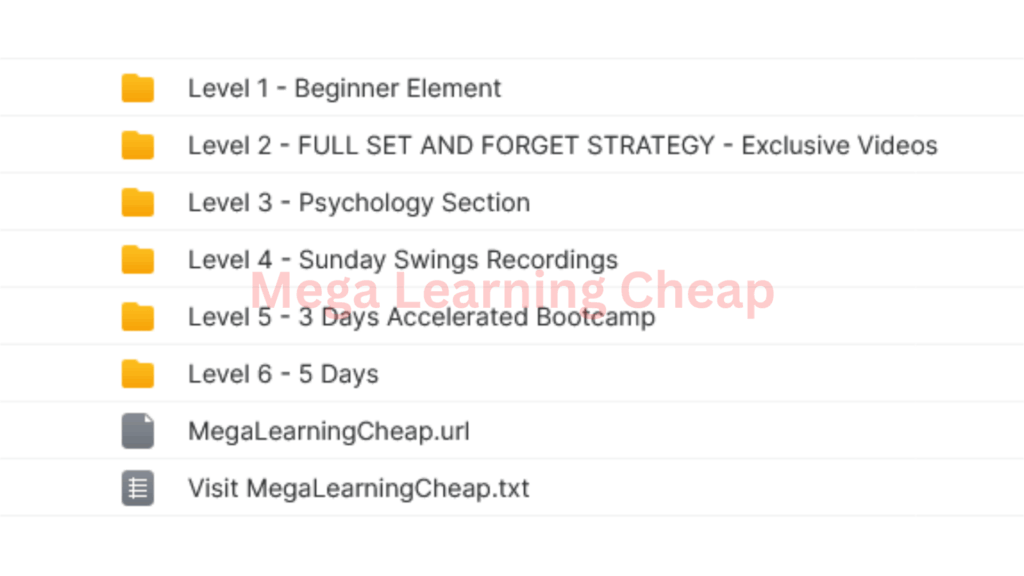

Swing Trading Lab – Full Set and Forget

Get the Full Set and Forget Course for $2997 $19

The Size is 34.53 GB and is Released in 2025

Key Takeaways

- How the ‘set and forget’ trading approach can help you stop stressing every day and checking your trades.

- Having structured plans and strong risk management is the key to capital preservation and consistent performance.

- Ongoing refinement of your trading strategies with data-backed insights helps you continually improve and evolve.

- By balancing automation with personal oversight, and by staying on top of market trends, you can increase performance and mitigate risk.

- With good trading tools and efficient use of your time, a trader can fit swing trading into a range of lifestyles and schedules.

- Backtested data, real trade examples, and user experiences provide confidence in the system.

Is a way to trade the markets with less time spent in front of the screen A complete swing trader toolkit for trade signals, entry and exit setups, and risk checks. A lot of people use this sort of arrangement to save time, since it operates on automated alerts and explicit rules. Most swing trading labs are stock, forex or crypto, and provide charts & checklists for every trade. They receive user-friendly step-by-step guides and updates that keep them on track without daily checking. For traders who like to set trades and forget them, this style can suit hectic schedules. The following illustrates how this method works.

The “Set and Forget” Philosophy

I call this the ‘set and forget’ philosophy. It’s based on swing trading, where trades can last days or weeks – looking for consistent profits. By establishing trades with the appropriate tools and rules, traders can circumvent stress, second-guessing, and the temptation to overtrade. As it turns out, this strategy applies equally well to rookie and veteran traders, and it can be sculpted to suit various objectives or ways of life.

1. The Blueprint

A good plan is the foundation of “set and forget.” It directs you what to trade, when to enter and when to exit. This plan can be as straightforward as a moving average cross, or as intricately nuanced as multi-indicator setups for the more advanced folk.

Explicit rules reduce difficult decisions in the heat of the moment. For instance, a trader could elect to buy when a stock closes above a key level and aim for a 5% profit. Newbies can run simple set ups with fixed entry and exit levels while sophisticated traders can implement filters or larger context analysis. This way, your plan suits you and keeps you committed to your schedule.

2. The Automation

Automation liberates you from the screen. With trading software, you can specify trade entries, exits, and alerts ahead of time. This eliminates having to respond to every price fluctuation.

You set stop-loss and take profit, which means the system trades for you. For instance, if you use a trading platform, you can automate your trades so that they hit at specific prices. This can reduce stress and error from breakneck markets.

Automated alerts help as well. If a market moves beyond your rules, you get a notification but don’t need to intervene unless you want.

3. The Risk Protocol

Risk control is crucial. Every trade should have a set risk amount—perhaps 1% of your total bankroll per trade. Use stop-loss orders to protect against large losses, such as a stop 2% below your buy price.

Check every trade for risk before you enter it. This keeps you from being caught off-guard, say, by an overnight market swing. Follow these rules, regardless of what the headlines or market gossip dictates.

4. The Review Cycle

Review your trades on a fixed schedule. See what worked or didn’t. Tl;dr: If you see a pattern or gap, tweak your plan. Continue to learn and tweak.

Beyond The Algorithm

Swing trading labs may be automated, but trading well requires more than code. Human judgment, market sense, and personal intuition still color real-world outcomes. What the best traders combine are not complicated systems, but simple strategies and clear thinking in forex, crypto, or any other market.

Human Oversight

A hands-off, “set and forget” style like mine can be effective for those who want to avoid the stress of micromanaging their feeds. Yet, even basic systems work better if traders check in regularly, monitor for trend shifts, and remain engaged with their instruments. Most discover that consistent interaction with a community or mentor encourages confidence and keeps ideas fresh. Others concentrate on a handful of signals—such as moving averages or support levels—rather than pursuing every new technique.

Market Adaptation

Markets evolve and what works today may not work next month. Being aware of world news, policy shifts, or significant economic events can make a difference. Historical data is helpful, but pairing it with live insights keeps a strategy fresh. Flexibility keeps traders from losing when conditions change, and those open to change typically discover more consistent gains. For instance, when volatility increases in crypto, others pivot to tighter stop losses or smaller holding periods.

Psychological Edge

Swing trading isn’t just about the math. It’s about mind control. Building persistence trains traders to follow their strategy, even after a loss, or through choppy swings. Handling stress — via routines, taking regular breaks or mindfulness — can reduce mistakes and maintain decision-making crispness. Emotional intelligence allows traders to identify when fear or greed is blurring their perspective. This edge is frequently what sustains a good strategy’s profitability over time.

Ongoing Learning

A good course or mentorship lays the foundation for growth to come. For many traders, a steady, minimalistic diet—an hour a day, say—allows them to keep up with markets and develop skills at a sustainable pace. Over time, this incremental learning compounds into a braver and more flexible approach to trading.

Built For The Real World

Swing trading lab–complete set and forget–has to fit into real lives, not just theory. Marketplace reality changes, therefore it’s critical to have an adaptable strategy that you can execute even when life gets hectic. Skip techniques that only work on paper or in idealized configurations. Instead, construct around what really works in the real world–some hard-hitting techniques, clever tools, and an emphasis on sustainable outcomes.

Time Commitment

- Checklist for efficient trading: .* Employ automated alerts to detect trade setups quickly. .* Define your entry and exit rules to reduce guesswork. .* Rely on mobile apps to control trades from anywhere. .* Reserve 1–2 hours a day for review and set-up. .* Maximize watched assets, so you don’t get spread thin. .* Review trades weekly to identify what’s effective.

Scheduling trades around work, study or family time prevents trading from becoming your entire life. Most busy traders invest under 2 hours per day and many require over a year to feel proficient. It’s smarter to select some quality trades versus attempt to run after every move, so your outcomes complement your lifestyle.

Capital Requirements

A hard stare at your initial capital establishes honest expectations. Swing trading can work with small amounts, say €500–€2,000, but returns increase commensurately with risk. Bigger capital can translate to bigger wins and losses, so it’s critical to balance risk with expected returns.

Others allow you to begin with tiny accounts, which makes it more accessible. The trick is to align your investment with your objectives and risk tolerance. In rapid markets, such as crypto, not all provide real-world value — so double down on assets with established histories.

Platform Integration

Picking the appropriate platform can accelerate your workflow. Find platforms that play nicely with manual and automated trading so you have options as you scale. An easy, tidy interface assists you to behave swiftly and steer clear of errors, particularly when marketplaces are unstable.

Risk management tools—like stop losses and alerts—are a must. Analytics and reporting auto-pilot your adjustment as market conditions shift, keeping you tuned to the real world.

The Architect Behind The System

The architect behind the swing trading lab system distinguishes himself by deep skill and long years working in the financial world. An eye on their history reveals a deep connection between direct trading experience and a passion to educate. Below is a table that sums up the key facts about the architect:

| Area | Details |

|---|---|

| Experience | Over 10 years of active trading |

| Core Skills | Market analysis, supply/demand, price action |

| Approach | Manual trading, focus on market moves, not heavy tech |

| Location | Nairobi, Kenya |

| Focus | Education, sharing, and trader support |

| System Base | Predictive setups, technical analysis, practical learning |

The architect’s decades on the field means this is not a system constructed on theory alone. They’d observe for hours how prices travel, how supply and demand direct the stream, and what indicators appear before a trade is worth the threat. Their system begins with plain talk—look for big price moves, identify where the buyers and sellers battle and then wait to pounce. This type of trading doesn’t rely on a bunch of indicators or fancy software. Instead, it requires the trader to scan the chart, believe in the price, and speculate.

By grounding the technique in supply and demand, the architect allows traders glimpse where the market could tip next, ahead of the masses. For instance, if a price sinks to a zone where buyers have leaped in previously, this might be a high-probability trade. The architect’s system is designed to identify these zones and to configure trades that are less likely to be stochastic. This can assist traders who, lost in the din of headlines or phony flashes, don’t know where to turn. It’s on selecting high-probability trades, which is critical because the majority of traders blow their accounts by chasing crap setups.

Their odyssey in Nairobi, a city at the crossroads of so many markets, adds a global flair. It forms their perspective on how world and local moves mingle. Years of learning, testing, and fine-tuning gave them a clear sense of what works. They contribute what they know, on the premise that elevating others and cultivating skills that stick.

Validated Performance & Proof

Swing trading lab’s “set and forget” approach is rooted in data and lived results, not assertions. We don’t just say we’re good at trading. Performance is VALIDATED by backtested results, real trade breakdowns, and stories from users around the world. These provide a robust glimpse of what traders, new or experienced, can anticipate.

Backtesting Data

Backtesting is the backbone of any system. By backtesting the swing trading lab strategy versus years of historical data, traders observe how the strategy endures various market cycles. We are more interested in core numbers such as p/l ratio, risk/reward ratio and win/loss percentage. These figures assist traders in gauging whether the tactic is efficient and consistent. For example, a win rate above 60% and a risk/reward ratio of 1:2 are often reliable signs. Backtesting aids in identifying vulnerabilities, indicating where strategies might be refined prior to risking actual capital. This is a crucial component of risk management and helps traders feel more comfortable following through on their strategy, even when markets get volatile.

| Year | Trades | Win % | Avg. Risk/Reward | P/L Ratio | Drawdown (%) |

|---|---|---|---|---|---|

| 2021 | 180 | 64% | 1:2.1 | 1.45 | -3.2 |

| 2022 | 172 | 61% | 1:2.0 | 1.38 | -3.7 |

| 2023 | 188 | 66% | 1:2.3 | 1.54 | -2.9 |

Trade Examples

Going over actual trades helps convert numbers into street smarts. One example: a trader sees a confirmed reversal on a 4-hour chart, enters with a 2% stop loss, and exits after a 5% move. Another trade demonstrates how adherence to the plan prevents panic-selling during a minor pullback, resulting in a robust gain as the trend reasserts itself. Patterns such as these—entries on unmistakable cues, exits on pre-determined targets—are typical of winners. They demonstrate the part discipline plays in adhering to the system, not feelings, particularly when the market gets choppy.

User Stories

Traders all over the world share how the system transformed their habits. One user in Asia began with minimal experience and now records consistent monthly gains, helped by explicit guidelines and basic risk controls. In Europe, yet another trader says that adhering to the plan prevented them from pursuing losses, which made their outcomes more consistent and less anxiety-inducing. These narratives exemplify that with the proper approach, even time-crunched, unseasoned individuals can experience success. It’s not luck, it’s a plan that works.

Your Trading Transformation

Adopting a more set-and-forget swing trading approach can transform your perspective and process of trading. A lot of folks spin their wheels in an endless cycle of reading long form guides or attempting to adhere to dicey tips and yet remain lost. This cuts through that noise. With swing trading, you keep trades open for days or weeks, not hours. That means you don’t have to gawk at charts all day or leapfrog in and out of trades every minute. Instead, you rely on defined stages and allow quality trades to unfold, which can reduce tension and assist you in maintaining your plan.

Many traders desire to be more systematic but don’t know where to start. Escaping gut instinct and toward rules is a great start. The course provides the means to identify supply and demand zones and interpret price action. These aren’t just buzzwords—they assist you visualize where price is apt to reverse, so you can discover stronger setups. For instance, when price touches a powerful demand zone and creates an obvious reversal pattern, that’s an indication to buy. This basic, replicable action can increase your winning trade percentage.

Learning from others accelerates your journey. Others thrive with a coach or community to query their ideas. Having access to actual trade examples or direct feedback on your ideas can make all the difference. The swing trading lab delivers real world cases and step-by-step tutorials, so you don’t have to guess what works. You stick with the plan, monitor your results, and adjust as necessary.

Risk and reward is a constant concern. It’s not only about earning it, but holding on to it as well. Determine your stop-loss and take-profit points before you enter a trade — this way you know what you can lose or win. This prevents small losses from becoming large. The swing trading lab guides you in how to set these points with reasoning, not just wishful thinking.

Improving requires time. Most traders lose initially—up to 95% fail to consistently profit, according to studies. It’s not from big dramatic shake ups, but real change comes from consistent education, experimentation and not quitting after one losing week. You learn to trust process, not pursue quick wins.

Conclusion

Swing Trading Lab’s ‘set and forget’ set up keeps it simple. It uses real prices and real proof, not just stories. Traders can verify the figures and experience the integration for themselves on actual trades. The designer develops every guideline for day by day life and hectic individuals, so that you do not should watch screens all day. The team delivers, not just hope. No matter whether you’re new to trading or had your share of charts for decades – here’s a place you can start with a clean slate. To find out more, check the complete guide and see how this approach gels with your personal style. Ready to test an easy road! Discover how the ‘set and forget’ method can transform your swing trades.