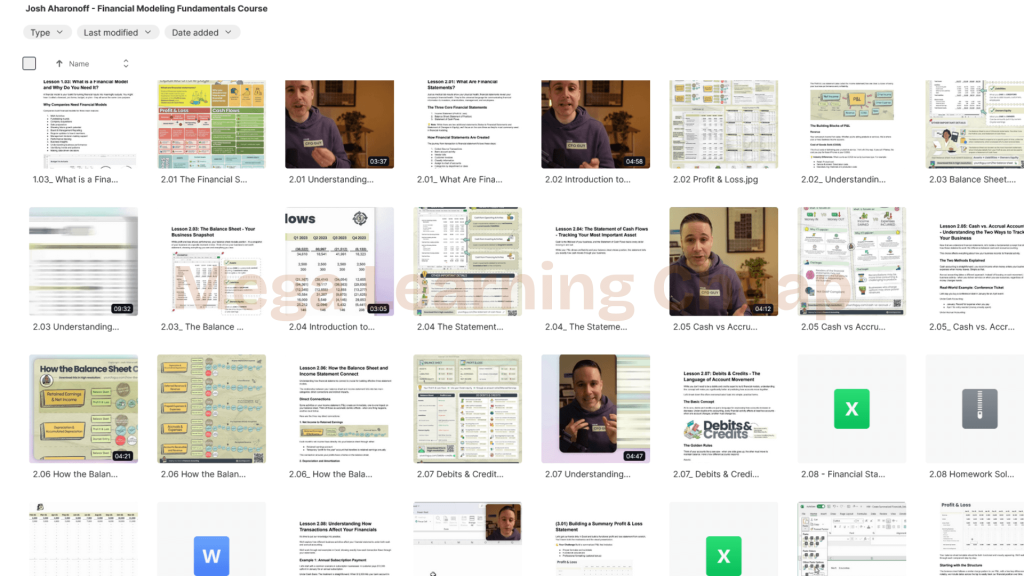

Course Format, Tools, and Risk-Free Enrollment

Even with a full-time schedule, you can move at your own pace: this beginner-friendly course takes about 4–6 weeks and centers on building a complete three-statement model in Excel. You’ll practice linking the income statement, balance sheet, and cash flow statement, so each assumption flows through the model with clarity and control.

You won’t start from a blank screen. You’ll get polished templates, concise handouts, and step-by-step videos that explain the finance concepts before you build. That way, you’ll understand why each formula belongs, not just where it goes. The materials guide you from raw inputs to a dynamic, auditable model you can adapt for real-world scenarios.

You’re not on your own, either. A dedicated support team answers questions and helps troubleshoot roadblocks, keeping you moving.

Enrollment is risk-free. There’s a 30-day money-back guarantee: complete the course, submit your finished model, and if it doesn’t meet your expectations, you’ll receive a prompt refund—no hassles, just accountability.

Frequently Asked Questions

Can Chatgpt Do Financial Modelling?

Yes, you can use ChatGPT to help with financial modeling. You’ll get guidance on structuring income statements, balance sheets, and cash flow statements, plus how to link them for dynamic, real-time analysis. You’ll clarify concepts like fixed vs. variable costs for better forecasting. You can also generate scenarios, drivers, and assumptions to stress-test outcomes. You’ll still need basic Excel skills to implement formulas, build schedules, and validate the model’s integrity.

What Are the 4 Components of Financial Modeling?

They’re the income statement, balance sheet, cash flow statement, and the assumptions that drive them. You track profitability on the P&L, measuring metrics like gross and net margins. You capture a point-in-time view on the balance sheet—assets, liabilities, and equity. You monitor liquidity with the cash flow statement across operating, investing, and financing activities. You then tie it all together with assumptions based on history and projections, so your model’s outputs stay coherent.

What Is the Best Course to Learn Financial Modelling?

The best course to learn financial modeling is a beginner-friendly, self-paced program that builds a complete three-statement model. You’ll appreciate that 80% of finance roles value hands-on modeling skills. You’ll learn to integrate the income statement, balance sheet, and cash flow, using practical templates and clear videos. You can finish in 4–6 weeks alongside full-time work, gain promotion-ready skills, and enroll confidently with a 30-day money-back guarantee and responsive support.

What Are the Basics of Financial Modeling?

You build a structured Excel representation of a company’s performance. You start with top-down or bottom-up assumptions, then forecast revenue, operating expenses, and key balance sheet items. You integrate the income statement, balance sheet, and cash flow so they reconcile and flow correctly. You stress-test with scenarios and sensitivities, validate with historicals, and document drivers clearly. You present insights visually so stakeholders grasp risks, levers, and valuation impact quickly.

Conclusion

You’re ready to turn numbers into narrative and accelerate your finance career. With a clear 7-step system, you’ll build three-statement models, pick the right forecasting approach, and move from raw history to dynamic, decision-ready dashboards. You’ll practice in real tools, learn by doing, and spot risks before they snowball. Enroll risk-free and put theory to bed—then let the data do the talking. Jump in now and hit the ground running; your next role will thank you.

![[ONLY $10] Top Trade Tools – Hedge Fund Trender 3 Top Trade Tools – Hedge Fund Trender Download](https://megalearningcheap.com/wp-content/uploads/2023/04/Top-Trade-Tools-–-Hedge-Fund-Trender-Download.webp)