OkkForex – Forex WATA

Get the Forex WATA course For ONLY $497 $10

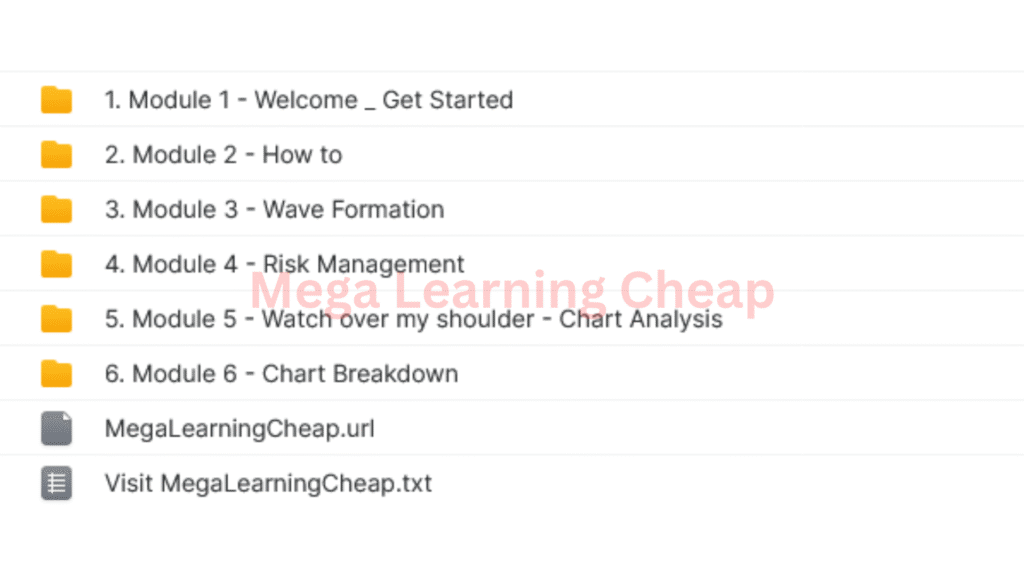

The Size is 1.38 GB and Released in 2023

Check out the sales page for more info

Key Takeaways

- The WATA trading method combines wave analysis and market structure to guide traders in their interpretation of price actions.

- This price action–based strategy has been utilized by novice and veteran traders around the globe.

- When applied consistently, WATA, with its unique indicators and risk protocols, can make your trading more accurate and help you manage risks effectively.

- The methodology promotes traders cultivate a disciplined mindset, stay flexible to evolving market conditions, and constantly refine their abilities.

- Engagement in the WATA trading community provides critical support, shared knowledge, and collaborative potential.

- Keeping abreast of tech tools and regulatory shifts is key for lasting success in the dynamic forex market.

Forex wata is a Nigerian term that primarily refers to sourcing US dollars or other foreign currency through unofficial or parallel market means, rather than through conventional banking channels. Folks love forex wata because when they need dollars for travel, business or school fees and are limited by their banks. These transactions usually occur in cities and at tangible forex locations. Forex wata rates can fluctuate quickly, depending on demand, supply and local regulations. A lot of people use these avenues because they require instant foreign cash. The body of this post will dive deeper into how forex wata works, who uses it and the key risks to watch out for.

What is Forex Wata?

Forex Wata is a carefully designed trading system for the forex market. It applies wave principle to forex price movement. The goal is to assist traders identify trends, anticipate pivots, and create unambiguous trade strategies. Consistency-driven, the strategy leans on a mix of price action, market flow, and time-tested chart tools. OkkForex was instrumental in developing and popularizing the Wata method, with their emphasis on hands-on training and trader assistance.

1. The Core Philosophy

Market structure is the heart of Forex Wata. It’s lesson is that understanding how prices form highs, lows, and retracements is what gives traders an advantage. Price action is the primary indicator—traders seek out signals that indicate where the market is headed.

It’s not about chasing every move. Instead, it’s about feeling out the market’s pulse, mixing technical expertise with straightforward, tangible actions. Traders are instructed to work on the structure and flow, not just the tools. This aids in keeping things straight, even when the market moves quickly. It’s a system that evolves with the trader, coaxing them to move beyond the micro and believe in what the chart reveals.

2. The Okkforex Origin

The Wata strategy began with OkkForex’s aim to demystify trading. From the beginning, it was crafted by trader input and the demand for transparent, intuitive tools. OkkForex continued to update the method as markets evolved.

They ensured education was accessible and jargon-free. The feedback of experienced traders helped optimize the technique, making it more applicable to novice and expert traders alike.

3. The “Wata” Metaphor

Wata means water, demonstrating how price moves in waves. Like water, the market ebbs and flows — sometimes smoothly, sometimes steeply. This picture simplifies for traders how prices can fluctuate up and down, then do it again.

The analogy assists traders visualize the market as dynamic, not static. By thinking in waves, traders learn to identify changes in momentum and enter or exit appropriately.

4. The Market Flow

In market flow, I’m referring to the manner in which prices progress with trends and corrections. Observing this momentum assists traders to decide when to jump in or exit. It means prepared to adjust as the market moves.

How watching flow helps you spot better trades, cut losses and find profits.

Stay open to what the market shows.

5. The Key Distinction

Wata stands out because it prioritizes price action, not just indicators. As such, it’s applicable for every level of expertise.

Traders use Moving Average, MACD and Fibonacci, but don’t depend solely on them.

It’s practical, prepared for actual market movements.

The Wata Trading Framework

The Wata Trading Framework is founded on wave theory to assist traders in interpreting and anticipating price movements in the forex market. It combines distinct elements—custom indicators, wave-driven analysis, and rigid risk parameters—to construct an elegant, but comprehensive strategy. It’s designed for traders seeking a simple, step-by-step method for interpreting charts, identifying entry points, and managing risk — even when the market is ambiguous. It’s adaptable to shifting market environments, and designed to get you beyond the confines of outdated trading approaches.

Unique Indicators

- Custom wave recognition tools identify price patterns in real time

- Volatility meters measure market pace to time smarter entries and exits

- Momentum indicators measure the velocity of a move, keeping you out of bull traps.

- Dynamic support and resistance markers adjust with new data

- Signal filters cut the noise and focus on high-probability setups.

These cues, combined, make wave spotting a lot more obvious. For instance, a volatility tool can alert when a trend is turning, while dynamic support and resistance lines indicate where to buy or sell. With these specialized instruments, traders can sharpen their timing and shoot for more precise trades. Sprinkling these into a toolkit can provide traders with an edge, particularly when old-school indicators flounder.

Analytical Methods

The beauty of the Wata strategy is its multi-timeframe analysis, allowing traders to view both the grand moves as well as the quick trades. Which means examining price waves across multiple chart time frames to identify trends and discover trading opportunities. The framework separates the two by first scanning the daily chart for trend direction, then zooming in on smaller timeframes to identify entry and exit points.

Multi-timeframe analysis gives you a great way to filter out weak setups. If a wave pattern appears on both the 4H and 1H charts, that setup is more likely to materialize. This cross-checking reduces risk and can increase win rates. Traders are encouraged to exercise these techniques, as becoming accustomed to the incremental approach can render decisions more expedient and assured.

Focused on review, it makes traders less prone to pursue trades hogwild on gut or static. Instead, they bank on chart signals that align across timeframes, which can help reduce errors.

Risk Protocols

- Determine a constant risk per trade (e.g. 1–2% of account balance)

- Always use stop-loss orders to limit downside

- Move stop-loss to break even once a trade moves in your favor

- Lock in gains as the trade develops, taking partial profits at targets.

- Review each trade to spot mistakes and adjust plans

Preservation of capital is a paramount objective in the Wata system. It demonstrates how to establish stop loss and target profit levels, allowing traders to enter each trade with a clear understanding of where to enter and exit. This helps sidestep big losses and keeps your emotions in balance.

Traders learn to cut losses quick and let winners run when you can. With explicit risk guidelines, they can target consistent expansion and sidestep the typical pitfall of allowing hope to interfere.

Even if a setup appears perfect, adherence to these risk guidelines can prevent a small loss from turning into a disaster.

Why Consider Forex Wata?

Forex Wata is the only all-level strategy designed for consistent profits in the world’s currency markets. Because forex trades 24 hours a day, five days a week, traders require a strategy that adjusts to quick shifts and evolving trends. WATA provides a framework that introduces structure and clarity to this landscape, empowering traders to manage price swings and decide with increased insight.

Potential Gains

- Numerous WATA traders experience consistent success, some even achieving full-time income replacements.

- Novices have done well following WATA’s easy rules, and expert traders claim it allows them to manage giant positions with little tension.

- One example: a finance worker in Europe with a non-traditional schedule used WATA to trade part-time, reaching his monthly profit target within weeks.

- WATA assist traders in risk management by promoting the establishment of specific, reasonable profit targets grounded in the strategy, instead of wishful thinking.

By following the WATA method consistently, traders can aim for targets that align with their abilities and capital. By emphasizing consistent growth over the quick win, traders develop confidence and avoid the typical errors that sabotage long-term results.

Deeper Insight

WATA is more than just entries and exits. It allows traders to visualize how wave patterns and price shifts influence the market. By recognizing these patterns, traders can make smarter decisions and keep from entering trades based on emotion.

WATA constructs understanding. It teaches you how to read the market’s flow — so you know when it’s easier to spot when to enter or exit. Knowing why moves—whether it’s high volume trading or breaking news—is extremely useful and can be a huge differentiator in outcomes.

With this insight, traders can plan accordingly. Armed with the proper instruments, they can monitor their advancement, calibrate when necessary, and continue to study.

Strategic Edge

WATA puts discipline first, giving traders a clear edge. It provides a rule-based framework to minimize mistakes and control emotions. This edge matters, because forex markets can be fast and volatile.

With WATA, traders are able to manage price spikes or news events as they stick to a plan. It’s an approach that works for full-time traders and busy traders alike. It’s this attention to risk management and goal that’s the secret.

Accessibility for All

WATA is accessible enough for beginners but complex enough for experienced veterans.

Anyone can apply WATA’s rules to trade in the dynamic forex market.

It can help build skills from the ground up.

WATA adapts to all trading styles.

Acknowledge The Inherent Risks

Forex wata trading has some risks that traders must be aware of. As the risks are inherent, and poor risk management can lead to large losses, it’s important to understand them. By acknowledging the pitfalls, remaining vigilant and prepared, traders can navigate smarter decisions and dodge typical traps.

Market Volatility

Market volatility means currency pairs’ prices can bounce up or down quickly, typically without notice. They can occur due to major news, interest rate changes, or abrupt demand and supply changes. These swings can provide opportunities for gain, but they increase the likelihood of rapid losses.

Some traders leverage the volatility, jumping into trades as prices fly to snag larger profits. These same moves can turn on them just as fast, particularly with high leverage. For example, with a leverage of 1:100, even a small price move could wipe out an account. To combat this, lots of traders place stop-loss orders, use smaller leverage and follow market news to the tee. Being up to date on trends and world events allows you to mitigate risk and make more intelligent decisions.

System Reliance

Depending too much on a single trading system can be dangerous, particularly when the market shifts. No system works always. What works in a trending market will blow up in a range-bound one.

So, be flexible. Traders need to blend system signals with their own intuition, evaluate their methodology regularly, and stay curious about fresh techniques. For instance, playing the Martingale alone can get you killed in a surprise market move. To evolve and get better as time goes on is what it’s all about.

Psychological Pressure

Trading is a cognitive beast. The rapid tempo and high stakes bring stress, fear, and greed — all dangerous judgment clouders.

Controlling your emotions is paramount. Some traders take breaks, limit trade size, or follow a regimen to help manage stress. Developing psychological fortitude, maintaining discipline, and using failures as lessons assist traders in adhering to their strategy and resisting impulsiveness.

Is Wata The Right Path?

It’s your call, trading strategy-wise. No public information about “Wata” as a specific trading system, so who knows what it’s worth. There are many factors that influence how successful any method can be, including the trader’s objectives, risk tolerance, and commitment to continued education.

| Trading Style | WATA Adaptability | Description |

|---|---|---|

| Scalping | High | Quick trades, small profits per trade |

| Day Trading | Moderate | Trades open and close within same day |

| Swing Trading | Moderate | Holds trades for days or weeks |

| Position Trading | Low | Long-term, less frequent trades |

Trader Mindset

A trader mind is good for all systems. Patience and discipline are key, because you’re waiting for good setups and following rules, regardless of whether you win or lose. Others traders quit too early or pursue fast profits, which amplifies danger.

Maintaining growth mindset is key as well. Markets evolve and no strategy ever lasts. Traders who continue to learn, embrace new trends, and view losses as a necessary step, stick around longer. Troubles occur, even with trustworthy methods. Traders who approach these with a growth mindset and leverage errors as lessons tend to get better.

Learning Curve

- Online courses and webinars

- Trading forums and discussion groups

- Demo trading accounts

- Books and eBooks

- Mentorship programs

There are too many resources for developing trading skills. Some like lessons, others thrive with demo accounts. Books and mentor advice provide practical tips. Over time, real experience crafts a trader’s skills much more than theory.

Accept the learning curve. Trading isn’t immediate. Most winning traders train for months or years before observing consistency.

Capital Needs

Forex trading with any strategy, including WATA requires sufficient capital. Playing underfunded accounts is a recipe for quick losses. Traders should risk only to funds they can afford to lose.

Strong risk management is necessary. Even good win-rate systems can have extended losing streaks. Schedule your account size, stop-loss points, too. Check financial health prior to and scale positions accordingly4.

Individual Circumstances

Hustling routes aren’t one size fits all. Try out new tactics with mini trades. Be reasonable with your expectations, understand your boundaries, and remain prudent.

Do research, avoid shortcuts.

Adapt as your needs change.

The Future of Wata

Wata at a crossroads as forex trading evolves rapidly. Global trade volume could experience a 25% increase — taking totals past $750 billion by 2025. Automation and tech-driven analysis will define how traders interact with Wata. Fast, real-time data and great market data will remain essential, particularly as milliseconds can be the difference between profit or loss. The business will continue evolving, providing new opportunities and challenges to every dealer.

Technological Evolution

| Benefit | Description |

|---|---|

| Speed | Real-time price feeds cut delays, boost reaction times |

| Automation | Trading bots handle orders fast, lower human error |

| Data Analysis | Powerful tools sift through market data, spot trends |

| Scalability | Platforms manage millions of trades daily, even in peak hours |

Trading platforms and tools now have a much bigger trading role in Wata. They allow traders to respond to price movements in milliseconds. With immediate access to news, live quotes and trading signals, you’ll be able to make those quick, smart moves. With millions of trades every day, technology that shaves a millisecond off response times can be a gamechanger. Dealers leveraging new tech, such as AI-powered bots and data tools, are times more likely to enjoy superior outcomes.

To stay up to date on tech changes is not just smart, it’s necessary. New tools arrive frequently, shifting how people buy and sell. For those who follow, they’ll probably have a leg up.

Community Growth

More traders trade with Wata than ever, creating a thriving worldwide community. This provides all of us a forum to exchange advice, pose questions and benefit from others’ successes and mistakes. By becoming part of groups, forums or online chat traders get real support and feedback.

Collaborating with colleagues allows innovations to diffuse and provides space for improved techniques to flourish.

Regulatory Adaptation

Forex regulations change every year. Keeping up with the latest can keep a trader out of trouble. Laws can alter how orders are given, which information is disclosed, or even what tools are permitted. Missing a rule change can equal lost trades or worse.

Companies and investors who adapt quickly to new regulations can maintain their advantage.

Conclusion

Forex Wata provides a definitive route for those who want to trade with less speculation. It provides step-by-step rules, so traders understand what to do next. Others, like the rhythm, and the charts make sense. There’s always some risk, but a lot of people like how Wata keeps it easy. A trader in Berlin used Wata to establish micro-daily objectives. Another in Nairobi loved how quickly they would be able to identify trends. Traders from all over continue to discover value in Wata’s no frills approach. For more, read real-world accounts from Wata traders or take a demo for a spin before you begin. Real growth comes from experimentation, from asking questions and applying what works for you. Keep your eyes on the prize but be open to new paths.

![[Hot Bundle] Build Six Figure Sites 2024 2 Course Bundle Download](https://megalearningcheap.com/wp-content/uploads/2022/04/Course-Bundle-Download.png)