Stacey Burke – ACB Trading Setups Masterclass

Download the ACB Trading Setups Masterclass for $97 $12

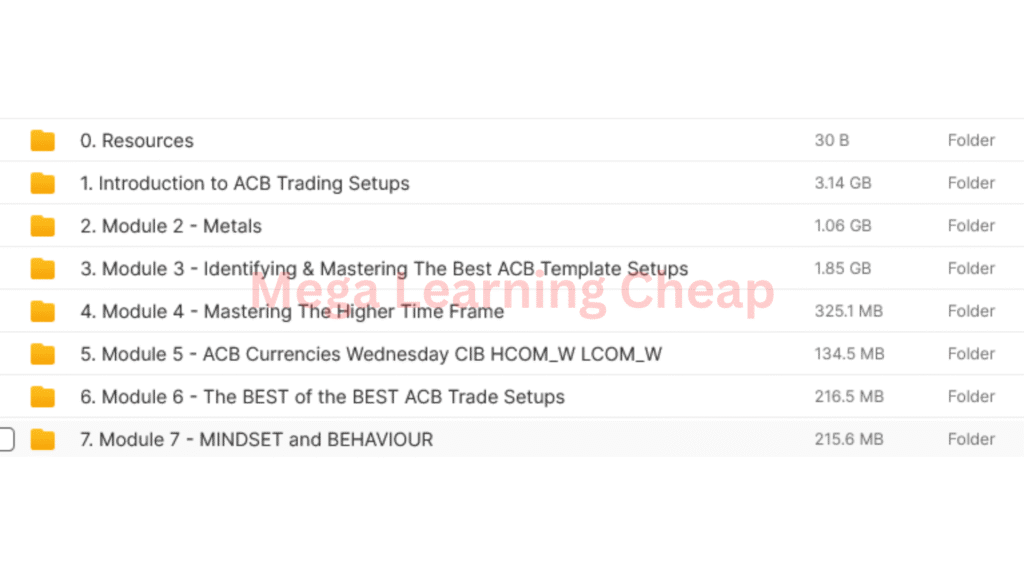

The Size is 6.92 GB and Released in 2025

To learn more, please read the Sales Page

The ACB Trading Setups Master Class is your complete roadmap.

You’ll learn to develop entry and exit rules, identify chart patterns, and how to recognize trends with plain vanilla tools. Each session is a deep dive into actual trades, revealing step-by-step methods to interpret price action and develop expertise in reading trade flows.

Traders from complete novice to experienced market players rely on these classes to eliminate the guesswork and create focus trading plans. Most master class lessons are filled with great advice on controlling risk.

They show you how to trade these setups in all different kinds of markets. To add even further value, many of the courses are accompanied by live trade reviews and live Q&A. The bulk of this post will dive into some takeaways from these courses.

What is the ACB Trading Setups Master Class?

This trading program is an advanced, modular course for traders who want to sharpen their skills with a systematic approach. The program is particularly strong in forex, futures and metals for high-probability, low-risk trading setups. It methodically deconstructs the essence of the Asian Consolidation Breakouts (ACB) strategy.

Drawing on practical experience and easy-to-follow modules, the class is a comprehensive roadmap for traders of all skill levels around the world.

Comprehensive Curriculum and Structured Modules

The curriculum is divided into 12 core modules that include market structure, metals, trading higher time frames, and trading mentality. Each module is designed to flow into the next, beginning with understanding how markets create and repeat patterns and how they move.

The metals module takes an in-depth look at the special behavior of gold and silver. These metals can be more reactive than the major forex pairs. This focused higher time frame module teaches traders to identify more defined trends and stay out of the “noise” found in the lower time frames.

Finally, mindset and behavior modules focus on instilling discipline and creating positive daily routines. These elements are every bit as important as technical know-how.

This course isn’t all theory. It provides detailed examples of the setup with annotated charts, step-by-step breakdowns, and daily routines. For example, a trader might learn to watch the 4-hour chart for Asian session price consolidations, then look for breakouts as the London session opens.

Every module is filled with real-time and historical examples, allowing traders to understand the market environment, not just textbook examples.

Core Principles of the ACB Strategy

It is highly focused on pure chart analysis and market timing, with minimalistic indicator usage. The Asian market hours are typically range-bound. This action often creates the setup for a continuation breakout once the London and New York markets open.

By understanding to identify these windows, traders can be much more effective in jumping on moves with lower risk. So the strategy, itself, is very hands-on and pragmatic.

For example, traders take note of a 3–5 hour period during the Asian session, setting up highs and lows. When price breaks out of this pre-market range as London opens, it often signals a high-probability opportunity.

This timing-based approach works well across forex, futures, and metals, making it highly adaptable.

Key Aspects: Risk Management and Emotional Control

- Have defined stop-loss and take-profit values for each trade.

- Size positions based on account balance, not gut feeling.

- Use trading journals to track and learn from mistakes.

- Stick to daily routines to avoid overtrading.

- Pause after losses to avoid revenge trading.

- Accept that missing trades is better than forced entries.

Tailored Advanced Techniques for Different Markets

Tailored advanced techniques for different markets are emphasized. For instance, forex pairs tend to respond really strongly during London open, whereas metals such as gold are often more volatile in the overlapping sessions.

In-depth case studies illustrate each setup in action, such as a forex breakout compared to a metals momentum move. As an example, the course demonstrates how futures markets can sometimes see distinctive liquidity spikes at session opens.

All setups will not apply to every scenario. Traders come away with skills to interpret technical trading without indicators, adapt for market idiosyncrasies, and develop the mindset that fosters sustained success.

Meet Stacey Burke: Your ACB Guide

Stacey Burke with years of experience in the markets under her belt, comes to the ACB course.

Known for a track record across forex, indices, and commodities, Stacey’s experience spans both volatile and stable periods, giving learners a view into real-world trading.

Students learn to follow Stacey through all market climates, frequently utilizing the Asian Consolidation Breakouts—known as ACB—to identify high-probability setups. This approach is not all talk and no action! Stacey’s live chart examples, drawn from recent trading days, show how to apply these concepts no matter what country or trading session you’re in.

Clear and Practical Teaching

Stacey’s teaching style is very clear, calm and methodical. Complicated trading concepts simplify into manageable components. In this fashion, even esoteric topics such as market structure or timing windows are logical!

One of the highlights is the focus on real chart examples. These examples teach you to identify and respond to price action right from the Asian session. Every lesson is tied directly to real-life experiences.

It combines clear and practical teaching with printable worksheets and checklists, allowing learners to develop habits and internalize setups.

Emphasis on Psychology and Discipline

Trading is so much more than setups. Emphasis on Psychology and Discipline Stacey brings lessons on psychology and discipline into each and every module. These sections prepare students to deal with frustration, resist temptations to make short-term decisions, and follow through on a long-term plan.

The master class makes it clear: real skill comes from pairing technical know-how with a steady mindset. By emphasizing a hands-on approach, students are equipped with the resources needed to manage their successes and defeats without flying off the handle.

The course structure builds from basics like market structure into more complex topics such as trade management, with each step grounded in daily trading routines.

Student Testimonials

| Student | Feedback |

| Asha R. | “Stacey’s methodical approach helped me trade with more confidence and less stress.” |

| Ben T. | “The worksheets and checklists keep me focused. I now have a clear routine.” |

| Li Ming S. | “The focus on psychology changed my results. I stopped second-guessing every trade.” |

| Carlos D. | “Real chart examples make the concepts stick. Stacey’s feedback is always specific and actionable.” |

Value of a Seasoned Mentor

A seasoned trader has seen what works and what doesn’t. Stacey’s advice goes beyond boilerplate guidance. She teaches traders to understand why the market is moving the way it is and take action accordingly with effective, tactical responses.

The course’s design—modular, interactive worksheets and daily checklists—helps novice to experienced traders create a system that works for them and that they can rely on.

The ACB Strategy Unpacked

Asian Consolidation Breakouts (ACB) is a price action strategy that follows the market in the Asian, identifying key breakouts. It hovers in anticipation of major moves when the London and New York open. It’s predicated on observing usage trends during off-peak times, and then moving quickly when the market starts to stir.

No indicators required—just the chart, a proven approach, and laser-like attention to the right time.

Key Indicators and Tools

ACB calls for the use of basic charting tools, rather than complex technical indicators. The simple horizontal line is the primary tool, drawn at the high and low of the Asian session. This is the connector heading for the consolidation box.

Candlestick patterns within this box receive additional focus. Traders look for unusual volume spikes and price action immediately following London or New York open. Timeframes such as 15-minute or 1-hour charts are useful for identifying specific setups.

This approach works for forex, indices, and even commodities where the market has visible Asian session ranges.

Systematic Approach for High-Probability Setups

- Draw a box around the Asian session’s high and low on the chart.

- Wait for price to remain within this box until London or New York opens.

- Identify a potential breakout—price closes above the prior high or below the prior low.

- Validate the breakout with a sizeable candle body, instead of a mere wick.

- Place a stop loss just beyond the other side of the range.

- Set the target based on recent price action or a predetermined risk-to-reward ratio.

- Manage the trade: move the stop as price runs, or close part of the trade at milestones.

First is discipline— with an upper-case D. No premature moves ahead of an obvious breakout. This is where patience is important, as false breakouts do occur.

Real Market Examples

On a normal weekday, the EUR/USD could go sideways between 1.0800 and 1.0830 during the Asian session. Sure enough, at the London open, price jumps high above 1.0830 with a huge bullish candle piercing through.

The trader goes long, puts his stop at 1.0795 and targets 1.0870. If price reaches target, trade ends as expected. Otherwise, the stop limits the damage.

Another example: Gold often consolidates during the Tokyo session, but London or New York opens can trigger large breakouts. Having observed the first 30–60 minutes after these opens you can quickly identify the cleanest moves.

Timing, Behavior, and Trade Management

… Timing is, well, everything. Behavior and trade management are crucial. Those ideal windows are the first hour after London or New York opens.

Avoid trading during the quieter pre-dawn hours—price action is sluggish, and false moves are common.

Timing, Behavior, Trade Management Cultivate Relationships. Move stops to BE once price breaks out, take profit as price approaches major levels of supply and demand, and avoid entering late.

ACB Master Class: Real Benefits

The ACB Master Class provides traders with a step-by-step guide to becoming a price action setups master. It teaches session behavior, timing and the discipline required to be a good trader. It’s all hands-on, real-world example driven, so participants can apply the knowledge they gain in real market scenarios.

- Improved skill in spotting high-probability setups

- Faster, more accurate entry and exit timing

- Better trade management for steady growth

- Fewer mistakes from overtrading or chasing signals

- Simpler, less stressful analysis—no reliance on indicators

- Growth in discipline and patience with every session

- Confidence in making decisions with a clear plan

Course Structure and Learning Tools

The course is produced with behind-the-scenes video guidance that demystifies each setup, with easy-to-follow charts and session timing. Students receive daily templates giving them the opportunity to hone their skills identifying and mapping out potential trades as the market opens each day.

Because lessons are self-paced, students of any age from any country can work through lessons on their own timetable. The case studies presented are based on actual markets. They discuss their successes and failures, which keeps the learning real and hands-on.

Each of these lessons illustrate setups using just price action—no crazy indicators—so that the real trading skills remain simple and effective.

Mastering Trade Management

Mastering Trade Management is the real meat and potatoes of the course. The ACB method trains students on determining targets, setting stops, and managing trades in motion. This focus helps traders hold onto gains and avoid common pitfalls, like moving stops too soon or letting emotions take over.

Every technique learned is supported by actual case studies. This gets learners to start thinking about how best to apply the tools in different market contexts. Risk management and understanding when to exit are as important as identifying a quality entry.

These skills prepare traders for long-term success!

Community Access and Ongoing Support

Students receive access to a private group of fellow students to share charts, ask questions, and seek feedback from one another. This community is energetic and encouraging, with members hailing from across the globe.

Ongoing support is provided through a live Q&A, periodic chart review, and answers to course questions by course mentors. Peer support helps traders stay on track. The group shares new setups and tips every week. This keeps learning fresh and practical.

Simplicity and Discipline

The course is disciplined in its simplicity, focusing on a small number of clear setups. This allows traders to save time and avoid the noise of things that simply don’t work. As a result, they produce less flawed work and spend more time on actual analysis.

The emphasis on discipline and mindset helps ensure that traders remain focused and even-keeled regardless of market conditions.

Is the Stacey Burke’s masterclass For You?

Profile of Serious Traders

Serious traders who get the most out of the masterclass often have a few things in common. They aren’t green to the industry, but they’re looking to fine-tune their game. If you’re serious about maximizing your trading efficiency and increasing your chances at profitability, this course is right for you.

You’ll be doing it without needing to add new tools or complicate things!

- You’re looking to learn how to trade price action with an emphasis on timing, not loading up on indicators.

- If you’re someone who trades intraday in forex, indices, or commodities, and you’re looking for setups that are more straightforward that you can apply to faster-moving markets.

- You appreciate discipline and wish to develop a strong daily practice, instead of just following signals.

- You want actionable skills to identify high-probability trades, determine the best time to enter and exit trades, and maximize your trading success while minimizing mistakes.

- You think you should be doing better than you are. To do that, you have to know how session behaviors—like those of the Asian, London, and New York markets—actually operate.

Bridging Trading Gaps

Or perhaps you’re already familiar with the fundamentals and have tested out a few strategies. You may find that gaps in your knowledge or experience are preventing you from making progress. Maybe you’re doubting your trades or confused on when to look for them.

This course bridges the gaps. It educates on why sessions move the way they do, further helping to bridge these knowledge gaps. If you crave daily process and mindset training to develop your consistency, this course is for you!

It really emphasizes the actionable process of developing discipline and confidence. If you’re a trader who has used a lot of indicators that have been distracting or are looking to move to a simpler chart setup, this will help.

Price action, market timing, and simple routines take the place of complex analysis. If you want quick, simple answers, these takeaways are for you.

Flexibility for Different Skill Levels

This course is ideal for intermediate and advanced traders. You won’t be going in cold, but you should have some fundamental understanding of the markets. For the more experienced traders, the emphasis on timing of sessions and mental discipline provides additional cutting edge.

If you feel stuck using the same old methods, the clear, actionable setups in the class can shake up your routine. This will help traders cut through the noise and focus on what really works during the busiest market sessions.

They will experience tremendous practical value in this method.

Suitability and Limitations

Not for traders who prefer complicated systems. Ideal for traders looking for a clear, straightforward, time-tested approach to the markets. If you rely on technical indicators, ask yourself if you are truly willing to stop relying on them.

Focus is given to the importance of discipline over seeking immediate victories.

My Perspective: Beyond ACB Setups

Initially taking on the ACB method is usually an often a significant turning for most investors. True transformation occurs when we do more than do just one approach. It draws from the experience of knowing how to read and respond to the market at large.

This journey often transforms traders in ways that extend far beyond the charts.

Building on the Basics

Some dogs and cats will make ACB setups look basic. They combine other methods with it, such as chart patterns or indicators, to refine their advantage. For instance, combining ACB with moving averages or support and resistance levels can assist in identifying stronger signals.

Some others introduce in danger guidelines—similar to having stop-loss factors clearly set—so a single commerce by no means places their account in danger. These pragmatic steps shift ACB from a hardwired system to a malleable toolbox.

This is more than just supplementing more tools. It’s all about finding what works best for you. Some view ACB as a rigid set of guidelines, and others as a jumping-off point.

Either approach can be effective, but the greatest expansion tends to be done by the risk-takers, the ones ready to trial and error and modify.

The Value of Understanding Markets

Traders who hold on to ACB setups usually end up going further down the rabbit hole of market structure. Themes begin to take shape. You see how price reacts at key zones: highs, lows, or trend lines.

This larger perspective allows you to identify true changes in trends vs. Statistical noise. Many participants find that after a while, they learn to trust their own sense of the market. They depend on it as much as any set of rules as well.

The psychology angle is equally important. As we all know, markets change quickly. Maintaining your discipline and not overreacting, especially when the sky is falling, requires extreme willpower.

With excitement comes impatience and it’s always tempting to want to get in and out too early. The greatest traders are the most patient, waiting for their edge.

Practice, Patience, and Growth

Mastering ACB setups requires a serious time investment. Practice makes perfect. Even after seeing them for months, you can still discover surprising details in the setups you think you’re most familiar with.

The markets are not the same. What worked like a charm last year might just require a simple little adjustment this year. Having a willingness to learn, willingness to evolve, and not rest on our laurels is essential to improving.

Personal risk style comes into it as well. There are some traders who do nothing but eat small consistent trades. Others are okay with larger gambles.

ACB can accommodate both, but every trader must experiment to find out what works best for them.

Moving Forward with ACB

There are a lot of different opinions about ACB, and that’s perfectly ok. Some traders believe in it, and others wish to have more space. The goal should always be to continue to learn.

The ACB master class is not the final objective. We get it. It’s not a trophy. It’s a start—a solid foundation to add to as your trading matures.

Conclusion

ACB Trading Setups Master Class demystifies the art of trading in a way that makes it seem clear and attainable. Stacey takes you beyond the theory with candid tales and practical how-tos. Those who attend get to experience the setups in actual live trades and not just chart slides. The lessons are appropriate for all skill levels, and the tools are delivered turnkey. Everyone appreciates the step by step approach, even when markets are challenging. To understand the true value, explore free introductory lessons or speak with former students. Interested in finding out whether ACB is a good fit for your style? Become a better trader today. Take the next step and experience a Trading Setups class for yourself or join the discussion online. The only way to really understand what’s effective is to see what works in practice.