TradePro Academy – Options Trading and Order Flow Course

Get the Options Trading and Order Flow Course for $297 $12

The Size is 14.49 GB and was Released in 2024

Key Takeaways

- My TradePro Academy Options Trading and Order Flow Course provides a well organized curriculum that combines theory with live trading.

- Students learn options basics and advanced strategies with an emphasis on income generation, risk management and market dynamics.

- Real-time order flow insights and volume profile analysis empower traders to make informed decisions and identify institutional market activity.

- It includes trading psychology and risk management, aiding you in building discipline, controlling emotions, and safeguarding your capital in turbulent markets.

- They enjoy hands-on learning, live trading labs and a community of traders and expert instructors.

- The course presents key trading concepts and fosters a holistic approach that combines technical analysis with live data for balanced trading strategies.

TradePro Academy – Options Trading and Order Flow Course, is an online educational experience that teaches people about options trading and order flow in today’s marketplaces. It touches on important subjects such as options fundamentals, trading strategies, risk management, and order flow analysis. Students receive video lessons, live sessions and trade ideas. So many sign up to learn actionable skills and put them to work in their own trades! The course is designed for beginners and intermediate traders who want to increase their market expertise. Lessons emphasize concrete action, plain language, and actual trading examples. In this post, we highlight the core components, pedagogical approach, and customer review of TradePro Academy’s course for those seeking a no-nonsense approach to education.

The TradePro Academy Course

TradePro Academy’s options trading and order flow course is designed to enhance your day trading skills with practical tools and real-world strategies! The curriculum is structured into folders and files, featuring video lessons, quizzes, and community support to guide beginners and experienced traders alike on their journey to trading profits.

1. Core Curriculum

The course teaches options trading basics and beyond. Lessons begin with option strategies for consistent income and risk management, such as weekly options and debit spreads. These strategies assist traders in locating trades that line up with their objectives and tolerance.

Courses dive more deeply into market dynamics, such as how to deploy pricing models and identify critical market changes. Hands-on lessons with quizzes and application exercises to help drive each topic home — ensuring you really digest it. Real world case studies that demonstrate how the theory operates in actual trades, deconstructing wins and losses to showcase what works.

2. Order Flow Integration

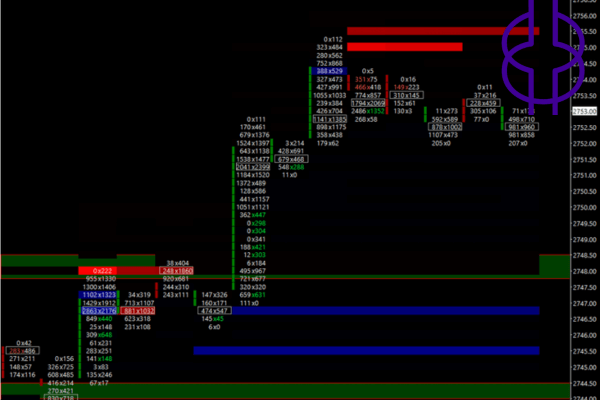

Order flow evaluation is what’s at the heart of the course. You learn how to read tape and identify the big players, which can help you make a difference on your option trades day-to-day.

Volume profile shows you where price action counts, using live information to inform decisions. These order flow skills are demonstrated with live examples, such as tracking block orders and measuring their impact on price movement. This style caters to traders who desire to polish their edge and respond quicker in turbulent markets.

3. Trading Psychology

A disciplined mind is everything. The course applies NLP to assist traders in maintaining their composure and adhering to their strategies.

It examines typical psychological bottlenecks, such as FOMO or capitulation selling, and provides strategies to overcome them. Here, the emphasis is on cultivating a mindset that promotes patient growth and decisive clarity — key for consistent performance.

4. Risk Management

Risk management is embedded throughout all modules of the trading courses. You learn how to set risk plans, measure risk-reward ratios, and employ stop-losses. Important position sizing and regular trading journal review are emphasized, making these techniques easy to implement yet effective in capping losses.

5. Live Application

Live trading labs tie everything together, allowing participants to observe, participate, and critique actual trades with instructors and fellow traders. These sessions reinforce confidence and help refine day trading skills as theory converts into performance.

Why Order Flow Matters

Order flow helps you monitor what buyers and sellers are up to in the moment, making it an essential aspect of day trading. By following order flow, traders can detect changes in demand and supply ahead of price action, allowing them to know whether a price increase is supported by genuine demand or just a temporary spike. For instance, if a stock price begins increasing but there isn’t much purchasing in the order flow, it may not be sustained. Strong buying, on the other hand, can indicate that the move is likely to continue. This sort of granularity is difficult to discern by glancing at price charts, which is why many traders benefit from an order flow course to refine their skills.

It’s institutional activity that drives most of the volume in futures day trading. When big funds or banks get to work and put in large orders, they tend to shift prices quickly. Observing order flow allows traders to identify these powerful moves. For example, a sudden spate of buy orders for an option may indicate a large player is constructing a position. This type of tip provides traders an opportunity to enter prior to the market reaction, enhancing their chances of trading profits. By understanding how to follow this activity, traders can better anticipate their entries and exits, ultimately leading to more successful trading.

Order flow consists of numerous small bits, including bid and ask sizes, trade volume, and the velocity of orders hitting the market. Each is useful for crafting a trading plan. For instance, an ascending bid size coupled with constant trade volume can suggest that the buyers are intensifying. Conversely, lots of trades going off the ask price can indicate an intense push upwards. The table below breaks down the main order flow elements and what they can mean for trading.

| Order Flow Element | What It Means | How Traders Use It |

|---|---|---|

| Bid/Ask Size | Shows buying and selling interest | Signals pressure in the market |

| Trade Volume | Measures how much is traded | Spots strong or weak activity |

| Order Speed | Tracks pace of orders | Finds sudden market changes |

| Price Level | Shows where orders build up | Spots support and resistance |

Not all moves matter in the market. Some are just noise, like tiny trades or erratic price spikes. Order flow helps you sift real signals from the noise, which is crucial for both beginner and experienced traders. A one-time large order, for instance, may not translate to a lot if it doesn’t alter order flow going forward. If volume accumulates and large trades continue, it indicates an actual shift, allowing traders to concentrate on breaks with substance rather than chasing false breaks.

Meet Your Instructors

Tradepro Academy’s options trading and order flow course is taught by veteran traders with practical expertise in options and futures day trading. They’ve been day traders and swing traders for years, ensuring that you’re learning from professionals who know how to identify market dynamics and respond effectively. One instructor began trading in 2013, providing him with over a decade of experience observing markets, refining strategies, and maturing through both triumphs and defeats.

Their instructors utilize time-tested trading techniques, instructing on strategies such as debit spreads, weekly earnings plays, and how to deconstruct order flow. This structured approach allows students to grasp the ‘why’ behind price moves, not just the ‘what’. Their order flow-centric evaluation aids in reading market signals to spot better trades, judge risk, and time moves accurately. This understanding is crucial for anyone looking to progress beyond rudimentary chart reading and comprehend how actual capital molds markets.

Individual attention is a key component of the curriculum. Your mentors respond to your questions, provide feedback, and offer guidance that aligns with your trading journey. For instance, Lenn, one of the professors, was initially encountered by a pupil at a trading seminar. That same student eventually enrolled in the program, demonstrating how the team prioritizes cultivating trust and long-term backing in their trading community. The instructors’ backgrounds blend autodidact smarts with insights learned from other masters, like Mark Douglass’ instruction around trading psychology and risk management.

The course team shares their teaching with a broader audience on their YouTube channel, where they explain trading concepts and market updates in easy-to-understand terms. This supplemental material provides additional opportunities for students to continue learning, even once the core course is complete, reinforcing their day trading skills.

We share bios and trading records for each instructor upfront, allowing you to see who’s teaching you and what they bring to the table. They want to ensure you leave with the tools to trade smarter, supported by real-world guidance and candid feedback, enhancing your chances of achieving trading profits.

Tools of the Trade

All options traders need a good toolkit to work from. Our course at TradePro Academy places a heavy emphasis on acclimating people to these tools, as they lie at the heart of order flow trading and effective trading strategies. Traders typically employ a combination of software, real-time data platforms, and itineraries to stay sharp and keep learning about day trading skills.

A few core tools and software used in the course include: Order flow analysis, a critical component of how traders identify shifts in the market, allows traders to glimpse into the flow of large orders, anticipate the actions of market makers, and identify potential price breakouts. Certain order flow programs, developed with retail traders in mind, provide them with a real-time breakdown of buy and sell activity. This is essential for futures day trading, especially for those who want to trade on their own, even if they’re not at a big firm.

- Real-time charting platforms for both stocks and options

- Order flow analytics software for tracking large trades and volume shifts

- Stock screeners for finding potential trades

- Risk management tools like stop loss and profit targets

- Trading journals for careful trade tracking and review

Real-time market data access is another must-have. Interactive Brokers, TD Ameritrade, Robinhood, and other platforms provide traders with live quotes, options chains, and order flow. These brokerages are popular with traders worldwide as they offer a broad set of tools and allow them to personalize their trading screens for their specific needs.

Technical analysis, in addition to order flow, helps traders make better decisions. For example, a trading plan may mix technical chart support and resistance lines with order flow information. Stock screeners assist traders in identifying mover stocks, particularly during earnings weeks or other impactful events, which can significantly influence trading profits.

Traders record their status with journals and checklists. Recording trades — what worked, what failed — and then reviewing these notes hones your strategies over time. Key metrics such as Delta, Gamma, and Theta are monitored on each options trade. Risk management is never a footnote, with stop losses and profit targets integrated into every trade plan, ensuring that traders can navigate market dynamics effectively.

The structured approach in our curriculum fosters a community of professional traders and participants, allowing for the exchange of ideas and trading tips. This collaboration is invaluable for both beginner and experienced traders, as it cultivates a supportive environment for refining strategies and achieving realistic trading objectives.

Beyond the Indicators

Trading is more than chart reading with moving averages or RSI. Most traders struggle with stopping themselves out of trades too early, or FOMO when prices move quickly, which can result in bad decisions. Looking beyond surface indicators, the order flow course approach provides a more direct perspective on current market action. Order flow reveals the buying and selling pressure beneath the surface — not just what occurred previously. For instance, if there’s heavy buying at a particular price, it will indicate strong support better than a moving average. Not just numbers, but actual buyers and sellers at work.

Traditional metrics have barriers. They rely on historical price and volume, so they tend to lag and miss rapid changes. However, futures day trading analysis adds real-time information, allowing traders to detect shifts as they occur. These insights can aid in timing trade entries and exits. For instance, if a trader notices an uptick in sell orders, it could hint that a move down is impending, even if the chart is still favorable. Using options trading, it is important to know the Greeks: Delta, Gamma, Theta, and Vega, as they illustrate how an option’s price can vary. If a trader skips the Greeks, he might miss some risks in a trade.

A great trading plan doesn’t rest on one indicator. By blending technical analysis with order flow and the Greeks, traders develop a more well-rounded strategy. This provides them additional means to verify that a trade is logical. Trading is not only about skill or math; mindset matters as well. Most traders think trading psychology is about fear, greed, or adhering to a plan. Tales from fellow traders in live trading rooms can provide fresh advice or demonstrate what not to do.

Growth in trading frequently means establishing reasonable income targets and monitoring performance. This keeps traders grounded and not adrift in optimism or pessimism. In other words, going beyond the standard charts can help traders get a sense of the broader market dynamics.

Is This Course For You?

This course is perfect for traders who understand the general foundations and are looking to expand their day trading skills and order flow techniques. If you have some trading experience and want to graduate beyond junior stock trading, this course dives deep into the data, tools, and actual trades. The lessons combine theory with practical work, ensuring you won’t merely read about trading; you’ll watch it unfold. Instead, it’s focused on how to read the market, identify real-time trends, and construct a strategy that suits your style. For those seeking a structured approach, the course takes you from technical analysis to formulating and executing a clear trading plan.

A significant portion of the course comes from the live trading room and weekly webinars. These platforms provide you with an opportunity to observe trades in real-time and receive feedback from traders worldwide. This collective learning environment allows you to observe the minds and behaviors of fellow traders. It’s a space to ask questions and learn from group slip-ups and successes. If you enjoy collaborating with others and appreciate a support network, this environment will help you evolve quicker and make crucial trading decisions with confidence.

The topics covered are designed for traders ready to explore beyond the basics. You’ll learn how to trade options, use debit spreads, and capitalize on earnings weeks. The course provides you with five trading setups and a complete trading plan template, enabling you to develop and test your own plan before risking actual capital. This keeps your approach grounded and less emotional, ultimately enhancing your trading profits.

If you’re a novice trader, an introductory course could be a more appropriate beginning. The pace and jargon can be rough without a trading background. This course is tailored for practitioners who want to work with real data and apply theory in practice. It might not be suitable for those who desire only theoretical knowledge or a slow step-by-step course.

Factors to consider before enrolling include your current level of experience and your willingness to engage with market dynamics actively. Being part of a community of professional traders can significantly enhance your learning experience and success in trading.

- Your current trading experience (intermediate or above is ideal)

- Comfort with real-time analysis and hands-on practice

- Interest in options, order flow, and day trading strategies

- Willingness to join a group learning space

- Need for a clear, structured trading plan

- Openness to feedback and live market sessions

Conclusion

TradePro Academy cuts through the clutter and confusion of options trading and order flow with straightforward guides and concrete tools. The course demystifies scary lingo, displays actual trades, and provides room for your inquiries. Trainers are ace and so is the way they teach, so organic and easy to digest. Order flow takes center stage, accompanied by live charts and case studies to bring theory to life. No fluff—just what you need to see how pros read the market. If you want to go beyond basics and learn how order flow molds trades then you’ll find something of value here. If you’re ready to learn from trades in the real world, or just want to see if this path fits your goals, take a look at the course page and view sample lessons.