Robot Wealth – Trade Like A Quant Bootcamp

Get the Trade Like A Quant Bootcamp for $194 $10

The Size is 10.81 GB and is Released in 2025

Robot Wealth’s Trade Like a Quant Bootcamp helps you build disciplined, testable trading systems grounded in data, not anecdotes. You’ll turn observations into hypotheses, run evidence-based tests, and assemble rule-driven strategies with tight risk controls. Work across assets, practice execution, and stress-test ideas with a collaborative community on Discord. Get self-paced modules, lifetime updates, and member-priced advanced courses. Bring $25k–$200k, reliable data, and a systematic workflow to scale sensibly. Keep going to see how you’ll put this into action.

Why Trade Like a Quant Exists

Why does Trade Like a Quant exist? To give you a rigorous, reality-checked path to trading well. If you’re serious about markets, you don’t need hype; you need a systematic framework that survives live conditions. This bootcamp exists to anchor your decisions in data, not anecdotes, so you can build strategies with edge and discipline.

You’ll confront the gap between complex theory and execution. Many technically strong traders struggle to implement advanced ideas when slippage, regime shifts, and market microstructure bite. The program pushes you to translate concepts into processes you can test, monitor, and refine.

It also nudges you to think like a business owner. You’ll seek inefficiencies worth exploiting, prioritize durability over thrills, and manage risk as a first-class constraint. With a structured approach and actionable insights, you’ll cultivate consistency rather than chase luck. Ultimately, Trade Like a Quant exists to help you trade profitably, sustainably, and with intent.

What You’ll Learn and Build

You’ve seen why a rigorous, data-grounded approach matters; now you’ll turn it into practice. You’ll learn to read markets with intent, develop intuition anchored in evidence, and spot real inefficiencies—not stories. You’ll practice filtering noise, testing hypotheses, and converging on edges you can actually trade.

You’ll also avoid three critical mistakes that sink traders. I’ll share hard-won lessons so you recognize traps early, manage risk deliberately, and iterate with discipline. You’ll translate these insights into a trading business plan that starts with high-probability edges and scales into diversified, competitive alpha.

You’ll get hands-on with data analysis and simulation. You’ll clean, explore, and model datasets; run simulations to understand variability and robustness; and evaluate performance with practical diagnostics. By the end, you’ll assemble actionable strategies integrated into a systematic operating framework—clear entry and exit rules, position sizing, risk limits, and review loops—so you can run sustainable, profitable trading processes with confidence and accountability.

Core Framework: From Observation to Edge

How do you turn a hunch into a repeatable edge? You start by translating raw observations into testable hypotheses, then stress-test them with disciplined research. In this bootcamp, you’ll learn to interrogate market behavior with clear mental models, not gut feel. You’ll frame a hypothesis, define the data and conditions that would prove or refute it, and iterate until a robust pattern survives scrutiny.

You won’t rely on math for its own sake. You’ll focus on how markets actually function—participants, incentives, frictions, and microstructure—and let those dynamics guide your ideas. From there, you’ll use practical tools to prototype, test, and refine rules so they’re actionable and auditable.

You’ll also think like a portfolio engineer. Instead of one shiny strategy, you’ll assemble multiple uncorrelated edges to improve risk-adjusted returns and resilience. The framework helps you avoid overfitting, validate stability across regimes, and document assumptions—so when conditions change, you’ll know what to adapt, retire, or scale.

Real Strategies Across Multiple Asset Classes

With a clear hypothesis-to-edge workflow in hand, it’s time to apply it to live markets across equities, crypto, and risk premia. You’ll translate observations into rules, then into deployable systems that target repeatable behaviors: mean reversion in single-name equities, momentum and funding dynamics in crypto, and diversified carry or value tilts in risk premia.

You’ll learn to isolate high-probability edges with clean entry/exit logic, position sizing, and portfolio construction that respects correlations. Each strategy is practical for part-time traders: low-friction data, straightforward execution, and routines you can maintain alongside a day job.

Risk management sits at the core. You’ll define max loss per trade, volatility scaling, and portfolio-level drawdown limits. Every example shows how to scale from about $25,000 to $200,000 without diluting edge—adapting universe size, order types, and liquidity filters.

How the Bootcamp Works

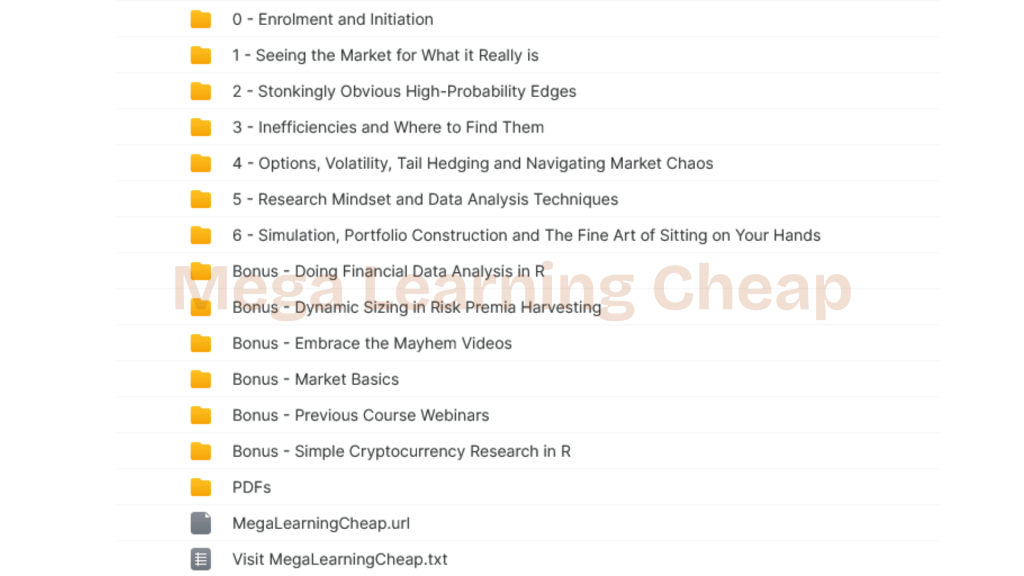

You progress at your own pace through structured modules, with videos and PDFs guiding you from market intuition to a concrete trading plan. With membership, you get access to downloads, ongoing updates, and a community that answers questions and shares real-world insights. Expect about 3 hours per week—and you can tailor strategies to your capital and risk constraints.

Self-Paced Learning Flow

Anyone can step into the Robot Wealth – Trade Like A Quant Bootcamp and move at a pace that fits real life. You control your schedule, advancing through lessons when you’re ready, without deadlines or fixed cohorts. This self-paced flow helps you stay consistent and avoid burnout.

You’ll get immediate access to a complete curriculum built around three focused modules: market intuition, edge discovery, and systematic trading strategies. Each module builds on the last, so you can apply concepts as you go and measure progress in real trading contexts.

If you’re trading part-time, plan for 3–5 hours per week to watch lessons, run experiments, and document takeaways. You also keep lifetime access to all materials and updates, so you can revisit and refine your approach whenever needed.

Access and Community

Although the Bootcamp runs on your schedule, access is immediate and all-encompassing: a streamlined sign-up opens up 10.7 GB of videos and PDFs, lifetime updates, and a private Discord where traders swap tactics, test ideas, and get real-time feedback. You log in and start learning instantly—no cohorts, no waiting, no expiration dates.

You’re not learning alone. In the private Discord, you’ll workshop strategies, compare results, and get personalized feedback from peers who speak your language. Share code snippets, troubleshoot edge cases, and refine hypotheses faster with collaborative eyes on your work.

Membership also means ongoing improvements. As new modules, examples, and refinements roll out, you get them automatically. The result: one place for trusted material, direct community support, and rapid iteration—everything aligned to help you improve your trading process.

Time and Capital Fit

From community to cadence, the Bootcamp fits real life. You’ll commit 3–5 hours a week, so you can learn and build systems without derailing work or family. Lessons focus on efficient practice—design, test, and deploy systematic strategies across multiple asset classes—so every session moves you forward.

You can start small or scale up. The frameworks work with $25,000 to $200,000, letting you compound skills and capital together. You won’t chase hot tips; you’ll implement rules, logs, and reviews that instill discipline whether you’re new or experienced.

Lifetime access means no pressure to rush. Revisit modules, digest updates, and refine playbooks on your schedule. The goal is durable habits: consistent research, measured risk, and executable strategies that align with your time and account size.

Community, Mentorship, and Ongoing Research

Even as markets shift, you’re never working alone—our community anchors your growth with real-time discussion, candid feedback, and a safe space to ask tough questions without judgment. You’ll share ideas, examine assumptions, and iterate faster because peers challenge you with rigor, not ego. When volatility bites or a drawdown tests your resolve, you’ll get grounded support, perspective, and practical next steps.

Mentorship happens in the open. Experienced quants dissect trades, stress-test hypotheses, and highlight blind spots so you refine process, not just outcomes. You’ll access specialized courses at member pricing to deepen skills in data handling, execution, and risk—then bring lessons back to the forum for critique and application.

Research never stops. You’ll join collaborative projects, from feature engineering to regime detection and walk-forward validation. Members publish results, share code snippets, and compare robustness checks, so you spot overfitting early and compound edge. The result: faster learning cycles, sturdier strategies, and accountable progress.

Time, Capital, and Tools You’ll Need

You’ll block 3–5 hours each week to work through the material at a sustainable pace. You can start with $25,000 and scale toward $200,000, using the same systematic tools and data workflows across asset classes. We’ll outline the essential platforms, data sources, and automation you need so you can fit execution around a busy schedule.

Weekly Time Commitment

Plan on dedicating 3–5 focused hours each week to the Robot Wealth – Trade Like A Quant Bootcamp, a cadence built for part-time traders with busy schedules. You’ll use short, high-impact sessions to review lessons, practice techniques, and reflect on results. This rhythm keeps momentum without crowding your calendar and guarantees steady progress through the thorough materials.

Structure your week with purpose:

1) Learning: Spend 60–90 minutes absorbing a core concept, then summarize what you’ve learned in your own words to cement understanding.

2) Application: Allocate 90–120 minutes to implement a tactic on sample data, iterate, and note edge cases you discover.

3) Review and planning: Use 45–60 minutes to evaluate outcomes, log insights, and schedule next steps so each week compounds.

Protect these blocks, track your wins, and stay consistent.

Capital and Tooling Requirements

While you keep a 3–5 hour weekly cadence, come equipped with workable capital and the right stack. You’ll thrive with starting capital between $25,000 and $200,000, letting you size positions sensibly and scale strategies as you learn. The bootcamp focuses on practical deployment, so you’ll put existing funds to work while sharpening edge identification and risk controls.

Bring data analysis tools you’re comfortable with and a broker or execution platform that supports systematic workflows. You’ll need reliable market data access, a research environment for testing, and an order interface that handles automation or disciplined discretionary execution.

You also get lifetime access to materials and updates, so your toolkit can evolve. As new data sources, libraries, and integrations appear, you’ll continuously refine, validate, and deploy improvements.

Frequently Asked Questions

Can Trading Bots Make You a Millionaire?

Yes, but it’s unlikely and far from guaranteed. You’ll need a robust, tested strategy, realistic expectations, and strong risk management. You must account for transaction costs, slippage, and liquidity. You’ll backtest thoroughly, validate live with small capital, and monitor and optimize constantly. You shouldn’t trust promises of effortless riches. If you combine skill, discipline, and adaptability with favorable market conditions, a bot can scale profits—but it can also amplify losses.

Do Quants Make 7 Figures?

Yes—many quants do make seven figures. Picture spreadsheets and code on one screen, seven-figure bonuses on the other. You blend math, programming, and market intuition to spot inefficiencies, then turn them into scalable algorithms. At top hedge funds, prop shops, and banks, you’ll earn a solid base plus performance bonuses. Not everyone hits $1M, but with elite technical skills, sharp risk management, and a proven PnL, you’ve got a real shot.

Is Algo Trading 100% Profitable?

No, it isn’t 100% profitable. You rely on historical patterns that can shift, so losses happen. Even strong strategies wobble when regimes change or execution slips. Backtests can mislead; live markets add slippage, fees, and unexpected behavior. You manage risk, cap drawdowns, and keep refining based on real-time feedback. You diversify signals, stress test, and monitor execution quality. Profitability comes from disciplined adaptation, not guarantees, and you accept uncertainty as a cost of doing business.

Can AI Quant Trade?

Yes, AI can quant trade. You use algorithms and machine learning to analyze massive datasets, spot patterns, and execute rules-based strategies at machine speed. You’ll cut human error and emotions, adapt models as markets shift, and optimize entries and exits. You can stream real-time data, backtest rigorously, and deploy with risk controls. Still, you shouldn’t expect guaranteed profits—overfitting, regime changes, and market shocks bite. Monitor models, manage risk, and iterate relentlessly.

Conclusion

You’re ready to trade like a quant—deliberate, test-driven, and resilient. Think of it like tuning a race car: one student cut drawdowns 30% by swapping a noisy indicator for a cleaner signal, then shaved milliseconds off execution. In this bootcamp, you’ll build edges from observation to live deployment, across assets, with mentors and peers at your back. Bring time, discipline, and the right tools. You won’t guess—you’ll measure, iterate, and accelerate with confidence.