Vulture Academy – Full Trading Course ITC and SMC

Get the Full Trading Course ITC and SMC Course for $2997 $19

The Size is 3.91 GB and is Released in 2025

Key Takeaways

- The Vulture Academy Full Trading Course offers a structured learning path suitable for both beginners and experienced traders, with comprehensive resources and step-by-step guidance.

- The course combines ICT and SMC to teach you how institutions trade.

- Students develop hands on experience through live trading, sessions and community, bringing the concepts to life.

- Risk management is a priority, with tools and protocols supplied to help traders safeguard their capital and make educated decisions.

- They monitor your progress with performance metrics and personalized mentorship, allowing you to keep evolving and fine-tuning your strategy.

- Vulture Academy graduates enter an incredible supportive worldwide community, receiving continuing access to resources, updates, and opportunities to collaborate and grow.

Vulture Academy – Full Trading Course ITC & SMC provides a step-by-step guide for individuals interested in Intraday Trading Concepts and Smart Money Concepts. The course provides a defined roadmap for traders of all levels, featuring articles on chart reading, risk management, and trade planning. Students receive practical tools and advice for deciphering price moves, identifying trade setups, and controlling trades with easy moves. Full of real-world charts and live trade examples to help make the concepts actionable. Most students enjoy the course simple and to the point, no fancy words or lengthy theory. Then the meat will dissect what each section of the course addresses and what it offers new and developing traders.

The Vulture Academy Full Trading Course

Vulture Academy offers a comprehensive trading course for all levels, developed around ICT and SMC, with a focus on crypto trading methods. This unique opportunity includes crisp video lessons, lifetime access, and a private discord community for networking with fellow vultures. With live classes every month and an e-book for rapid reference, students can develop skills that fit any schedule and pursue funded trader positions.

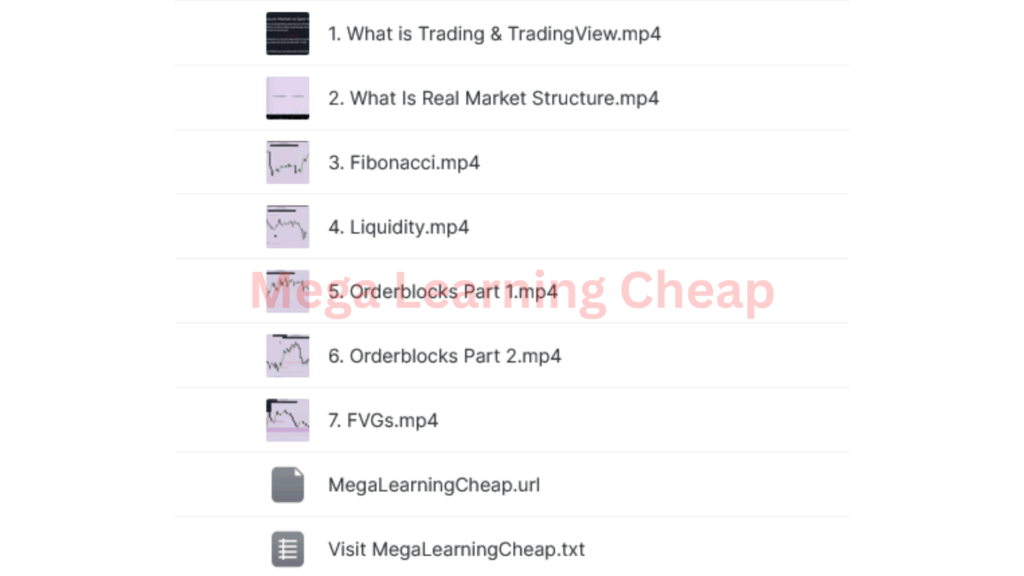

Core Concepts

The course kicks off with fundamentals such as how to use TradingView, decomposing charts and necessary tools for transparent analysis. It lays out the fundamentals of what drives price action, illustrating how to identify structure behind market moves.

Students are taught to utilize Fibonacci tools to identify entry and exit points. By identifying liquidity pools, traders can identify areas where price is likely to respond, assisting with trade planning. For instance, the course describes to mark liquidity pools so traders can steer clear of fakes and identify genuine opportunities.

Advanced Strategies

Orderblocks are a core concept of SMC, identifying where smart money buys or sells. The course teaches students how to identify these zones and apply them to their trading.

FVGs get covered, as well. These are low-volume price zones, which tend to suck price back later. By learning to identify and trade FVGs, students can target high-probability setups. The course provides supply and demand shift examples, so students can observe how to connect these concepts to actual charts.

Risk Protocols

Risk management is the crux. The course outlines basic rules for placing stop-losses, sizing positions, and not risking too much per trade.

It addresses how to align your trades with your personal risk tolerance and how to structure trades that suit your objectives. Tips for handling losses and locking in profits. This assists traders in not only guarding their capital, but developing consistent habits.

Practical Application

Students walk through actual trades and market cases. They come to live sessions and webinars for feedback and questions.

The Discord chatroom is active too — students can chat with one another and share tips about what works.

There are hands-on chart reviews in each class.

Monthly live sessions help keep skills sharp.

Performance Metrics

Performance tracking is built in, Students learn to let data be their guide — to see what is working and what can be improved.

Mentors give feedback, so students can improve their approach.

Goals get set based on performance, not just guesses.

Why ITC and SMC Matter

ITC and SMC act as a lens for observing how the big players sculpt the markets. These concepts guide traders to peer beyond shallow price charts and detect what’s occurring under the surface. Mastering market structure, the foundation for SMC, is dissecting how prices behave and fluctuate with supply and demand. For instance, an HI-LO Activator detects a pattern of higher highs and higher lows, allowing traders to know if a market is trending up. This type of clarity of logic is essential for all those who want to trade with greater confidence, regardless of their location or the asset they track, including crypto currencies.

Order blocks are yet another huge component of SMC. These zones reveal where banks and funds have entered large orders which typically result in price inflection points. If a trader can identify an order block, they can strategize trades around these probable reaction zones, instead of guessing. Kind of like seeing footprints, these blocks provide insight into what the big players could be up to, creating a unique opportunity for traders to network with fellow vultures.

Fair Value Gaps (FVGs), part of ITC, allow traders to identify when prices move so quickly that there’s a value imbalance. This can frequently imply the market will return to ‘fill’ that gap. For instance, if a price sprints up after big news, there could be a gap where trades hadn’t occurred. Being aware of FVGs, traders can observe the price to come back to that zone, which can be a really nice area to get in or out of a trade during a trading session.

ITC and SMC both provide a complete approach to read markets. They’re not simply instruments—they’re vehicles to understand how capital flows, where risk lurks, and how patterns emerge. Using these notions, traders can identify support and resistance in Fibonacci numbers, control risk by following liquidity, and prepare for potential market pullbacks. For any stock, forex, or crypto trader, these techniques assist in honing your craft and stabilizing your returns.

The Vulture Methodology

I love the Vulture Methodology because it’s one of the only trading courses out there that fuses ICT and SMC into a single, distinct art, and easy-to-follow strategy. This method seeks to help traders perceive both those giant market moves and the microstructure intricacies like a vulture, allowing them to identify superior trade ideas. The course establishes a stepwise path that constructs fundamental trading skills for every level. New traders pick up the fundamentals, while more advanced students delve into the weeds on concepts and technical setups. The lessons break down trading into small steps, from reading price action to identifying high-probability areas, which assists students in developing genuine ability over time.

One of the most important aspects of the Vulture Methodology is its approach to market structure. The course educates you on how to read market swings and identify where the big buyers or sellers are likely to strike, leveraging tools like order blocks and Fibonacci levels. For instance, if a trader observes price pull back into a previous order block that coincides with a Fibonacci level, the methodology demonstrates how to utilize that area for a possible trade. Furthermore, it explains measuring liquidity—identifying where the most stop losses or pending orders lie. This prevents traders from getting caught up in phony moves and instead helps them focus on genuine trends.

The course includes practical components, such as utilizing TradingView for chart analysis and technical indicators. By demonstrating how to configure charts, mark key levels, and apply basic indicators, the Vulture Methodology provides students concrete methods to organize and monitor their trades effectively. The lessons apply to all markets, and even for traders who focus on one currency pair, the method offers sufficient setups to locate trades on a daily basis.

Students receive lifetime access to the course, including video lessons, e-books, and tools. We have a private Discord group where traders share trade ideas, ask queries, and learn from one another. Some lessons are live/1:1 sessions, so traders can receive feedback/support when they need it. For those wanting to trade with larger accounts, the course reveals routes to internal or external funding based on skill advancement.

Meet The Mentor

Our mentor from the Vulture Academy full trading course is exceptional for both his real estate prowess and his impeccable track record. Having spent over 15 years buying and selling homes and buildings, the mentor offers lessons forged from real-life deals, not just theory. Their experience spans numerous market cycles, providing them with the expertise to steer students through fluctuations in price action, demand, and risk. Just last year, the mentor’s students purchased over $100 million in real estate — the ultimate testament to how the mentor’s trading methods play out in the real world.

This mentor’s pedagogy is grounded in the conviction that doing yields results. The program pressures students to dive in quickly, so they don’t just learn but seal actual deals. Several of my students have purchased at least one property after studying with The Mentor, evidencing that the course is not just hot air. The curriculum, which has sold more than 3 million copies domestically, is renowned for assisting a diverse population of students to accomplish their real estate ambitions. From first-time young adults to experienced investors searching for their next currency pair, the course caters to all.

Individual attention is part of this mentorship. The mentor conducts weekly trading sessions, allowing students to ask questions and decompose difficult steps. These meetings take students from theory to practice, with immediate feedback and answers to queries. The mentor grants lifetime access to the course and all materials, so students can return and refresh themselves anytime. Support does not end after the first deal. Continued support is provided via a private Discord group, through which students can communicate with fellow vultures and receive feedback. This online community unites individuals from diverse locations, varying backgrounds, and unique aspirations, all striving to carve their own niche in real estate.

The mentor’s approach is clear: start quickly, take action, and learn as you go. This emphasis keeps the Vulture Academy course relevant for anyone who desires to achieve authentic outcomes, regardless of location or initial circumstances.

Your Trading Transformation

A trading transformation is not just about acquiring new hacks or analyzing charts; it’s a complete transformation in how you think, prepare, and operate in the market. Vulture Academy’s full trading course in ITC and SMC offers a unique opportunity through a step-by-step schedule that transforms the chaotic highs and lows of trading into a manageable, consistent system. The course achieves this by translating tough concepts into bite-sized steps. Many traders begin confused and unsure which direction to head, but a defined approach and concrete lessons help dispel this uncertainty quickly.

Transforming your trading begins with your mind. Most traders arrive with old habits or baggage from previous experiences. The course structures lessons to assist with these mind blocks, enabling eligible students to develop a more disciplined trading method. For instance, an impulsive trader learns to chill, verify, and strategize. The curriculum places a big emphasis on stress and risk management. Instead of a bad trade ruining your week, you learn how to follow your trade plan, use intelligent stops, and keep your losses small. This way, if it all goes south, you know what to do next.

Real change happens when you apply what you learn in live markets. The course encourages you to test new concepts, monitor what succeeds, and adjust your strategy if necessary. You may begin to notice that over time, your wins and losses balance out. It’s not luck; it comes from discipline, a solid plan, good risk rules, and avoiding the urge to chase trades. A significant part of this is shifting from merely reacting to news or price action to planning your trades in advance, such as identifying critical market junctures and positioning trades ahead of the action.

Forming good habits is a process. Some traders experience significant losses before they alter their work habits. The course teaches you how to overcome these obstacles, establish a consistent strategy, and measure your progress. The goal is to empower you to trade with greater confidence, feel in command, and stay calm when the markets turn chaotic, all while building a supportive network with fellow vultures along the way.

Beyond The Charts

The Vulture Academy trading course extends beyond technical expertise and emphasizes a unique opportunity for traders to engage with a vibrant, live community. This network allows individuals to establish credibility, exchange strategies, and discuss concepts related to crypto trading. Once you join, traders can learn from each other’s wins and errors, which assists both novice and experienced traders in developing at a rate that suits them. We have regular trading sessions and open forums where folks can pose questions, exchange advice, or dissect their prep day. This daily prep keeps traders nimble and prepared for shifting markets. Circling back to our habits point, sharing these routines enables others to establish strong habits.

A massive video library is central to the course’s approach. Each clip explores core trading concepts — market structure, liquidity, order blocks, and fair value gaps. For example, traders discover how liquidity impacts price action or how order blocks identify high-interest price locations. The course refreshes these videos frequently, ensuring traders are always ahead of the curve with new strategies or market changes. With videos such as how to use technical tools like Fibonacci lines, traders learn that these lines act as probable support or resistance, but the course emphasizes not to depend exclusively on them. Each instrument has bounds and must cooperate with other tests.

Frequent updates and new lessons keep the resources fresh. Because trading days can extend beyond regular workdays, the course demonstrates how to trade during unusual hours. This aids individuals in other time zones or who wish to trade after hours. Traders discuss optimum trading hours, holding periods, or times to exit and secure gains. These discussions emphasize risk management and exits — a necessity for anyone who wants to hold onto their profits.

The academy’s emphasis is not simply on craft but on consistent, authentic growth. Mixing group discussions, resource sharing, and a sharp, pragmatic perspective, the course delivers genuine benefit. It gives traders a healthy foundation and flexibility to adjust to shifts in the market. Each member can carve their own path, leveraging best practices and inspiration from peers across the globe.

Conclusion

Vulture Academy’s full trading course offers some serious skills. ITC + SMC influence how traders identify moves and interpret trends— not only in theory, but in live trades. The mentor demonstrates every step with explicit guidance, not guesswork. Because the lessons go deeper than charts, students develop new habits and experience true transformations in their own trading. To explore or begin with the course, visit Vulture Academy’s primary page and discover what aligns with your objectives. Next step is easy — discover how these tools work for you and what you can accomplish in the markets.