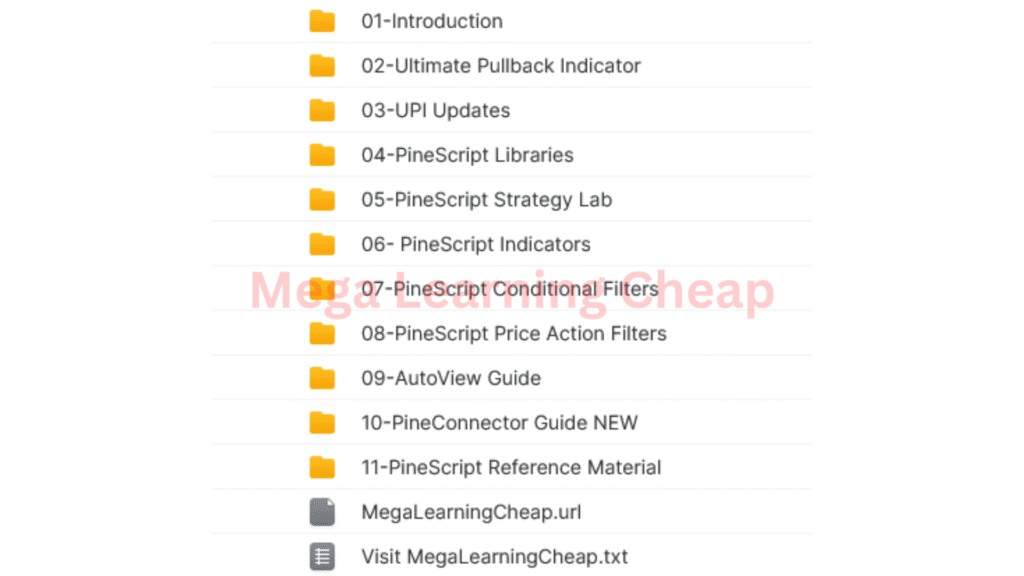

Matthew J. Slabosz – Pine Script Indicators and Strategies

Get the Pine Script Indicators and Strategies Program for $997 $20

The Size is 67.53 GB and is Released in 2025

Key Takeaways

- Matthew J. Slabosz is recognized for his expertise in Pine Script, offering innovative indicators, strategies, and educational resources to support traders of all experience levels.

- His algorithmic style — the Slabosz Method — combines coding, markets, and trading psychology into a process-driven approach to trading.

- Clean code, clear visuals and user customization lie at the heart of creating Pine Script tools that are not only practical but easy to use for traders worldwide.

- Developing and fine-tuning indicators and strategies involve learning basic coding principles, experimentation, and continuous tweaking to perform consistently across different market scenarios.

- Profitable trading strategies pair reasonable entry and exit logic with sensible risk management, enabling traders to navigate market dynamics and guard against losses.

- A trader’s mindset of discipline, learning and emotional control is critical to sustainable success no matter where you live or what the market environment is.

Matthew J. Slabosz is known for his work with Pine Script indicators and strategies, which are widely used in the field of technical analysis on the TradingView platform. His indicators allow users to trace price trends, identify signals and manage trades in real time. Lots of traders use pine script for its open access and obvious syntax, and Slabosz has constructed a strong catalog spanning the simple and advanced. His toolkits are commonly concerned with risk control, signal clarity and simplicity of use, rendering them useful to novices and veterans alike. For anyone wanting to construct or modify their own scripts, his work provides a reliable foundation and concrete illustrations. More specifics follow in the sections below.

Who is Matthew J. Slabosz?

Matthew J. Slabosz is a distinguished member of the Pine Script community — a developer, educator, and innovator. From Queensland, Australia, he’s a solid programmer since 2005 and has traded markets since 2017. His work focuses on constructing useful tools and disseminating wisdom to assist traders in navigating a dynamic market.

The Developer

Matthew’s coding expertise extends beyond theory. He develops Pine Script indicators and strategies that address real trader needs. All tools are designed for live markets, be it forex, crypto or stocks. He started as a day-trader and has since moved into portfolio-based quantitative systems, preferring stocks in the U.S. Australia. This shift makes his scripts emphasize risk management and consistent growth, not hard-driving profit.

He really notices how traders actually utilize indicators. His style typically focuses on capital preservation and compounding, a habit he’s developed from both experience and seasoned mentors. He frequently posts these scripts publicly, allowing others to utilize, explore, or adjust them. This habit of sharing has made his work a staple in the Pine Script community and helps traders level up their workflows with practical, well-documented tools.

The Educator

Matthew is passionate about teaching. He provides classes and guided lessons, covering elementary to advanced Pine Script subjects. Students of all stripes can pick up something practical from his stuff.

- For newcomers, he offers comprehensive guides and video walkthroughs that demystify the fundamentals of Pine Script and indicator mechanics.

- For the power users, he adds chapters on building complex strategies, optimizing scripts, and backtesting.

His style, hard topics broken into simple steps. Many traders who complete his courses end up having the skills to develop their own indicators, so they trade with increased confidence and independence.

The Innovator

Matthew is proud to be a thought leader. He’s a frequent contributor to Pine Script, demonstrating innovative methods to address classic issues. His programming background since age 15 informs the way he approaches trading problems—he applies ingenuity to construct solutions others may overlook.

With market flexible strategies. He adjusts fast and prompts them off to continue learning. This need for daily refinement is evident in his scripts, updates, and how he interfaces with the wider trading community.

Deconstructing the Slabosz Method

The Slabosz Method is a system for developing Pine Script indicators and strategies. It is based on a mixture of coding, market research, and disciplined trading psychology. Matthew J. Slabosz brings 7+ years of Pine Script and trading experience to this method, turning it into a pragmatic, example-first framework. Slabosz’s traders tend to decompose large scripts into tiny, explicit steps — making it simple to learn, modify, or debug. The method’s emphasis on clean code, custom indicators, and systematic testing has enabled many to automate their analysis and optimize both entries and exits.

1. Core Philosophy

At its core, the Slabosz Method represents mechanical trading and rigorous risk management. Slabosz deconstructs each trade to teach that there should be a plan, not a guess, and risk should be set with care.

Traders are forced to tailor their approach to their personal risk tolerance and to current market action. This method instead encourages its users to remain honest about what they can manage and to pivot when the market pivots. It’s not about engineering a script that works, but aligning with a plan that suits the character of the user.

Discipline is crucial. The Slabosz Method demands traders continue studying and refresh their techniques, because markets aren’t static. Growth is a product of experimentation, learning from failure, and incremental progress.

2. Market Insights

Matthew’s years of chart study provide him keen insights into trends and price moves. He demonstrates how reading the “narrative” behind the chart—such as identifying a definite uptrend or a traditional reversal pattern—can enhance a script’s advantage.

Good scripts are rooted in actual market data, not just theory. These scripts monitor things like moving averages, support and resistance, or volume shifts. If the market changes, the signs have to as well.

Keeping up is crucial. A Slabosz Method trader will still observe fresh price action, monitor economic announcements and update scripts where appropriate.

3. Code Structure

Well-ordered Pine Script code causes scripts simpler to read and repair. Slabosz emphasizes employing chunks, annotations, and descriptive labels for script segments. Maintaining modularity in your code means that each module performs a single task, such as a module for generating signals or a module for conducting risk checks. This comes in handy when testing or updating features.

A explicit code style guide further assists teams collaborate. One coder can pass off a script and another can pick it up and save time and errors.

4. Visual Clarity

Visually appealing charts allow traders to identify signals quickly. Top-notch scripts employ bold colors, clean lines, and uncluttered spacing.

They do color schemes. Red for risk, green for safety, or blue for neutral is typical. Transparency leads to quicker informed decision making.

Charts should never be confusing.

Easy to read is easy to use.

5. User Customization

The Slabosz Method urges users to customize scripts to their own style. Slabosz usually incorporates input boxes or switches in his scripts so traders can experiment with different parameters, such as moving average length or alert types.

That freedom implies that one script can serve multiple purposes. For instance, a day trader would configure a short look back period, whereas a swing trader employs a longer one. Dozens of users tell me custom scripts saved them time and sharpened their edge.

Building Slabosz-Inspired Indicators

Matthew J. Slabosz style indicators are a mix of Pine Script and actual trading logic. For example, to build custom indicators inspired by Slabosz, to fit a strategy, to automate trades, or to visualize new perspectives on market data. Pine Script mastery is the secret sauce, as well as learning how to translate trading concepts into functioning code. Many traders execute hands-on projects, such as constructing moving average crossovers or risk filters, to hone these skills. Great indicators mix multi-timeframe analysis, alerts, and risk controls for algorithmic trading.

Key foundational elements for building Pine Script indicators:

- Grasp Pine Script syntax, functions, and built-in variables.

- Know how to code basic trading logic and signals.

- Use risk management rules within the script.

- Add multi-timeframe data or overlays.

- Build and test alert conditions.

- Optimize script parameters for different markets.

- Use plotting for clear data display.

- Review and refine code with real-world data.

Foundational Code

Key snippets comprise inputs, the main code block, plot commands. These are the bread and butter of Pine Script indicators. Understanding of variables, conditionals and loops explains how a script functions. Take, for instance, a basic moving average indicator — decide on an input length, compute an average and plot it on the chart.

Grasping fundamental programming concepts—such as variable assignment, scope, and function use—eases Pine Script development. Most powerful indicators rely on modular code, separating the logic into chunks. Things like arrays for data and functions for repeated logic are common in advanced scripts. Training is essential. Building scripts from scratch, tweaking open-source examples or re-creating classic indicators can all help learners build a strong base.

Unique Inputs

Special inputs allow users to customize indicators. User settings, including lengths, thresholds or symbols, help make tools flexible. For instance, a volatility filter may have a user-set threshold to alter its sensitivity.

Flexible inputs allow the same script to power a wide variety of strategies or markets. By enabling users to select periods or even asset classes, we expand the utility of the tool. Some of the most successful indicators, such as customizable RSI or adaptive moving averages, demonstrate the utility of carefully tuned inputs.

Advanced Plotting

Pine’s advanced plotting options aid in visualizing these intricate market signals. Utilizing multiple plot types—lines, histograms, shapes—can emphasize multiple signals simultaneously, such as overlaying buy/sell markers with trend lines.

Dynamic plots shift in real time, displaying morphing support levels or refreshed trade signals as data refreshes. A little color-coding or alert markers can make decision points clear. Playing around with these options allows traders to create indicators that don’t just show a line or a number.

Crafting Effective Strategies

Crafting great Pine Script strategies is about more than code. It requires clear guidelines, intelligent reasoning, and continuous optimization. Good strategy work relies on both technology and actual trading, helping traders identify better trades and minimize losses. Below are key components:

- Write trading rules in plain English before coding

- Use clear structure and comments in scripts

- Combine signals from different timeframes for more context

- Rely on indicators, multi-timeframe analysis, and data series

- Test and debug strategies often

- Adjust for real-world markets and trader goals

- Keep personal risk tolerance in mind

Entry Logic

Specifying entry logic is the essence of any strategy. Simple rules, such as “buy when the moving average crosses up,” prevent back-slapping with second-guessing. Pine Script allows traders to utilize signals like RSI oversold, crossovers, or custom indicator triggers. Multi-timeframe setups, such as waiting for a trend on a daily chart but trading on an hourly-chart signal, can provide an edge, for example. Backtest entry logic — doing it on historical data forces traders to observe whether or not a rule actually works. Entry logic is not fixed. Some traders modify it for other asset classes, volatility, or their own style. What works in a hot market won’t work if prices go sideways.

Exit Conditions

Knowing when to get out is as critical as when to get in. Exit strategies assist capture profits and prevent downturns. Pine Script allows backtesting exit strategies, whether fixed targets and stop-losses, trailing stops or time-based exits. Establishing these rules prior to trading limits emotional decisions during stress. Reviewing trades, seeing what worked or busted, and adjusting exit logic over time is key when it comes to keeping a strategy sharp. For example, a wider stop-loss distance in high-volatility markets can reduce unnecessary stops.

Risk Management

No strategy is without risk controls. Traders employ risk management to guard their capital and sidestep large drawdowns. Here’s a checklist for key techniques:

- Establish stop-losses and take-profits for every trade

- Cap trade size according to account balance (i.e. risk 1% per trade)

- Use position sizing formulas

- Diversify across assets and strategies

Knowing your risk tolerance ahead of time informs all your sizing decisions, from the initial entry size to when to pull back. Focusing on these habits can make a genuine difference — some traders experience up to 18% better back-tested returns when risk management is baked-in.

The Art of Pine Script Optimization

Optimization for Pine Script means making trading indicators and strategies work better and faster. For TradingView traders, good optimization = less lag, smoother backtests, scripts that save time. With Pine Script, effective code can be the difference between a strategy that stays ahead of the market and one that falls behind. Clean, well-tuned scripts help automate drudgery, so traders can spend their effort on shrewd decisions, not wrestling laggy code.

Code Efficiency

Well-optimized Pine Script not only reduces wasted time, it keeps backtests fast. With scripts running clean, traders can test more ideas without waiting. Typical errors—like running loops when built-ins will do, or not using request.security cleverly—drag things. Instead, utilize functions such as valuewhen to monitor prices and maintain simplicity for the script.

Small tweaks accumulate. Simplifying code, eliminating redundant computation, and leveraging transparent logic all can help. For example, merging as many conditions as possible into singular statements, or recycling computations, can save seconds on each run. Still, it’s critical not to sacrifice the primary purpose of a script just to make it speedy. Optimized code is understandable and performs its intended function. Periodically cleaning up scripts, in other words, not only helps increase speed, it simplifies future edits.

Performance Tuning

| Technique | Impact on Performance |

|---|---|

| Minimize Loops | Faster execution |

| Use Built-in Functions | Lower resource use |

| Avoid Redundant Calls | Reduces lag |

| Optimize Timeframes | More accurate, quicker results |

| Speed Profiler Tool | Finds slow spots in code |

Examining execution times aids in identifying bottlenecks. When a script hangs or backtests take too long, tools such as TradingView’s Speed Profiler Tool can reveal which lines bog things down. Tweak, test and then test again for speed and you’ll see a steady increase in performance.

You should log every adjustment. Maintaining notes of what changed and how it helped makes future updates easier and helps traders learn what works.

Backtesting Rigor

Comprehensive backtesting is crucial for truthful output. If a strategy appears to shine in live markets, it’s probably because it performed well in hard, diverse backtests. Best practice is using sufficient sample data, verifying results across market types, and ensuring you don’t ‘overfit’ to historic moves.

Diving into backtest reports, traders observe what performs and flops. This feedback loop yields improved scripts as time passes. Backtesting is not a one-time sanity check, it’s an integral, iterative part of strategy construction.

Continuous Optimization

Script tuning should never end. Check and update and review code, often. Utilize TradingView’s debugging tools. Remain inquisitive and receptive to different approaches.

Beyond the Code: A Trader’s Mindset

A trader’s mindset isn’t about your coding chops or technical know-how. It means constructing a well-defined mentality that allows traders to survive in the jungle of market chaos. Though Pine Script indicators by Matthew J. Slabosz may help traders get started, the actual edge results from each individual’s thinking and actions. The top traders don’t just apply off-the-shelf tools—they carve out their own paths, tweak rules, and remain mindful of what works for them.

Discipline, patience and emotional control — these are the beating heart of trading. Markets can move quickly and price swings can rattle even the steeliest nerves. Following a plan keeps traders from making impulsive decisions. For instance, if a trader lays out their rules in English before coding them, it helps keep the process transparent and anchored. You can get swept up in charts and numbers, but good traders pull back and follow their plan. They wait for the setups and do not enter or exit out of fear or greed. This sort of patience is practiced, but it minimizes errors and preserves capital.

A positive mindset shapes how traders make choices. When people think clearly, they can judge risks, spot changes in the market, and adjust their methods as needed. Instead of copying others or using off-the-shelf indicators, traders with the right mindset look for ways to use or change tools to fit their own needs. For instance, they might change a Pine Script indicator to better match their risk levels or trading goals. This way, they are not just following the crowd—they are building something that fits their own style.

Personal growth and learning lie at the core of all this. Nobody nails it 100% of the time. Every loss or win is a lesson. Traders who periodically review their trades, acquire new skills, and stay up to date with the market are more likely to fare well in the long term. The market evolves, and the trader does as well. It’s this habit of learning and adapting over time that separates real traders.

Conclusion

Delving into Matthew J. Slabosz’s pine script reveals a direction for traders that want to use code to craft their own edge. His style fractures giant steps into tiny, actionable motions. Followers traders watch how little code tweaks can mold real profits and trim real drawdowns. Each piece of his approach clings to simple principles and objectives, so nothing goes astray in the grass. It keeps code sharp and trading smart. To stay ahead, traders can experiment with novel concepts and exchange with fellow Pine Script users. For those willing to give it a shot, begin with an uncomplicated script and take notes on what actually does. Celebrate your successes and lessons, and continue learning along the way.

Frequently Asked Questions

Who is Matthew J. Slabosz?

He develops indicators & strategies for TradingView and Pine Script

What is unique about the Slabosz Method?

The Slabosz Method is about transparent, utility-based coding in Pine Script. It focuses on simple customization and real-world trading usage for every level of trader.

How can I use Slabosz-inspired indicators?

Just look at Slabosz’s code examples and modify. His indicators are plug-and-play and customizable for many markets.

What makes an effective Pine Script strategy?

The best strategies employ transparent logic, dependable signals, and extensive backtesting. Smart strategies are elegant, customizable, and grounded in actual markets.

Why is Pine Script optimization important?

Optimization optimizes an indicator’s or strategy’s accuracy and efficiency. It enables traders to optimize parameters for various securities and market trends.

How does a trader’s mindset impact results?

A disciplined mind is a must. It assists traders in controlling risk, adhering to strategies, and responding to evolving markets unemotionally.

Where can I learn more about Pine Script from Matthew J. Slabosz?

Check out his website or edu-trading on the forums and YT. He posts frequent tips, tutorials and code snippets at all levels.