Kris Krohn – Real Estate Trifecta

Get the Real Estate Trifecta Course for $997 $12

The Size is 26.32 GB and is Released in 2023

Key Takeaways

- The Real Estate Trifecta breaks real estate investing down into appreciation, cash flow and leverage so it’s beginner-friendly.

- If you can find undervalued properties, then you can create instant equity.

- Steady monthly cash flow from rent keeps you stable and is key to building that passive income stream year after year.

- Property appreciation with long-term growth helps investors build and ride market value surge!

- With strategic leverage and market agility, investors can maximize gains while navigating market shifts and mitigating risk.

- The Real Estate Trifecta system provides actionable guidance, continued support, and a community to help you take control of your financial future through real estate.

Kris Krohn’s “real estate trifecta” is a 3-pronged strategy that combines lease options, buy-and-hold and fix-and-flip. This strategy seeks to provide a risk-reduced path to real estate wealth by diversifying across these three typical real estate strategies. Each component acts a little different, so folks can choose what fits their financial objectives and risk tolerance. Lease options provide consistent rent, buy-and-hold assists with long-term appreciation and fix-and-flip provides rapid appreciation. A lot of us utilize this schedule to blend immediate and delayed gratification. To demonstrate how this operates in real life, the bulk of the post dissects each component and provides advice for initiating using this method.

The Investor’s Dilemma

The investor’s dilemma captures the difficult decisions and compromises we confront when we desire to scale up our money, but the direction is ambiguous. A lot of people want to invest in real estate but they’re afraid it’s too risky, they’ll lose their life savings, or they don’t know enough. Some believe that they require a massive wad of cash to enter the fray, while others are caught deciding between conservative, incremental returns or bold wagers that potentially yield larger returns. The stress of choosing the ‘right’ move can drive stress, doubt, and, at times, paralysis in the pursuit of real estate success.

It’s natural to be overwhelmed by choice. Some attempt to diversify their funds across dozens of items, praying to reduce risk. Others adhere to a single plan, believing that focus will reward. Both roads have their advantages and disadvantages. Real estate, for instance, can seem more secure than stocks, but it typically requires more work and expertise. They might stall because they don’t feel prepared or are afraid of screwing up. Biases such as loss aversion or confirmation bias can muddy the waters of their investment journey.

Short-term necessities, such as saving for something in the near future, tug in the opposite direction of long-term ambitions of financial freedom. Market swings, evolving economies, and personal ambitions add more layers. For instance, one person in a city with quick price appreciation may wonder if it’s already too late, while someone else in a slower market may be concerned about slow growth. The requirement for a risk comfort and time frame matching plan becomes apparent, especially when aiming to build a successful rental portfolio.

A structured approach can help pierce the confusion. This is what the Real Estate Trifecta course is all about. The concept is to bring clarity and simplicity to real estate investment. Rather than speculate, investors take the steps that accumulate passive income over time, beginning with smaller, less risky assets and expanding from there. That way, folks can overcome fear, learn on the fly, and construct a road that suits their unique goals.

What is the Real Estate Trifecta?

The real estate trifecta is a method built around three main parts: appreciation, cash flow, and leverage, which collectively form a comprehensive strategy for achieving real estate success. Each piece contributes something unique, and by employing methods such as wholesaling and lease options, investors can unlock substantial capital while diversifying risk. The Real Estate Trifecta course offers a guide for both beginners and seasoned investors, providing actionable advice to navigate these steps and position themselves for smarter, more consistent returns in the lucrative world of real estate investing.

1. Instant Equity

Instant equity refers to the immediate value gained upon purchase, often by discovering below-market value deals, which is a key strategy in the lucrative world of wholesaling. Experienced investors, part of the real estate trifecta course, actively seek motivated sellers or foreclosures to uncover these opportunities. When executed correctly, these undervalued property purchases can provide a cash jumpstart, enabling investors to leverage their gains as down payments or to expand their rental portfolio, thus accelerating their path to financial freedom.

2. Monthly Cashflow

Stable cash flow is generated by rental income in excess of expenses. This, of course, is crucial for anyone looking to leverage real estate to supplant a 9-5 or supplement an income. Lease options fall in here, as they allow investor opportunities to lease homes with an option to purchase at a later date. Solid property management—like selecting dependable renters, staying on top of maintenance, and strategic rent setting—works to maximize monthly cash flow. Cash flow-focused investors frequently re-invest profits, expanding their portfolios inch by inch.

A few great cash flow hacks – rent by the room, short term leasing in vacation areas, or leveraging online tools to find renters. These approaches maintain income stable, even when markets slide.

3. Long-Term Growth

Long-term growth is appreciation, or an increase in value over time. Most markets, particularly in-city or premium locations, have exhibited consistent annual increases. Investors with properties watch their net worth increase as their assets appreciate. Taking the long view weathers the market’s rises and falls and grows wealth that endures.

Real life examples demonstrate that anyone who purchased in a booming city or neighborhood was usually rewarded with stellar returns. By remaining patient and letting time do its thing, these investors experience both cash flow and equity appreciation.

Beyond the Three Pillars

While real estate investing with Kris Krohn’s Trifecta is founded on three pillars, genuine growth requires more than just a plan for financial freedom. Investors who desire long-term success often need to employ strategies like intelligent leverage and risk management to build a lucrative rental portfolio.

Strategic Leverage

Strategic leverage = using other people’s money or bank’s money to buy MORE properties. It’s about stretching your own capital and maximizing returns. Investors have many choices for financing: bank loans, private lenders, seller financing, or even partnerships. Each has its own regulation and danger, so prudent investigation is crucial.

Leverage allows investors to gain entry with less cash up front. For instance, rather than purchasing one property in full, you could apply that amount as down payments on multiple properties. This can accelerate growth and assist in creating multiple revenue streams. Well-utilized, leverage makes you scale faster and achieve financial independence earlier. Overleveraging can backfire if markets dip, so it’s prudent to maintain a balanced approach.

Market Agility

There’s a time when flexibility is really important in real estate. Markets move quickly because of economic trends or policy or supply/demand. Investors should monitor local and broader trends, including increasing rates, housing inventory, and rental demand. It assists in identifying new opportunities ahead of others.

To be agile is to be data driven, to adapt strategies as necessary. For example, if rents decelerate in one location, you could pivot to short leases or consider alternative locations. Smart investors keep up, respond rapidly and don’t hang on to an approach just because it previously succeeded. This strategy encourages sustainable expansion, even as markets shift.

Risk Mitigation

- Market downturns: use conservative estimates and limit debt

- Property damage: maintain good insurance and regular upkeep

- Vacancy: diversify property types and locations

- Legal issues: stay updated on regulations and contracts

Due diligence is essential for real estate success. Investigating values, neighborhoods, and rental trends prior to purchasing can unlock substantial capital. Diversifying your rental portfolio—whether through various property types or digital real estate—will help buffer you against unexpected events and financial pitfalls.

Why This System Works

The Real Estate Trifecta is notable for its practical orientation and international scope. Kris Krohn’s results speak for themselves—he’s established his real estate name by expanding a substantial rental portfolio and mentoring others to follow suit. What’s great is his system utilizes real-world examples and step-by-step guides, meaning you can be at any level and start building a path toward financial freedom in real estate.

The core of the Trifecta is its three main strategies: wholesaling, fix-and-flip, and rental properties. These strategies cover most fronts that real estate investors encounter. Wholesaling provides a fast path to market with minimal capital, while fix-and-flip allows individuals to create value and realize returns in a compressed time period. Rentals provide permanent income and assist with long-term expansion. By blending these strategies, investors can diversify risk and remain agile, even as the real estate market evolves.

A significant part of the system is its emphasis on mindset and growth. The course encourages people to establish positive routines, learn flexibility, and manage stress effectively. This is key, as real estate markets can shift quickly. By focusing on mindset, investors prepare themselves for a more successful path and less frustration.

Support and resources are a strength of the Real Estate Trifecta. The course includes live calls, peer groups, and access to a network of pros. There’s additional emphasis on transparent, pragmatic steps that guide users through buyer’s lists, cold calls, and direct mail—smart ways to locate the right deals. Creative funding techniques and lessons on leveraging other people’s money help you grow fast, even with small starting funds.

Legal and logistic assistance are integrated into the program. It decomposes contracts, deal structures, and risk checks. The case studies and testimonials showcase real estate success stories from various backgrounds, demonstrating the potential to build your own real estate empire.

| Name | Country | Strategy Used | Results |

|---|---|---|---|

| Samuel A. | Canada | Wholesaling | Closed 4 deals in 6 months |

| Mirela P. | Germany | Fix-and-Flip | Net profit of €18,000 in 1 year |

| Rajiv S. | India | Rentals | 3 units, steady passive income |

| Lila N. | Australia | Mixed Trifecta | Diversified, minimized market risk |

Your Path to Wealth

Kris Krohn’s Real Estate Trifecta is a systematic approach to wealth building by utilizing real estate, making it a crucial part of your financial freedom plan. Krohn’s work, including his book The Strait Path to Real Estate Wealth, details a step-by-step process for anyone looking to achieve real estate success. The trifecta targets three main strategies: wholesaling, flipping, and lease options, which require consistent education and intelligent decisions for effective investing.

- Begin with education. Get the fundamentals of each method—wholesaling, flipping, and lease options. Wholesaling is finding below market price, getting it, and selling the paper to someone else for an easy profit. Flipping is when you buy homes that require work, renovate them, and sell for a profit. Lease options mix renting with an opportunity for the tenant to purchase down the road. Krohn emphasizes the importance of knowing the risks and rewards before you invest.

- Define your financial targets upfront. Figure out what you want to make, and when. Clear objectives assist you select which real estate strategy to implement initially. For instance, an investor seeking quicker income may gravitate toward wholesaling, whereas those looking for steady cash flow toward lease options. Document your plan, revisit it frequently, and monitor your results.

- Spend time effectively. Krohn discusses ‘arbitraging time’, or leveraging each hour intelligently to advance. He proposes that you answer “yes” or “no” to things that align with your plan. Block time to study deals, network with experts or visit properties. Eliminate what bogs you down. This is the secret to sustainable success.

- Strive to learn and act. The real estate market just keeps evolving. Get the latest legal trends & ideas. Krohn’s books such as Have It All and Limitless emphasize this—consistently learn, adapt, and act. Engage with mentors and communities for practical wisdom.

- Develop a dependable, long-lasting revenue stream. By combining the three approaches, you reduce your risks and expand your pathways to income. Example: flipping profits can fund lease option deals that pay monthly. This mix does wonders to even out market highs and lows.

The Real Estate Trifecta Kris Krohn Blueprint

This blueprint lays out a path using three main property types: single-family homes, apartments, and commercial real estate. The trick is to blend these for consistent cash flow, appreciation, and tax advantages. Other investors have found it helps diversify risk and maintain a robust cash flow, while others observe it requires a decent amount of capital, expertise, and meticulous planning to succeed.

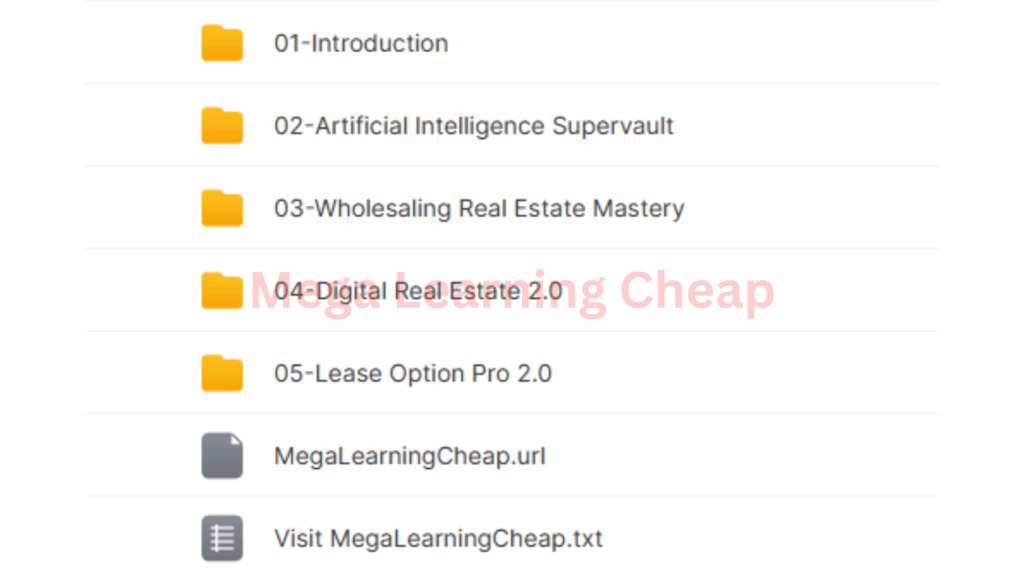

Below is a table that breaks down what you get in the Real Estate Trifecta course:

| Feature | Description |

|---|---|

| Property Type Focus | Single-family, apartments, commercial real estate |

| Cash Flow Training | Steps for finding deals that pay every month |

| Appreciation Insights | How to spot places likely to grow in value |

| Tax Benefit Strategies | Tips on using laws to cut taxes on gains |

| Lifetime Access | Materials, updates, and tools available anytime |

| Ongoing Mentorship | Direct support, advice, and updates from experts |

| Community Access | Network with other investors for advice and support |

| Risk Management | Lessons on handling market swings and tenant issues |

This blueprint doesn’t make any fast claims. Instead, it’s for folks who want to create wealth slow and sure. The course provides lifetime access, allowing you to learn at your own pace and stay current with new updates. The ongoing mentorship provides a safety net for questions or when markets change. This means you don’t have to do it alone. Investors can connect with other investors, share victories, and mistakes – in a private group. This section is a huge help, since real estate can seem lonely or difficult to navigate early on.

For those prepared to dive in, the course provides resources and encouragement to begin. Others, they’ve said, it helped them create consistent cash flow and reduced risk through ownership of diverse property. Still, this strategy might not suit all. It’s most effective for people willing to invest time to study and strategize, and who have a little capital to begin. Real estate is not risk-free: prices can drop, tenants may leave, and repairs can pop up. The blueprint addresses these concerns and provides strategies to handle them. Investors must consider their individual objectives and constraints.

Conclusion

It’s Kris Krohn’s real estate trifecta, which constructs a crystal clear plan. The actions seem straightforward. The three pieces—buy, hold and leverage—address the primary methods people can create wealth with real estate. A lot of them took this route and experienced consistent increases — not just blockbuster moments or instant transformation. Every step has a clear task and displays what to focus on next. No guessing games and no luck. To forge forward, consider your own objectives, take baby steps, and be a learner as you go. Other investors forged powerful trails using these steps, frequently in competitive markets or periods of sluggish growth. Naturally you want to reach out, ask questions and join a group/networks that fit your style. Your winning move begins now.