Phantom Trading FX Courses

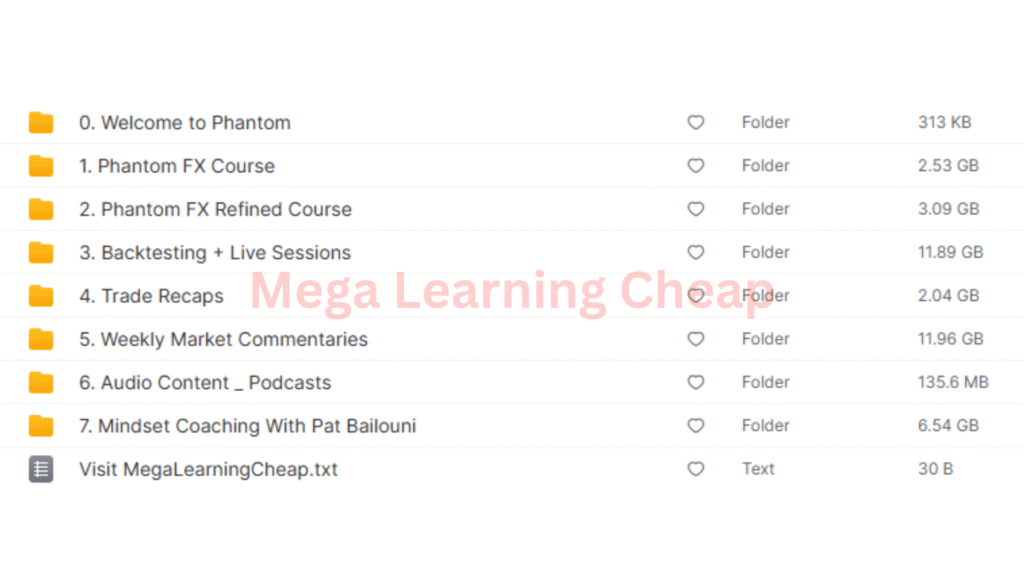

Download the Phantom Trading Bundle for $297 $12

The Size is 38.18 GB and Released in 2025

To learn more, please read the Sales Page

Key Takeaways

- This is an organized and in-depth forex trading course for traders of any skill level, emphasizing hands-on education and community support.

- The course stresses disciplined trading, risk management and emotional control to help achieve consistent long-term success in the international forex market.

- Students experience a transparent curriculum, live interaction, and mentorship to master the concepts of market structure, order flow, and liquidity with effectiveness.

- The community aspect offers continuous support, networking, and live discussions, facilitating a shared environment for traders to exchange ideas and navigate issues collaboratively.

- Actionable strategies, like custom-crafted trading plans and strong risk protocols, assist students translate course concepts to real-world trading and enhance outcomes.

- With funding options and partnerships with proprietary firms, traders have the opportunity to scale capital and move towards a professional career, backed by expert insights and resources.

This Bundle is a comprehensive set of learning materials for aspiring forex traders. Along with video lessons, the bundle typically includes trading strategies and templates that function on widely-used platforms such as MetaTrader 4 and TradingView. The overall goal is to assist users in identifying straightforward methods for reading charts, identifying trends, and managing risk through step-by-step instructions. Most traders utilize the bundle to develop trading skills and gain a better feel for the forex market. For both new and more skilled traders, the package includes guided learning and support content. The bulk will discuss what’s in the bundle and who might benefit from it most.

What is Phantom Trading FX?

It is a forex trading course, built for new and experienced traders who crave straightforward, actionable instruction. The bundle provides more than 30 hours of in-depth lessons, honing in on market structure, order flow, and liquidity. The course divides into 12 lessons, each introducing new techniques—beginning with fundamentals and progressing to sophisticated tactics. We emphasize hands-on tools and hands-on trading, so students develop habits for sustainable success. Community support and mentoring are key parts of the course, too—making it more than just lessons.

1. The Core Philosophy

Phantom Trading’s heart is cultivating good, consistent, trading habits. The course emphasizes the importance of discipline and a measured approach over seeking quick victories. This mindset keeps traders calm and disciplined, even during challenging markets.

The philosophy instead puts risk management and emotional control front and center. They learn to identify high-risk setups, manage their losses, and take action with a calm mind. It caps big losses and maintains progress steady over months, not just days or weeks. The plan is to create a trading community where we’re all rooting for each other, celebrating success and learning from failure.

2. The Learning Framework

It incorporates a transparent, stepwise learning path. Each of the 12 modules takes students from simple concepts to in depth trading strategies. The course combines video lessons, interactive live sessions and practical assignments, so students can observe real-world examples and experiment with new techniques.

Modules span supply and demand, smart money moves and price action. Weekly livestreams, trade reviews and mini-lessons keep the content fresh. Active practice is encouraged—just observing isn’t sufficient, students are encouraged to participate, question, and experiment with concepts.

3. The Community Aspect

A large part of Phantom Trading FX is community. Members have access to live discussions, frequently held on Discord, in which traders exchange tips, discuss trades, and query. This back and forth is helpful to those confronting the same challenges, as they learn from one another’s tales and relish the successes.

Peer support drives you through the tough spots and hone your skills. Connecting with other traders introduces new perspectives on the market or discover new strategies that suit.

4. The Strategic Edge

It is different, as it teaches time-tested strategies that concentrate on high-probability trades. Students learn how market moves occur, the importance of liquidity, how to set reasonable stop-losses or targets.

The course advocates for every trader to develop their own strategy, based on the techniques presented, tailored to their individual objectives and approach.

Deconstructing the Methodology

The bundle deconstructs trading into actionable pieces. The approach is oriented around market structure and order flow and liquidity Traders discover via weekly sessions, mini-lessons, market outlooks, and trade reviews. There’s support from coaches and analysts providing personalized assistance and niche courses, such as the Phantom Strategy Course.

Market Structure

Market structure is price action. It assists in identifying trends in the market and locating quality trade setups.

Knowing trends is observing higher highs and lows in an uptrend or lower lows in a downtrend. This aids traders in selecting superior entry and exit points. A specific instance is a range-bound market, where prices ricochet back and forth between support and resistance, and breakout setups, where price exits the range.

Traders employ market structure with price action tactics—such as sitting on confirmations before taking trades. A trending market, for example, may dictate pullback entries whereas a market moving sideways may favor breakouts.

Order Flow

Order flow is the flow of buy and sell orders in the market. It reveals where dough is flowing and aids in reading price action.

Things like order books, volume profiles and footprint charts allow traders to identify where most of the trading is occurring. By observing order flow, traders are able to identify when buyers or sellers are becoming aggressive and improve their decision making. For instance, a surge in buy orders can presage a price jump.

Augmenting order flow analysis in your daily routine helps traders identify covert shifts and steer clear of fakeouts.

Liquidity Concepts

Liquidity refers to the ease with which you can purchase or sell an asset without causing significant price fluctuations. To forex, high liquidity translates into quick executions and low slippage.

Pairs with high liquidity, such as EUR/USD, minimizes risk and smoothens trades. Low liquidity pairs tend to have larger spreads and have larger price swings.

Traders should do this before planning a trade, particularly around volatile news events, to avoid surprises and manage risk.

Entry Models

Entry models assist traders in timing their trades for maximum effect.

It’s the timing that counts. Selecting the appropriate model in an appropriate market increases the likelihood of success.

- Breakout Entry: Enter after price leaves a range or key level.

- Pullback Entry: Wait for price to return to a trendline before entering.

- Reversal Entry: Enter when price shows signs of changing direction.

- Retest Entry: After a breakout, wait for price to retest the broken level.

Honing these entry archetypes in other markets develops competence and confidence.

Who Benefits Most?

The Phantom Trading FX Bundle is designed to benefit traders of all levels, from beginners to seasoned professionals. This course suits many trading styles and levels by providing foundational and advanced knowledge. The program’s team comprises multiple analysts and coaches, so members receive support and guidance. Though numerous users share actual momentum, financial victories and a supportive community, a few have expressed issues with expense, messaging and spam. The table below shows how the course fits the needs of traders at each stage:

| Trader Type | Key Insights and Skills Developed |

|---|---|

| Novice | Basic forex concepts, risk management, access to mentors and community, encouragement to ask questions |

| Intermediate | Advanced strategies, personalized feedback, mentor connections, deeper market analysis |

| Advanced | Sophisticated techniques, community leadership, continuous learning, adapting to complex markets |

Novice Traders

- Learn basic forex terms and how markets work

- Get simple risk management tips

- Access video lessons for step-by-step learning

- Join a community where asking questions is welcome

- Find mentors who guide without judgment

For novice traders, the course instills confidence. Most report feeling momentum within months. With a huge team and lively forums, noobies get assistance on the fly. The assistance allows them to inquire and absorb at their speed.

Intermediate Traders

Intermediate traders leverage the course to hone their edge. They receive exposure to advanced techniques and instruments, like deep chart analysis and risk control methods, which aid identify trends more quickly. Includes hands-on sessions to pilot new ideas. Others write about getting funded after clearing trading challenges, such as a $10,000 challenge, highlighting the program’s significance at this stage.

Mentors on one-on-one feedback. The community trades tips and stories, so traders benefit from hearing about others’ successes and failures.

Advanced Traders

Power Traders receive strategie for sophisticated markets and report on international trends. The course includes high level strategies, like multi-timeframe analysis and risk diversification. These tools allow professionals to customize their trading and discover new opportunities.

The most skilled need to keep learning. The program promotes sharing cutting-edge knowledge, which makes the entire community smarter. Other experienced traders moderate group chats, contributing and discovering fresh concepts.

Potential and Community

All traders can aim for consistent profits if they continue to learn.

Many say the mentors are kind and humble.

Some users have concerns about costs and communication.

A few have reported unwanted calls and negative experiences.

Beyond the Charts

Trading ain’t just patterns or numbers on a screen. Attention frequently turns away from charts to trader habits, mindset, and routines that ultimately drive a trader’s results over the long term.

Trader Psychology

Trader psychology refers to a trader’s emotions, thoughts, and behavior when trading. It molds why we get out of trades early or gamble too large. For most traders, even those who pick up the essentials quickly, emotions interfere with sound decision making. Some grapple with FOMO or hubris. Others, stressed from pursuing lofty win rates, resort to nefarious habits. Discipline-building is the trick. A ritual—checking trades, journaling thoughts—keeps feelings in line. Some traders dedicate months to learn to remain calm and optimistic, but those who do tend to fare better. A good support system or trading group can go a long way.

Risk Protocols

Loss limitation is central to risk guidelines. A good plan implies that you know how much to risk on each trade and you never risk too much. Setting stop-losses is one method of loss limitation. Position sizing–how much you trade each time–should suit your account size and risk comfort. These actions defend your equity and extend your runway.

- Define stop losses for every trade to limit losses.

- Position size as well so no trade can blow up your account.

- Go with a predetermined risk percentage, like 1% of your capital per trade.

- Track and review trades to spot mistakes.

- Don’t switch up rules on the fly, even if you lose. Traders who follow these steps report feeling more empowered and able to persevere through difficult periods.

Process Development

A good process provides organization and prevents spur-of-the-moment trades. Your trading plan should include entry and exit rules, risk limits and review steps. Backtesting or testing your plan with historical data indicates the effective and ineffective.

Most traders discover that the act of putting their plan on paper exposes flaws and helps them improve. Others find that once they’ve been working with the system for six months or so, it starts to feel more natural and their outcomes get better. A defined strategy and log can transform trading from guesswork into a professional habit.

The Funding Advantage

It provides traders with a transparent pipeline from education to live trading, emphasizing confidence-building and funding. The program’s roadmap is structured to get you to steady and funded within less than a year. Another big attraction is the ability to obtain funding via prop firm partnerships, providing traders with an opportunity to scale without putting all their own capital at stake.

| Funding Option | Benefits | Prop Firm Collaboration |

|---|---|---|

| Direct Prop Firm Funding | No personal risk, larger capital | Yes (multiple firms) |

| Challenge-Based Funding | Rewards consistent results | Yes |

| Scaling Programs | Growth through performance | Yes |

| Community-Pooled Accounts | Shared risk, support | Sometimes |

Scaling capital as traders demonstrate consistent profits and responsible risk management. Funding provides access to bigger markets and more trade opportunities, offering qualified individuals genuine professional opportunities.

Bridging the Gap

Most traders understand the theory but can’t trade with real money. The FX Bundle seeks to close this disconnect by providing actionable guidance, live streams and a community that nurtures growth.

Backup doesn’t stop at the lessons. The program even provides coaching and feedback to assist with the transition from practice to actual trades. This practical assistance is crucial. It cultivates confidence and faith in your own process. For a lot of folks, real world trading is the breakthrough—it’s what pushes them out of the demo and into funded accounts.

Real-world experience, consistent training, and support from coaches make traders sense-prepared for the ordeal. Traders, don’t miss out on these funding opportunities – they can be the difference between a hobby and a career.

Prop Firm Alignment

The bundle partners with prop firms to link traders with capital. That is, traders have an opportunity to trade large accounts with minimal personal risk.

Prop firms provide more than mere funding. They provide risk tools, community chats and training. These allow traders to learn and evolve quickly. With less concern about losing their own cash, traders can concentrate on quality trades.

For a lot of us, lining up with a prop firm is a tough, pragmatic way to begin a trading trajectory.

Scaling Capital

Scaling capital is more than just trading bigger. It means maintaining consistent gains, controlling risk, and exhibiting discipline. Successful traders tend to be able to earn additional funding as they go along.

Maintaining a plan, imposing restrictions, and applying benchmarks is essential. Prop firms seek traders who demonstrate this. The FX Bundle emphasize the importance of these habits. With time, this emphasis will enable traders to scale accounts and assume larger responsibilities.

Is This Your Path?

Selecting a trading course is a significant decision, and not all courses are a good fit for everyone. The FX Bundle says, Is This Your Path? While many who join are looking for more than a ruleset—they want a path to evolve and witness transformation in their trading and in themselves. Others have spent years looking for a good fit. One reader reported that ‘after three years I finally found a course that made sense, and dam it felt good.’ Some claim their lives changed for the better once they discovered a program that aligned with their objectives.

Dedication is a big part of any trader’s path. The Phantom Trading course establishes clear steps, but anticipates consistent work. Others students feel more confident and committed to their schedule once enrolled. They think daily practice, group support, and clear feedback keep them on track. A few note that the community of sharing ideas and results sustains them to keep at it. Not just studying from videos or wikis. The daily grind and checking in with others feels equally as valuable as the lessons themselves.

The course can be a great option for those who have clarity in their desire and are willing to work. Some experienced early doubt wash away with the momentum of making progress. Others are still wandering, praying the wanderings will bring them the outcomes they desire. Or sometimes, someone discovered that the course wasn’t right for them and left. What this demonstrates is it’s crucial to introspect your own ambitions and be honest about what you require.

Conclusion

Phantom Trading FX delivers precision instruments to aid traders strike their objectives. The bundle eliminates the fluff and provides actionable steps for application in the market. Every lesson concentrated on skill, not luck or hype. Traders experience evident improvements in both ability and velocity. The funding angle is ideal for those who want to deploy less of their own capital. New and adept traders alike find a seat here. The lessons cling to practical application — not fantasy. For the emerging trader, this bundle provides a direct road to expansion. For the full scoop and to see if it matches your style, preview here or try a sample lesson.