SQ Academy – StrategyQuant MasterClass

Download the StrategyQuant MasterClass for $390 $15

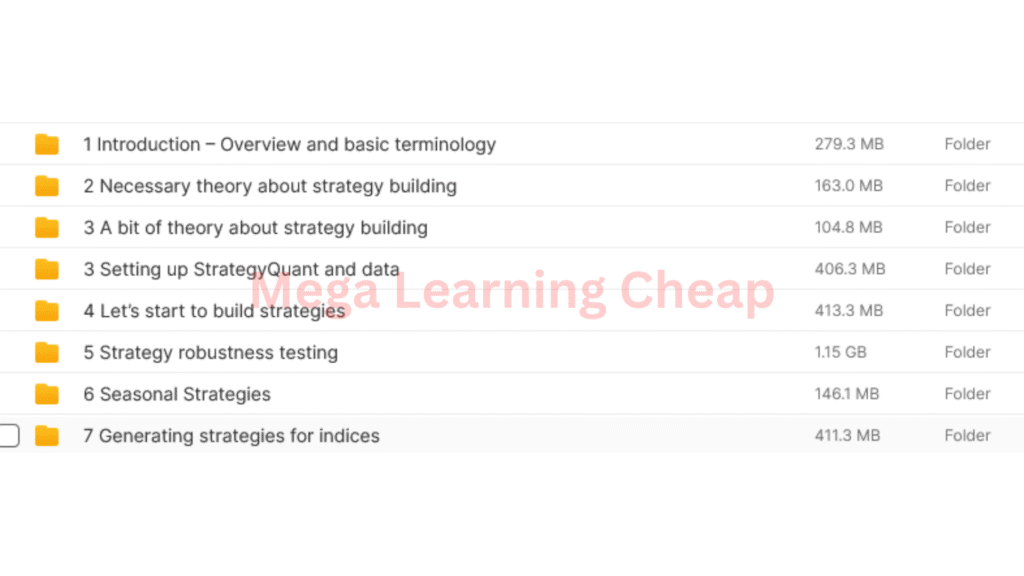

The Size is 3.03 GB and Released in 2025

To learn more, please read the Sales Page

The Overlooked Advantage Separating Profitable Traders from the Pack

Every year, thousands of traders pour into the markets armed with indicators, economic news, and half-digested YouTube strategies. Most of them end up in the same place: losing money and wondering why their edge keeps vanishing.

There’s a reason this happens. It’s not bad luck or a broken system—it’s a lack of structured, data-driven thinking. The market punishes improvisation. And rewards systematization.

That’s why a quiet group of traders is quietly pulling ahead. They don’t follow gurus. They don’t buy signals. They use automation tools that allow them to build, stress-test, and deploy strategies that operate with machine-level discipline. These traders aren’t guessing. They’re engineering. And their weapon of choice is a comprehensive methodology taught inside a singular program built for traders who want to trade like hedge funds operate.

A Mechanical Approach to Markets, Built for Human Beings

This course isn’t built on theory. It’s engineered around a platform that allows anyone—from a retail trader with zero programming skills to an ex-quant looking for a better workflow—to build trading strategies that behave like self-sufficient organisms in the wild.

Instead of chasing setups, you generate strategies based on genetic algorithms. Each strategy is subjected to rigorous trials: Monte Carlo simulations, walk-forward testing, and robustness analysis that filter out the flaky and leave you with what actually works.

The secret isn’t complexity. It’s structure. Everything in this program has one purpose: to replace gut feeling with rules that win more than they lose, over hundreds of trades, in multiple markets, across decades of backtested data.

Forget Signal Services—This Is Your Trading Lab

What makes this approach different is what it doesn’t do. It doesn’t sell you a dream of six figures by the weekend. It doesn’t hype “set-it-and-forget-it” systems. What it offers is a laboratory environment. You’ll create your own rules. Your own entry logic. Your own filters. You’ll generate hundreds of variations. Then pressure-test them until only the battle-hardened remain.

These strategies can be applied to forex, stocks, futures, or even crypto. There’s no asset-class bias. If it has data and a price feed, it can be processed, shaped, and traded with your system.

And the best part? You don’t need a PhD or a software background. The interface handles the coding. You handle the logic.

Why Most Trading Education Fails and This Doesn’t

Typical trading courses rely on charisma. A teacher who once hit a few winning streaks walks you through candlestick patterns and RSI setups. But the markets change. That pattern doesn’t work in a sideways environment. That RSI setup fails during high volatility.

This program avoids all that by cutting out the middleman between you and the market. You create systems that adapt to different conditions. If your strategy only works in trending markets, you’ll know that upfront—and can either refine it or create a mean-reversion counterpart.

Instead of chasing certainty, you’re building probability-weighted portfolios. That’s the mindset shift this course creates. That’s why students walk away not with “a new strategy,” but a process that generates dozens of strategies tailored to specific goals.

From Strategy Creator to Portfolio Manager

The course goes far beyond strategy generation. You’ll learn how to organize your systems into portfolios. Not every strategy needs to be a home run. Some reduce drawdown. Some provide consistency. Some capitalize on rare market conditions. You’ll understand how they work together—and how to balance exposure across instruments and timeframes.

Modules include sessions on deploying your systems to VPS environments for 24/7 execution. Others walk you through exporting to popular platforms like MetaTrader, NinjaTrader, and TradeStation.

You’ll learn about curve-fitting pitfalls, how to avoid over-optimization, and what statistical tests reveal about your system’s durability in live conditions.

This isn’t an endpoint—it’s a foundation.

A Support Network for Builders, Not Bystanders

Included with your access is an invitation to a private forum of traders and engineers who speak the same language. No fluff. No screenshots of “today’s gains.” Just testing frameworks, questions about edge calibration, and solution sharing.

You’re not learning in isolation. You’re entering a guild. One where best practices are debated and documented. Where problems are dissected, and knowledge is compounding.

The benefit isn’t just access—it’s acceleration.

Your First Strategy May Not Work—And That’s the Point

There’s no false confidence here. This is not about handing you a winning strategy in a box. It’s about teaching you to build strategies that can be tested to failure—and fixed. Because real strategies aren’t born fully formed. They’re forged in tests and re-tests.

The material shows you exactly how to interpret equity curves, detect anomalies, and apply filters that eliminate random outperformance.

You’ll learn when a strategy looks good due to luck—and how to determine if it truly has a statistical edge.

This is what the professionals do. They break their systems before the market does it for them.

Turn Strategies Into Assets—Monetization Pathways Included

One often overlooked advantage of having your own strategy suite is the ability to monetize beyond your personal trading.

Some students license their systems to brokers or hedge funds. Others join marketplaces that pay royalties. There’s even a module covering how to become a strategy provider to trading platforms—turning your algorithm into recurring income.

If you choose to remain private, you still benefit. Systems built through this methodology can run with minimal intervention, freeing up time while maintaining risk-adjusted exposure across assets.

Addressing the FAQs Without the Fluff

Can beginners use this? Yes—so long as they’re serious. The software handles coding. The course handles logic. Your role is to bring curiosity and discipline.

How long does it take to become proficient? Most students report real traction within 4 to 6 weeks. Mastery depends on repetition, not memory.

What markets does it work on? Any with historical data. Forex. Commodities. Indices. Cryptocurrencies. ETFs. If it trades, it works.

Does it work in live conditions? Strategies are tested against slippage, latency, spread variation, and more. If you follow the process, your strategies will be hardened for real markets.

What This Really Offers: Autonomy

This course is not about hand-holding. It’s not about finding a magic system. It’s about putting you in the position to build, vet, and manage systems on your own terms.

Whether your goal is to replace a day job, build passive income, or just stop second-guessing every trade—you’ll find the foundation here.

The content is dense. The testing is rigorous. But the outcome is clarity. You’ll stop wondering what works and start proving it.

This is the real edge. The one very few ever take the time to build.