The Private Banker Course

Download The Private Banker Course for $117 $12

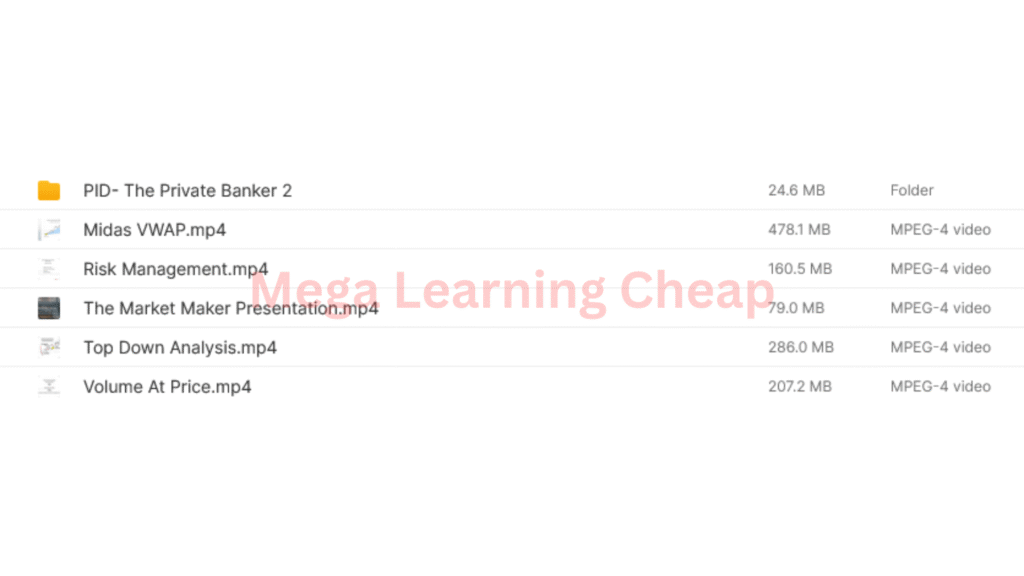

The Size is 1.21 GB and Released in 2025

To learn more, please read the Sales Page

The Financial Underground Is Recruiting — And This Is Your Way In

They move quietly. They operate behind encrypted terminals, trade from private offices, and manage wealth that doesn’t show up on public filings. Their job is not to speculate. It’s to preserve capital, deploy it efficiently, and create asymmetric advantages in uncertain conditions. You won’t find them arguing on forums or flexing trade wins. They are private by design—because those who serve wealth, move in silence.

But every so often, a window opens.

A way to be trained in their mindset.

To learn the skills that make them indispensable.

This is that window.

Professional-Grade Thinking Begins Where Public Content Ends

Most traders spend their entire careers reacting to price, learning patterns, and trying to master emotional discipline. But the top professionals aren’t watching indicators—they’re reading the market’s language. They understand order flow, volume logic, and structural price behavior in ways that casual traders don’t know exist.

This course begins at that intersection: where surface-level tactics end and market logic begins. You won’t waste time learning how to trade breakouts or draw fib levels. Instead, you’ll study price through the lens of hierarchy, imbalance, delta flow, and rotational structure.

The program teaches you how to dissect a chart the way a hedge fund analyst does: top-down, context-first, volume-confirmed. It’s not technical analysis. It’s technical decoding. And once you learn it, you’ll never see a market the same way again.

Risk Isn’t a Side Topic — It’s the Framework for Everything

Let’s drop the myths. Trading isn’t about being right—it’s about staying solvent. And yet, most educational platforms treat risk as a module, not the core of the craft. That’s like teaching flight school without covering aerodynamics. This course reverses that. Here, risk management is the curriculum.

You’ll learn to quantify and plan for risks most traders never even consider—like event exposure, liquidity risk, system latency, and compounding psychological strain. You’ll learn to identify when opportunity costs quietly destroy edge. And you’ll see how proper tactical risk management allows you to survive what the market throws at you—not once, but over the next 5,000 trades.

Professionals aren’t lucky. They’re risk-aware in ways the public rarely understands. This course makes that clarity your own.

Frameworks Beat Forecasts. Always.

You can’t predict markets. But you can prepare for how they behave under stress. That’s where this course delivers its most unique value: trade methodology rooted in session structure, not setups. You’ll study time-price-opportunity theory, volume profiles, auction behavior, and distribution logic—not as ideas, but as execution strategies.

You’ll walk through examples of real sessions—morning opens, trend days, reversal conditions, late-day fades—and learn exactly how to operate inside them. These are not textbook cases. They’re modeled from actual performance scenarios, where decisions are made with money on the line and uncertainty in the air.

By the time you finish, your idea of what a “setup” looks like will evolve into something far more powerful: situational clarity.

True Mastery Demands Research — Not Just Practice

Here’s what most traders never realize: the difference between competent and elite is not reps, it’s research. Studying your own trades is helpful. But analyzing structural context, order book behavior, and cumulative delta across session types? That’s when your edge sharpens.

This program goes deep with modules that break down trade mechanics at a forensic level. You’ll learn how liquidity gaps drive fast moves. How absorption points act as market tripwires. How session opening types, imbalance detection, and trap-reversal signatures signal what’s coming before the move begins.

You’ll also get access to structured research covering TPO distributions, VWAP anomalies, and order flow imprints. This is the kind of material prop traders review during desk meetings—not the kind posted on Twitter threads.

You Don’t Just Get Lessons. You Get Tools for War

It’s one thing to understand the theory. It’s another to execute under pressure. That’s why this program doesn’t stop at education—it arms you with professional-grade resources.

You’ll receive preconfigured chartbooks compatible with Sierra Chart, including custom templates for volume distributions, TPO rotations, and intraday structural breakdowns. Every template is built for clarity and precision—so your screen isn’t overloaded with indicators, just the information that matters.

You also gain access to handbooks that dive deeper into VWAP theory, curve logic, and multi-day auction analysis. These are structured like operating manuals, not marketing fluff—because when volatility spikes, you need tools that do more than look pretty.

Reputation Is Quiet, But the Results Aren’t

The people using this material don’t need to advertise. They manage capital for private clients, family offices, or their own proprietary portfolios. They aren’t concerned with followers—they’re concerned with preservation, consistency, and scalable process.

Some manage seven figures of personal capital. Others run independent advisory firms. What they share is the same foundation you’re about to be trained in. Not gimmicks. Not memes. Just structure, discipline, and edge.

And once you’re trained in these principles, your path opens too. Whether you use it to manage personal wealth, trade professionally, or advise clients with high stakes and high expectations—this course turns you into an operator, not a follower.

This Isn’t About Trading Alone—It’s About Power

Financial fluency is a power language. It opens doors at boardrooms, dinners, and back offices that operate without press releases. It gives you the confidence to negotiate with wealth managers, to see through false narratives, and to think ten years ahead—not ten minutes.

The people who shape capital flows think differently. And this program is your on-ramp into their world. Once you’re inside, everything else changes—your opportunities, your network, your leverage.

Because when you stop reacting to the market and start thinking in frameworks, you stop being a consumer of information—and become a producer of results.

The Training Isn’t Easy—But That’s the Point

There are easier programs. There are louder promises. But none of them will turn you into a weapon in the markets. This course doesn’t chase dopamine. It builds clarity. It doesn’t sell a dream. It trains the kind of person capable of building their own.

Each lesson is a brick. Each module, a blueprint. You’ll be challenged to think deeper, operate slower, and act with ruthless precision. The goal isn’t speed—it’s durability. The goal isn’t income—it’s competence.

Because in this field, those who can stay composed while others flinch are the ones who inherit the upside.

If that’s the kind of operator you want to be, then the next page isn’t just a curriculum.

It’s your turning point.