Troy Broussard – Low Stress Options Trading

Get the Low Stress Options Trading Course for $995 $13

The Size is 0.2 GB and is Released in 2025

Troy Broussard’s Low Stress Options Trading teaches you to generate steady income with conservative cash-secured puts and covered calls. You’ll follow a simple, rules-based process aimed at about 1% per week, focusing on probability, time decay, and disciplined risk management. Training fits busy schedules, with tools like an Options Scanner, trade alerts, and weekly Zoom support. It works in regular or IRA accounts, prioritizing defined risk and quality stocks. Stick around to see how the strategy, tools, and community fit together.

Who Is Troy Broussard?

Meet Troy A. Broussard, the founder behind Low Stress Trading, a division of Low Stress Training, LLC. You’ll recognize his blend of technical rigor and practical teaching. He draws on a background in electrical and nuclear engineering from his US Navy service, then layers in over two decades building Software as a Service products. That mix lets him turn complex systems into clear, reliable processes.

You also benefit from his entrepreneurial streak. He’s founded multiple coaching and consulting companies, so he knows how to guide you from confusion to confidence. In Low Stress Trading, he focuses on conservative options approaches built for beginners who want structure and safety. You’ll appreciate how he breaks down each step without jargon and keeps you focused on disciplined execution.

Under his leadership, the program earns consistent praise for its straightforward methodology and supportive community, giving you a place to learn, ask questions, and stay accountable.

The Low Stress Options Trading Philosophy

Although markets can feel chaotic, the Low Stress Options Trading philosophy gives you a simple, conservative path: sell cash‑secured puts and covered calls to target steady, repeatable income. You focus on controlled risk, consistent process, and weekly execution rather than prediction. The aim is about 1% per week across up, down, or sideways markets, relying on time decay and prudent position sizing.

You’ll learn a straightforward framework that beginners can grasp quickly and apply in traditional or IRA accounts. The emphasis is discipline: define risk with cash on hand, own shares when assigned, and monetize positions when conditions are favorable. You don’t chase trades—you let probabilities work.

The program’s structure is clear: a $1,000 first month, then $100 monthly for ongoing support, coaching, and resources—no upsells. You’re encouraged to think long term, build habits, and participate in a respectful, open‑minded community that shares insights and keeps you accountable as you steadily compound results.

Core Strategy: Cash Secured Puts and Covered Calls

You’ll start by mastering cash collateral basics for cash secured puts and stock ownership for covered calls so every trade is fully funded and risk is defined. Next, you’ll learn to select strike prices that balance probability, premium, and assignment risk across different market conditions. Finally, you’ll plan for rolling and assignments to manage outcomes, preserve income, and keep your Low Stress approach intact.

Cash Collateral Basics

Cash is your seatbelt when trading low-stress options. With cash-secured puts, you reserve collateral equal to the strike price times 100 shares. That cash covers the obligation to buy if assigned, keeping you out of risky, naked positions. You still collect premium upfront—often around 1.94% for a 7‑day window when the stock stays above the strike at expiration—so you’re paid to wait while managing risk.

If the stock closes below the strike, you’ll buy 100 shares at that price, but you keep the premium, lowering your effective cost. This conservative setup fits well in taxable accounts and IRAs, aligning with prudent, rules-based trading.

- Set aside strike x 100 as cash collateral

- Collect premium immediately for income

- Avoid naked options risk entirely

- Use confidently in IRAs and conservative accounts

Selecting Strike Prices

Two decisions drive low-stress strike selection: where you’re happy to transact and what income justifies the risk. For cash secured puts, pick a strike where you’d gladly own 100 shares, typically below the current price. Anchoring the strike at or just under a proven support level tilts odds in your favor and reduces downside.

Price the premium against capital at risk. If you sell a $16.50 put for $0.32 with 7 days to expiration, that’s a 1.94% one-week return—worth considering. In higher implied volatility, premiums expand, so you can often set strikes farther out-of-the-money and still collect solid income.

For covered calls, choose a strike slightly above the market to capture upside and premium. Keep choices consistent with your risk, timeframe, and income targets.

Rolling and Assignments

When time or price moves against your option, rolling and handling assignments keep the strategy low stress. You’ll close the current contract and open a new one to shift risk, extend time, or adjust strikes. With Cash Secured Puts, rolling out and/or down can reduce assignment risk and still collect premium. If you’re assigned, you’ll buy 100 shares at the strike and keep the premium, which cushions your basis. For Covered Calls, if price pushes above the strike, roll up and out to keep shares and harvest more premium.

- Define your roll trigger: delta, days to expiration, or breach of strike.

- Compare credit received to added risk and time.

- Plan for assignment; pre-fund share purchases.

- Track adjusted cost basis after rolls and assignments.

Training, Tools, and Membership Structure

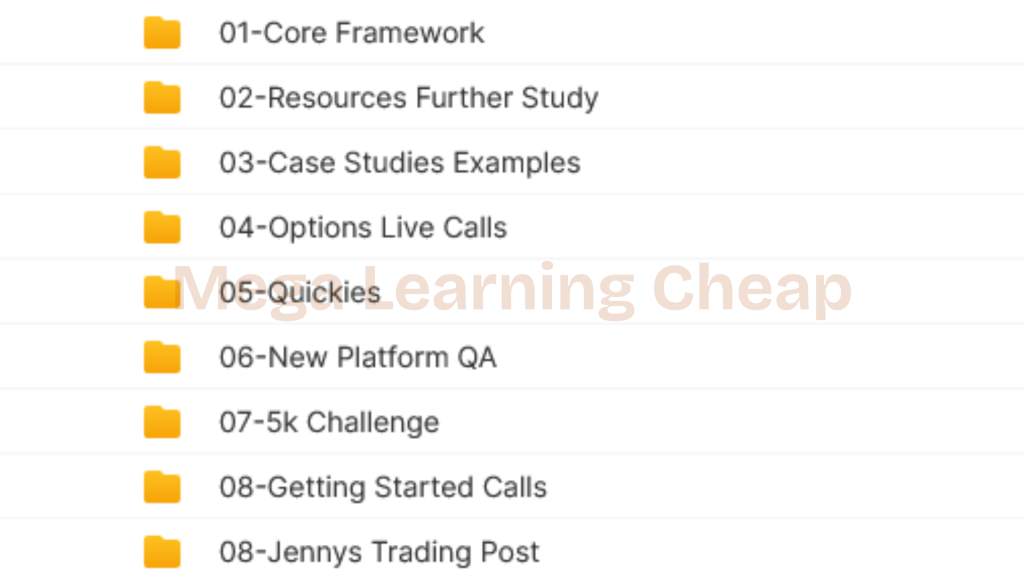

Start with six months of on-demand training videos, then continue month-to-month at $100 for trade notifications and community access. You’ll get exactly what you need to execute the method without bloated curricula or upsells. The core training is structured so you can learn at your pace and revisit modules when you need a quick refresher.

Use the proprietary Options Scanner to filter trades that fit the strategy’s criteria. It streamlines idea generation and helps you track performance without juggling multiple tools. You won’t need extra software—free screeners and platforms are included, and you’ll only pay standard per-contract trading fees.

Plan on 1–2 hours a week. The system’s built for busy schedules, so you can review lessons, scan for setups, and place trades efficiently. Inside the private community, you’ll discuss setups, execution, and rules in a secure, centralized hub that protects sensitive information while keeping all resources easy to find and use.

Real-World Results and Community Experiences

Though results will vary, members consistently report meaningful gains and greater confidence using the straightforward sell-puts-and-covered-calls approach. You’ll see traders credit simple, repeatable rules for turning prior skepticism into steady progress. Many describe tangible financial improvements and a calmer mindset, especially after replacing guesswork with defined income targets and risk limits. Wins aren’t universal, but the consistency theme shows up again and again.

Community support amplifies results. You’re not working in isolation—you’ll swap notes, compare trade logic, and learn faster by seeing how others manage entries, adjustments, and exits. Regular Zoom calls help you stay accountable, though some find they drift into stories instead of structured teaching. Still, timely customer support keeps you moving when you hit questions or need clarity.

- Share real trade recaps to solidify lessons

- Compare position sizing and assignment handling

- Ask support for fast, practical guidance

- Use calls for accountability and process refinement

Platforms, Ratings, and How LST Compares

Even in a crowded field of options education, Low Stress Trading (LST) stands out for its conservative, time‑efficient approach. You’re not chasing complex spreads or momentum plays. Instead, you’re applying consistent, rules‑based selling of puts and covered calls to target steady weekly cash flow.

When you compare platforms, OnlyOptionsTrades.com and WarriorTrading.com both earn strong 4.8 user ratings. They offer robust toolsets and often lean into more aggressive tactics. LST positions itself differently: it prioritizes clarity, controlled risk, and minimal screen time so you can trade around a full‑time job without sacrificing structure or discipline.

Training inside LST is straightforward and accessible, which helps if you’re new and want a predictable path. You also get a supportive community—regular Zoom calls and direct interactions keep you engaged and accountable without overwhelming your schedule. If you value simplicity, consistency, and a calm learning curve, LST’s model compares favorably to high‑engagement alternatives.

Risks, Account Types, and What to Expect

You’ve seen how LST stacks up; now let’s get clear on risks, account types, and what to expect. Low Stress Options centers on Cash Secured Puts and Covered Calls—conservative tools that keep risk defined. With CSPs, you only buy 100 shares if price dips below your strike, and you reserve cash equal to shares times price, so there’s no margin surprise. You avoid high‑risk tactics like naked puts.

You can run LST in IRAs and Roth IRAs if your broker permits options; many HSAs allow them too, but it’s provider-specific. Expect roughly 1% per week on average, with income scaling to portfolio size—for example, around $1,163 weekly on $60k.

- Confirm options approval level for IRA/Roth IRA/HSA accounts before placing trades.

- Size positions so cash collateral comfortably covers potential assignments.

- Plan for occasional assignments and manage them with Covered Calls.

- Commit to learning; results depend on your engagement and execution.

Getting Started and Next Steps

Start with an account setup checklist: confirm options approval (including IRAs if your broker allows), fund the account, and enroll for the $1,000 first month to access training and resources. Next, map a first trades roadmap: practice selling a Cash Secured Put, then a Covered Call, using the program’s trade notifications and training videos. Stay on track with monthly $100 access, community support, and regular Zoom calls to refine execution.

Account Setup Checklist

Two essentials kick off your low-stress options journey: the right account and the right expectations. Open a traditional brokerage account with options approval that supports Cash Secured Puts and Covered Calls. Most IRAs restrict these, so verify permissions before funding. Next, learn how Cash Secured Puts work: you’re agreeing to buy 100 shares at a set strike if the stock finishes below that price at expiration.

- Confirm your broker’s options level supports selling Cash Secured Puts and Covered Calls; enable margin only if required for order entry, not leverage.

- Fund the account with enough cash to secure one contract (100 shares) per trade.

- Schedule 1–2 weekly hours for videos, scanning, and review.

- Activate your six-month access to training and the proprietary Options Scanner; engage with the community and commit long term.

First Trades Roadmap

With your account ready and expectations set, the First Trades Roadmap moves you into action with Cash Secured Puts. You’ll target quality stocks, agree to buy 100 shares at a predetermined strike, and collect a premium up front—paid whether the stock gets assigned or not. This keeps risk defined and decisions simple.

Start in a traditional brokerage account to build confidence before exploring IRAs. Lean on the six months of training videos to master entries, expirations, assignment, and management.

Use the proprietary Options Scanner to filter for liquidity, reasonable premiums, and strikes that align with your risk. It quickly surfaces candidate trades that fit the plan.

Show up in the community. Join the Zoom calls, share screenshots, ask questions, and review results. Consistency compounds skill and calm.

Frequently Asked Questions

How Does LST Integrate With Tax Reporting Software and CPA Workflows?

It integrates through exportable reports, standardized CSVs, and APIs that map trades, assignments, and expirations to tax lots. You’ll sync accounts, tag wash sales, and reconcile 1099-B data automatically. It generates Schedule D-ready summaries, short/long-term breakdowns, and adjustments. Your CPA can import files into popular tax software, review audit trails, and lock periods. You’ll automate corporate actions, multi-account consolidation, and end-of-year rollups, reducing manual entries and errors.

Are There Accommodations for Non-U.S. Market Hours and International Brokers?

Yes. You can configure alerts and dashboards for non‑U.S. market hours, set custom trading sessions, and schedule notifications in your local timezone. You’ll add international brokers via API or file imports, with support for common formats like CSV and FIX. You can map symbols across regional exchanges, convert currencies automatically, and adjust contract specs. You’ll also customize holiday calendars, daylight‑saving shifts, and margin rules to match your broker’s jurisdiction.

What Are the Minimum Computer and Internet Requirements for LST Tools?

Like a car needs fuel, you need a modern setup: a Windows or macOS computer from the last 5–7 years, 8–16 GB RAM, a dual-core (preferably quad-core) CPU, and at least 10 GB free storage. Use a 1080p monitor or better; dual monitors help. Keep your browser updated (Chrome, Edge, or Safari) and enable cookies. For internet, use a stable broadband connection: minimum 10 Mbps down/2 Mbps up; 25/5+ is ideal. Wired beats Wi‑Fi.

How Are Alerts Delivered During Trading Halts or Broker Outages?

Alerts still trigger server-side based on data feeds, but delivery depends on market and broker connectivity. During exchange halts, you’ll get halt/resume notices; price-based alerts queue and fire when trading resumes. If your broker’s down, platform-native alerts still send via email, SMS, and push, assuming your account’s authenticated. If your internet drops, you’ll receive queued messages once you reconnect. Always enable redundant channels and verify contact settings before volatility spikes.

Can LST Strategies Be Automated via APIS or Third-Party Bots?

Yes, you can automate strategies via APIs or third‑party bots, as long as the rules are codifiable and your broker or platform supports programmatic trading. You’ll define signal logic, risk parameters, and order routing, then connect via REST/WebSocket or platform SDKs. You should sandbox-test, add fail-safes for halts/outages, throttle orders to avoid rejections, and log everything. Start with paper trading, then roll out gradually with alerts and circuit breakers.

Conclusion

You’ve walked the map with Troy Broussard—from who he is to how low-stress options trading actually works. Now it’s your turn to pick up the ring and step into the quiet power of cash-secured puts and covered calls. With training, tools, and a measured plan, you don’t have to chase dragons or swing for fences. Start small, stay disciplined, and let consistency be your North Star. Open your account, join the community, and take your first deliberate step.