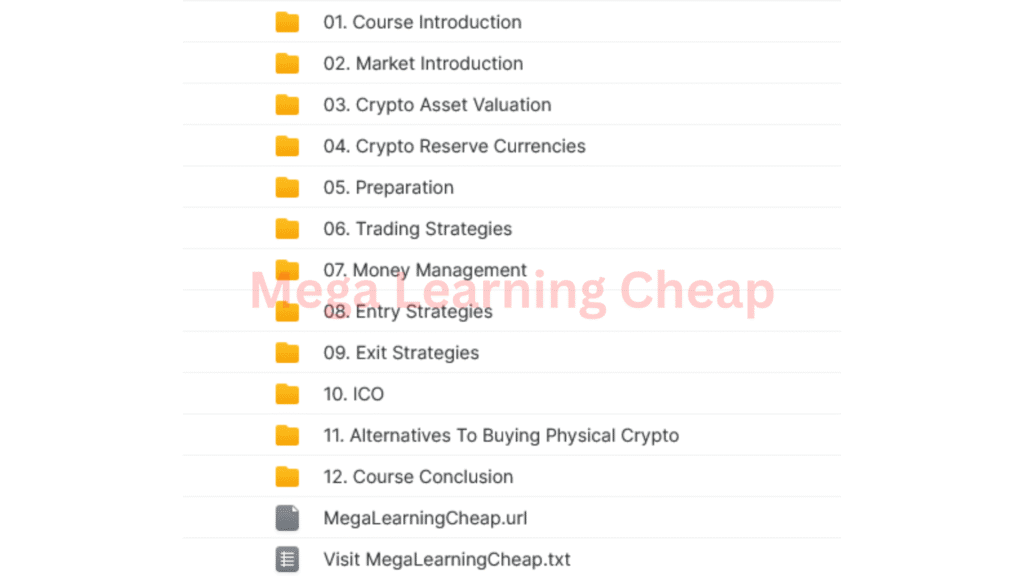

Investopedia Academy – Crypto Trading

Get the Investopedia Academy Course for $197 $12

The Size is 1.06 GB and was Released in 2025

Key Takeaways

- A framework is critical to ride the uncertainty and volatility in crypto trading — to give students an informed-digestive decision making process which steer them away from the hype-driven gambler’s fallacy.

- We find that with a good grasp of core concepts and technical analysis, aspiring traders can have a good basis for success in crypto trading.

- Critical thinking and credible sources matter to outflank misinformation and build strategies.

- Risk management methods and discipline fortify portfolios and minimize stress caused by roller–coaster market ride.

- Hands-on experience and real-world application is supported, guaranteeing students can translate theory into practical trading situations.

- With expert instruction and results-backed learning that keeps you growing, students gain access to a trusted educational platform and a supportive trading community.

Investopedia Academy – crypto trading is an interactive course that covers the fundamentals and key concepts of trading digital coins on world markets. Folks turn to this course to understand how crypto trades function, the tools that assist, and market chart reading. It includes risk tips, how to keep coins safe and to recognize scams. Real-world trade examples and step-by-step guides assist students acquire practical skills. Lessons are written in simple language, and each lesson progressively builds upon the previous one. A lot of people turn to the Academy to get a confident start in trading or to develop skills for additional trades. In the following excerpts, important course concepts are illustrated with their application in actual trading.

Beyond The Hype

Cryptocurrency investing presents a compelling combination of potential and peril, particularly in the dynamic cryptocurrency market valued at over $2.4 trillion. Price jumps attract new speculators, but it’s not that simple. With no trusted third parties, transfers are quicker and peer-to-peer, yet legal ambiguities and hacks highlight the dangers. A systematic, data-driven methodology, such as that offered in a comprehensive cryptocurrency trading course, is essential for anyone looking to trade cryptocurrency or invest in this space. The Investopedia Academy’s course focuses on practical skills, not hype, to help you make informed choices.

Market Volatility

Crypto prices turn on a dime more rapidly than many other assets. One news story or law change can result in steep declines or jumps, and large entities can shift the entire market within minutes. This sort of volatility means trading plans must be fluid and traders should anticipate the unexpected.

By learning when and why these price swings occur, traders can help identify patterns and prevent impulsive trading. Tools such as price charts, order books, and volatility indexes can assist in following trends or spikes. Because mining is now dominated by big companies with massive resources, changes in their behavior can amplify market action.

Cultivating resilience is key. Unexpected price moves will give your nerves a workout, if you have a battle tested game plan and risk management strategy, you’ll know how to stay calm.

Misinformation Overload

There are tons of myths about crypto trading. Some argue that anyone can mine coins on any computer, except nowadays, it’s mainly large firms with high-priced equipment. Another myth: crypto is always private and safe. Hacks and lost coins—like 20 percent of all bitcoins now lost—paint a different tale.

Trust reality, not hearsay. Seek out primary sources, industry reports, and reputable data sites. Learn to verify assertions and identify too-good-to-be-true claims. Not every guide or guru on the web has accurate or current information.

These skills, more than anything else other than critical thinking skills, matter. If it sounds crazy, verify from more than one trusted source before acting on it.

Trading Anxiety

Trading crypto can make you crazy. With smart plays and high risks it’s easier to get anxious or freak out. Even the veterans get the heat.

Small steps assist. Establish trading rules. Utilize stop-loss orders. Have breaks and don’t chase losses. These habits hold cortisol at bay. Over time, a consistent, rule-based strategy helps develop discipline and reduces impulsive trading.

Training is crucial. Being informed about the reality and the risks makes traders feel more confident in their decisions and less likely to panic.

A Structured Trading Blueprint

A structured trading blueprint can provide crypto traders with a roadmap to success in cryptocurrency trading. By keeping decisions rational and minimizing risk, Investopedia Academy’s cryptocurrency trading course serves as a guide for anyone looking to trade cryptocurrency with greater confidence and expertise. The prescribed curriculum ensures that you accumulate knowledge in the proper sequence, starting with cryptocurrency fundamentals and advancing to complex concepts.

1. Core Concepts

You start by learning about the basics of crypto and blockchains. All begin by comprehending the unique aspects of cryptocurrencies compared to traditional money, such as decentralization, digital wallets, and the public ledger system.

Getting comfortable with words like private keys, public keys, mining, and consensus mechanisms prepares you for everything to come. If you attempt to omit these, you’ll risk missing the rationale of how the market functions. For instance, understanding what a blockchain fork is enables you to identify when a coin’s price can swing wildly. Establishing this solid foundation ensures you won’t be taken by surprise by new buzzwords or quick-shifting fads.

2. Technical Analysis

Technical analysis is where traders learn to read the market’s signs before striking. Learn the essential and advanced chart patterns, support and resistance levels, and volume trends.

You’ll become familiar with popular indicators like moving averages, RSI, and MACD. Real-world case studies illustrate how these tools assist traders in identifying trends, anticipating reversals, and timing their trades. Working it on historical price data, for example, makes it easier to understand how a moving average crossover might predict a price surge — not just in principle, but in practice.

3. Proven Strategies

You’ll discover trading tactics that have succeeded time and again—such as trend following, breakout trades, and swing trading. All of the strategies are adaptable to your risk tolerance and your goals, whether you’re a daily trader or holding for months.

The course leads you through designing a trading plan tailored to your style. You’ll discover why no one strategy works eternally and how to adjust your plan as the market evolves. Being open to adaptation and takeaway from every trade is what distinguishes seasoned traders.

4. Risk Management

Risk management isn’t simply a lesson — it’s the foundation of sound trading. You’ll discover how to place stop-loss orders and employ position sizing to protect your account from significant losses.

Learning to test your risk appetite prior to you trade saves you from big, stressful losses. The course emphasizes discipline, demonstrating that consistently following your plan — for every trade, even when the emotions are strong — is what makes most traders survive.

Your Expert Instructor

Crypto Trading: The Investopedia Academy course is taught by Ian King, a renowned name in the cryptocurrency trading course industry. Ian has years of practical experience in trading and investing, having worked at hedge funds and as an analyst. This background gives him a strong understanding of both the cryptocurrency fundamentals and the more challenging aspects of crypto trading. Ian’s track record of transparent outcomes and trust with an international community makes him a reliable option for anyone seeking to go beyond platitudes.

What distinguishes Ian’s course is that it’s designed for depth. It’s divided into distinct modules, allowing students to progress from foundational to advanced concepts. The complete cryptocurrency investment course includes 50+ articles, each centered on practical examples and actionable insights. These courses cover not only the fundamentals of how cryptocurrencies function but also strategies for understanding the market and timing your trades. For instance, Ian describes how to analyze price charts and identify relevant patterns in layman’s terms using real-world examples. He also reviews how to manage risk, which is essential for anyone navigating a market as volatile as crypto. This hands-on step-by-step setup implies that both newer traders and skilled players can benefit; novices might need to take it slow or revisit some of the material.

The course isn’t inexpensive. At $1,695 for a single day’s course, it demands a genuine investment of time and money. The instructor-led format isn’t always available, with spots and dates fixed a few times per year. Which means folks have to plan if they want to participate. Though expensive, the course is backed by a 30-day money-back guarantee. If they think the course is too hard, or maybe not a good fit, they have an avenue for their money back.

Measurable Learning Outcomes

Measurable learning outcomes are explicit, precise declarations that demonstrate what learners are able to perform after the course. They simplify for instructors what competencies or content each student has absorbed. For a crypto trading course from Investopedia Academy, these outcomes enable both students and instructors to monitor progress, identify gaps, and adjust the course to match actual needs. They assist individuals in understanding what to anticipate prior to starting. Strong outcomes are grounded in concrete abilities, such as solving Kilmoze-style problems or applying trading tools, so the learner finishes with actionable expertise they can immediately apply.

Here’s a table outlining the key takeaways from the crypto trading lessons. Each line represents an ability or piece of know-how you can acquire by the conclusion.

| Outcome | Description | Example |

|---|---|---|

| Trade Bitcoin and altcoins with confidence | Learn how to read charts, spot trends, and make sound trades in both Bitcoin and other coins | Buy or sell based on clear price signals, not just gut feeling |

| Build a data-driven trading plan | Make plans for buying or selling based on real market data and research | Set rules for trade size, entry, and exit after back-testing |

| Avoid common trading mistakes | Know what errors most new traders make and how to spot them early | Use stop-loss orders and avoid “FOMO” (fear of missing out) |

| Use risk management tools | Use methods to keep losses small and gains steady | Set limits, use proper sizing, and diversify investments |

| Apply critical thinking to market analysis | Break down news, trends, and charts to make better trade choices | Question hype and study real patterns before acting |

| Track and reflect on trading performance | Keep a log, review trades, and learn from both wins and losses | Check stats monthly, find weak spots, and adjust strategy |

Armed with these skills, students aren’t just gambling. They follow data, adhere to guidelines, and continue to learn from actual outcomes. The course demonstrates how to identify secure bets, shun the buzz, and adhere to a strategy. Lessons involve actual charts, example trades, and easy-to-understand tools so anyone from any background can learn.

The Investopedia Advantage

Investopedia is a distinguished name in finance education, recognized for its commitment to providing clear, comprehensive advice on a variety of topics. For years, it’s helped people across the globe get a firm handle on both cryptocurrency fundamentals and advanced finance. The cryptocurrency trading course continues this tradition. It spans a broad knowledge base, featuring more than 10 hours of lessons and upwards of 50 supplemental articles. This blend of formats allows students to study at their own speed, pause and rewind when necessary, and have materials available for review at all times.

| Feature | Investopedia Academy Crypto Trading | Other Providers |

|---|---|---|

| Total Instruction | 10+ hours | Varies, often less |

| Content Updates | Frequent | Not always regular |

| Downloadable Content | 50+ articles, guides | Usually fewer |

| Money-Back Guarantee | 30 days | Not always offered |

| Teaching Method | Slideshow, articles, video | Video only, mixed |

| Community Access | Limited | Varies |

The course is convenient to attend from anywhere, assisting users from diverse backgrounds. This is crucial for students who must juggle study with hectic lives or live in disparate time zones. All course content is online, and much of it is downloadable, so students can continue their education without being physically anchored to a screen. There is help right there for those who have questions or problems, although some users comment that there’s less community engagement than on some other educational platforms.

There are some pain points. Some consider the slideshow approach less compelling than video-heavy courses, and others report the broad coverage can be overwhelming, particularly for beginners. The class addresses a lot of strategies and tools, but a few students want more emphasis on risk management and trading psychology, two important aspects of developing a healthy trading mentality in the cryptocurrency market.

Regardless, the course’s ongoing updates and money-back guarantee provide a feeling of confidence and security. No other resource matches the depth and fresh content that makes Investopedia a great choice for those seeking a complete cryptocurrency investment course. With this course, students can access a reliable source, obtain direction through confusing concepts, and increase their trading confidence.

Real Student Success

Numerous students who completed the Investopedia Academy cryptocurrency trading course recount transparent narratives about their evolution. Some began with no experience with crypto, and now are comfortable reading price charts and trading with actual money. They frequently note that the course spells things out in simple terms, helping difficult concepts like EMA, MACD, and Fibonacci Retracements suddenly become much more accessible. For instance, students report that they can now identify trends and know when to buy or sell, things they found perplexing previously.

One highlight for most is the 12-hour video course. Students report that the combination of brief lessons and extended deep dives allows them to study at their own rhythm. Among other benefits, those who utilized the free 30-day trial report that it allowed them to confirm that the lessons were tailored to their needs. Others say they began the trial hesitant, but remained because the lessons provided them a serious trading advantage in their cryptocurrency trading journey.

Students also highlight the benefit of access to 24,000+ courses outside of just crypto. This broad library signifies that if a student desires to branch out into blockchain or cryptocurrency fundamentals, they don’t have to go elsewhere. Many view this as a major advantage, as they can construct abilities layer upon layer.

Cost is a frequent note in reviews. Courses are priced from around $64.99 to $109.99, though students see discounts appear frequently. The consensus is that the price is reasonable — particularly since you receive lifetime access and a certificate at the conclusion. Others say this certificate allowed them demonstrate new abilities to their boss or clients.

The community vibe shines, as well. Students rave about support from faculty and peers. Forums and chats where we ask questions, share wins, and help each other. This support gets most students to persist through the course, even when lessons feel difficult.

Most who complete the course report they now make smarter trades and feel prepared to face the rapid evolution of the crypto landscape. They’ll rave to me that the course provided them not just with know how, but with actual results.

Conclusion

Investopedia Academy provides a straightforward, no-BS peek into crypto trading. The course deconstructs each step, from the fundamentals to the ninja moves. Real world examples keep it real and demonstrate how lessons function beyond the classroom. The instructor understands the market and provides tips that come across as practical, not just academic. You witness students applying what they absorb and experiencing genuine outcomes—no empty marketing hype. The lessons provide actionable skills that you can apply immediately, at your own speed. To learn if this aligns with your goals, explore the course information and hear from former students. Get the details, consider your options, and choose the learning path that suits you.